Some links to products and partners on this website will earn an affiliate commission.

Last week I wrote an article which explained the best order to apply for American Express cards, if you want to earn the most points/miles/Avios possible from welcome bonuses. I concentrated purely on welcome bonuses in that piece, but there are a number of ways to boost you Amex earnings even more, so I thought it would be fun to put everything together and see just how many points a single person could earn in total.

[Please note that there may be other personal factors to consider in terms of how easily you can meet the minimum spend requirements to trigger the bonuses, annual fees, etc. This post is aimed primarily at people new to points/miles/reward credit cards – I am therefore making the assumption that you would be starting from a position of not having had a personal Amex card in the last 24 months]

To maximise your earnings, you will actually earn three different types of points – Amex Membership Rewards, Nectar, and British Airways Avios. All of them can be transferred to Avios though, so for the sake of simplicity, I’ll generally refer to the Avios total.

Remember, that it is now possible to effectively cash out Avios at a minimum of 0.8p each (via Nectar), so I’ll include the notional cash value too.

Where do I start?

I would recommend reading the full article here in order to understand the rules Amex applies to welcome bonus eligibility, but the basic order you should apply for cards in is as follows:

- Business Amex Gold/Platinum (if you are eligible for a Business card – otherwise, start with the personal Amex Nectar.)

- Personal Amex Nectar

- Personal Amex Platinum

- Personal British Airways Premium Plus Amex

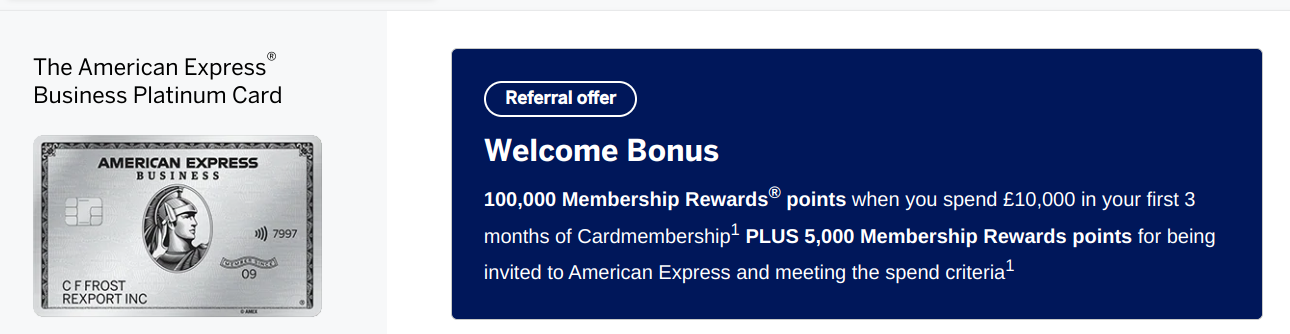

Earn 140,000 Amex Membership Rewards Points with the Business Platinum

The headline welcome bonus on the Business Platinum (annual fee £595, but you can get a pro-rata refund) is 100,000 Membership Rewards Points. If you use a referral link when you apply for the card, like this one, you will receive an additional 5,000 points.

You have to spend at least £10,000 on the card in the first 3 months to trigger the bonus, which will get you another 10,000 points. So, that’s 115,000 in total.

Amex regularly offers small incentives for adding supplementary cardholders to your account. You would probably want to give someone the single free supplementary Platinum card that you are entitled to, so that they can share the various Platinum benefits like elite status with various hotel loyalty programmes, but Amex will give you 5,000 bonus points on top for doing so.

You can then add another four people as (free) Gold cardholders to your account and receive 5,000 bonus points for each of them. Add the 5,000 and the 20,000 (4 x 5,000) together, and you’ve got an additional 25,000 points.

When you put all the above together, your ‘real’ sign-up bonus is 140,000 Membership Rewards Points, rather than 100,000.

140,000 Amex MR Points can be exchanged for 140,000 Avios, worth at least £1,120 (if cashed out via Nectar). Not a bad start!

Amex Business Card Eligibility

- The business has a current UK Bank or Building Society account

- You/The business have/has no County Court Judgements for non-payment of debt

- You are aged 18 or over

- You have a permanent UK home address

If you don’t want to pay an annual fee or are concerned about hitting the £10,000 spend requirement in 3 months, you should consider the Business Gold Amex instead, which has a sign up bonus of 52,000 points and is free for the first year.

Earn 25,000 Nectar Points with the Amex Nectar Card

Next up, is the Amex Nectar Card. If you are not eligible for an Amex Business card, this is the card you should start with.

The Amex Nectar is free for the first year and has a solid sign-up bonus – 21,000 Nectar Points (worth at least £105, if you use a referral link. You could also transfer the 21,000 Nectar Points into 13,125 Avios.

Add on the 4,000 Nectar Points you would earn from hitting the £2,000 minimum spend, and your total would be 25,000 Nectar Points (worth at least £125), equivalent to 15,625 Avios.

Add on the 4,000 Nectar Points you would earn from hitting the £2,000 minimum spend, and your total would be 25,000 Nectar Points (worth at least £125), equivalent to 15,625 Avios.

There is no bonus currently available for adding supplementary cardholders to an Amex Nectar account.

The running total is therefore 155,625 Avios (worth at least £1,245).

Earn 44,000 Amex Membership Rewards Points with the personal Amex Platinum

If you use a referral link like this one, the welcome bonus on the personal Amex Platinum is 35,000 Membership Rewards Points, rather than the standard 30,000:

There is an annual fee of £575, but you receive a pro-rata refund when you cancel the card.

There is an annual fee of £575, but you receive a pro-rata refund when you cancel the card.

Add 4,000 points for meeting the £4,000 minimum spend requirement. Then there is another 5,000 points for adding a (free) supplementary cardholder. Put that all together and you’ve got 44,000 Amex Membership Rewards Points from the personal Platinum card.

The running total is now up to 199,625 Avios – worth at least £1,597.

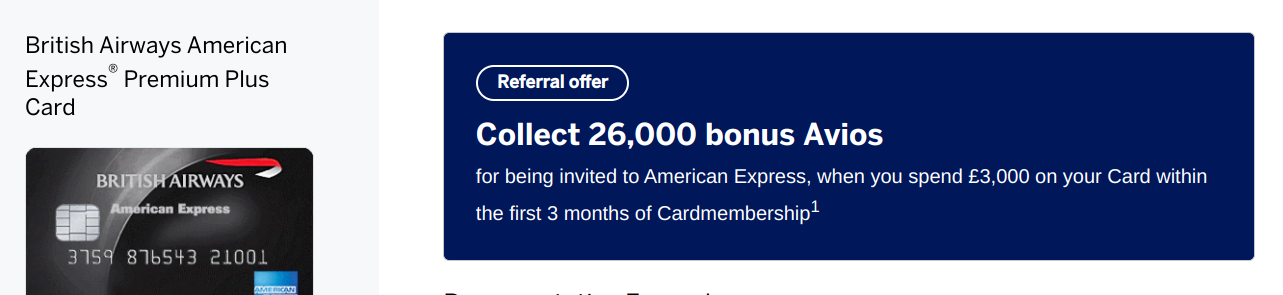

Earn 33,500 Avios with the British Airways Premium Plus Amex

The final card you would be eligible for a welcome bonus on is the British Airways Premium Plus card. The welcome bonus is currently 26,000 Avios, if you sign up using a referral link like this one.

The card has an annual fee of £195, but again you can get a pro-rata refund when cancelling.

Add 4,500 Avios for meeting the £3,000 minimum spend requirement, plus another 3,000 Avios for adding a supplementary cardholder, and the total is 33,500 Avios.

What’s the grand total?

If you add up all the above, your total haul would be a massive 233,125 Avios! If you cashed them out via Nectar, that is worth a minimum of £1,865.

That’s from only 4 cards, so over the course of a year, you could split your applications every 3 months, to concentrate your spending on each minimum spend requirement one card at a time. Assuming you cancelled each card after ~3 months each time, you would incur annual fees of about £350 in total, once you got your pro-rata refunds back. That’s a net ‘profit’ of about £1,500…

Bottom line

Even if you aren’t eligible for a Business Amex, you can still earn 93,000 Avios, worth ~£750. I also haven’t mentioned the myriad other benefits (airport lounge access, elite status with hotel loyalty programmes, 241 BA Avios redemption voucher, etc, etc) that the credit cards above offer…

As a result of the welcome bonus eligibility rules, many regular readers sadly won’t be able to take advantage of the above, due to already having Amex cards (or having had them in the relatively recent past). However, if you are new to the world of points/miles and credit card rewards, there is massive value to be found – so long as you apply in the right order!

Worth noting that you must hit one welcome bonus before applying for the next card.. Found out the hard way:

1. No history with Amex

2. Applied for Gold and then BAPP within a month, fulfilled the minimum spend requirements on both

3. Only got the welcome bonus on BAPP but not on Gold

4. Spoke to Amex and was told I was only entitled to one (luckily it was the higher BAPP one..), even though they could not clearly point at any relevant T&C

5. Cannot really argue with them as they make the rules

Ouch! Cheers for sharing though Max – that’s not one I’ve heard before. You’re right that they make the rules, but I would personally have been tempted to make a bit of a fuss about that, given it doesn’t seem to be mentioned in the t&cs.

On the very small number of occasions I’ve had cause to complain to Amex due to miscommunication from an agent or whatever, they’ve sorted it out after taking a proper look. It can require a bit of patience to begin with though, to ensure the case gets looked at by someone with sufficient authority to investigate properly and make amends if required.