Some links to products and partners on this website will earn an affiliate commission.

Over the last few years, American Express has introduced various rules that make it genuinely quite difficult to work out the order you should apply for Amex cards in, if you want to earn the maximum possible amount of points from welcome bonuses.

Get the order right though, and you could earn 179,000+ Avios (or other points/miles) from just 4 applications.

[Please note that there may be other personal factors to consider in terms of how easily you can meet the minimum spend requirements to trigger the bonuses, annual fees, etc. To avoid making things unnecessarily complicated, I’m sticking purely to explaining the best order to apply for cards in, if you want to earn the largest amount of points from welcome bonuses. I am also making the assumption that you would be starting from a position of not having had a personal Amex card in the last 24 months]

Business Amex Gold and Business Amex Platinum

The first rule to be aware of is that Amex allows you to earn a Membership Rewards Points welcome bonus (transferable at a 1:1 rate to British Airways Avios, Virgin, and many many more) on its personal Amex Gold and Amex Platinum cards, even if you already have the Business versions of the same cards. However, it does not permit the reverse.

To be completely clear this means that:

- If you have a Business Amex Gold/Platinum, you can still get the welcome bonus on the personal Amex Gold/Plat

- If you have a personal Amex Gold/Platinum, you cannot get the welcome bonus on the Business Amex Gold/Plat (in fact, even if you cancelled your personal card, you would still have to wait 6 months to be eligible for a Business Card bonus)

- Also, it probably doesn’t need to be said, but if you already have a Business Card that earns Membership Rewards Points (or have had in the last 6 months), you are not eligible for a Business Card welcome bonus. Eg. You can’t get the Business Platinum bonus if you already have a Business Gold.

Therefore, if you are eligible for a Business Gold or Platinum, that is where you should start.

Right now, Amex is offering some ridiculously good welcome bonuses on its Business Cards.

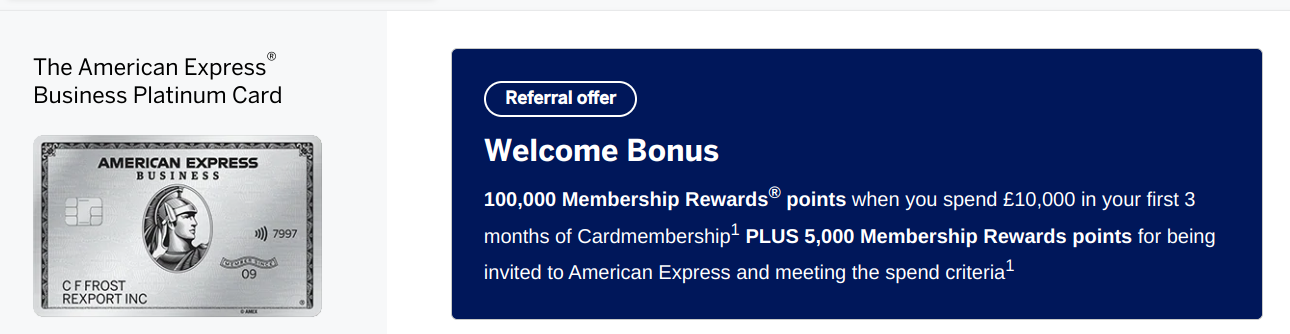

The headline welcome bonus on the Business Platinum (Annual fee £595, but you can get a pro rata refund) is 100,000 Membership Rewards Points. If you use a referral link when you apply for the card you will receive an additional 5,000 points.

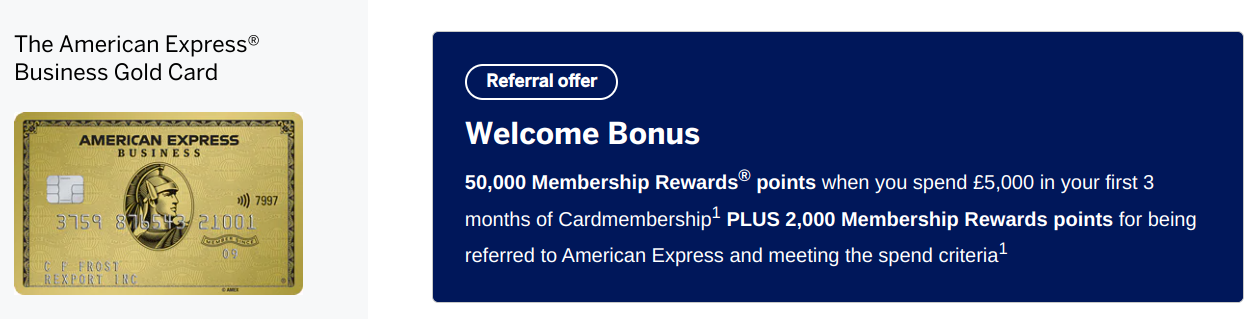

The headline welcome bonus on the Business Gold (free for first year) is 50,000 Membership Rewards Points. If you use a referral link when you apply for the card you will receive an additional 2,000 points.

Amex Business Card Eligibility

- The business has a current UK Bank or Building Society account

- You/The business have/has no County Court Judgements for non-payment of debt

- You are aged 18 or over

- You have a permanent UK home address

If you are eligible, you can get a massive 52,000 or 105,000 points to kick things off.

If you’re not sure about the value of Membership Rewards Points, I’d suggest you should aim for getting at least 1p each, which would value the above bonuses at £520 and £1,050 respectively. The absolute minimum ‘floor’ value is 0.8p each via Avios and Nectar.

Personal Cards

First…

You might think that your next move (or first move if you are not eligible for a Business card) should be to get the personal version of the Gold or Platinum, but that would be a mistake.

Amex has a general rule with its personal cards that you cannot receive a welcome bonus on a new card if you already have a personal Amex card (or have had one in the last 24 months) – but there are two very important exceptions.

You can, in fact, still receive the welcome bonus on the Personal Platinum and the British Airways Premium Plus, so long as you haven’t had a personal card that earns Membership Rewards Points, or Avios, (respectively) in the last 24 months.

The key to maximising your total then, is to first pick a personal card that doesn’t earn Membership Rewards Points or Avios.

There are other potential options (like the Amex Marriott Bonvoy card), but I would suggest that the Amex Nectar card is the best option. It’s free for the first year and has a solid sign-up bonus – 21,000 Nectar Points (worth at least £110, if you use a referral link. You could also transfer the 21,000 Nectar Points into 13,125 Avios.

Second…

At this point you already have a personal American Express card (the Amex Nectar), so you are not eligible for the welcome bonus on either the free BA Avios card, or the free (in first year) personal Gold card.

You are still eligible for both the personal Amex Platinum card and the Amex BA Premium Plus card though.

I would personally opt for the Platinum card next, as it allows you to potentially receive a lot of additional points from referring friends/family, but the order here doesn’t actually matter if you are looking purely at welcome bonuses.

If you use a referral link like this one, the welcome bonus is 35,000 Membership Rewards Points, rather than the standard 30,000:

There is an annual fee of £575, but you receive a pro-rata refund when you cancel the card.

There is an annual fee of £575, but you receive a pro-rata refund when you cancel the card.

Third…

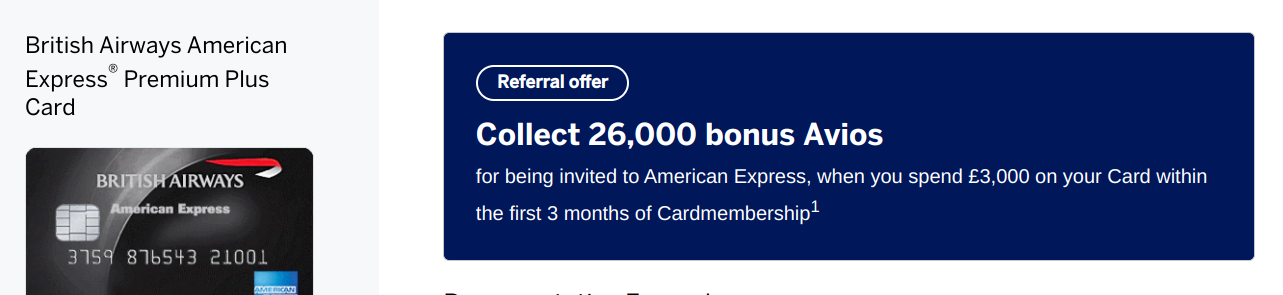

The final card you would be eligible for a welcome bonus on is the British Airways Premium Plus card. The welcome bonus is currently 26,000 Avios, if you sign up using a referral link like this one.

The card has an annual fee of £195, but again you can get a pro-rata refund when cancelling.

Bottom line

It is important for me to state that the strategy outlined above may not be the best strategy for you personally. There are a huge range of factors that could influence that. It is simply an explanation of the order in which to apply if you want to get the most points possible from welcome bonuses.

As regards tallying the points total up, for the sake of consistency, let’s say you transfer everything to Avios (whether that’s a good idea or not is a separate question!). If you were eligible for an Amex Business card (and selected the Platinum), you could earn a grand total of 179,125 Avios.

That’s from only 4 cards, so over the course of a year, you could split your applications every 3 months, to concentrate your spending on each minimum spend requirement one card at a time. Assuming you cancelled each card after ~3 months each time, you would incur annual fees of about £350 in total, once you got your pro-rata refunds back.

It’s also worth pointing out that you could earn 10,000s more points from earning normal points when hitting the spend requirements, and bonus points for adding supplementary cardholders to your accounts, and referring friends/family members…

Hi Joe

The first and last bullet points seem to contradict one another.

Point one: says if you have a business card you can get the bonus on the personal.

Point three: if you already have a Business Card that earns Membership Rewards Points (or have had in the last 6 months), you are not eligible for either business or personal bonuses.

which one is right?

The Amex business cards are all MR earning cards! so your first point must incorrect?

Good catch – thanks! The first point is correct. You 100% can get personal Amex welcome bonuses (including MR earning cards) if you have a Business MR earning card.

The intention was simply to write that you can’t get a Business bonus if you already have Business card (or have had one in the last 6 months).

The (embarrassing) irony is that I actually only added that 3rd point with the intention of adding absolute clarity…which backfired quite spectacularly.

I’ve now fixed the error.

Im not planning on doing the couple referal thing to get the 179k!

So can I do:

BA Prem- Plat- Nectar or any sequnece of that or do you always have to start the new 24 month cycle with Nectar?

Hi Joe,

Nothing to do with couple/family/friends referrals in the article above (I’m working on that- should end up about 500K! 😉 ).

The fundamental point in order to maximise, if you’re not eligible for a Business Amex, but are new to Amex (or haven’t had a personal Amex card for 24+ months), is to start with a card that doesn’t earn either Avios or Amex Membership Rewards. I would suggest Nectar is probably best, but Marriott is a possibility too. Then I’d personally do Plat, then BA Prem after that.

However – you can still get the Plat welcome bonus if you have BA Prem (and vice versa) – so there are circumstances (if you want Plat benefits, or the BAPP companion voucher sooner, for example) where it could make sense to forgo the additional points you would get by starting with Nectar/Marriott/etc.