Some links to products and partners on this website will earn an affiliate commission.

Another day, another series of cuts by Amex. Hot on the heels of last month’s Amex changes, today it’s sign up bonuses and referral bonuses that are taking the hit.

Sign up bonus changes

As HFP reported this morning, the sign up bonus cuts are as follows:

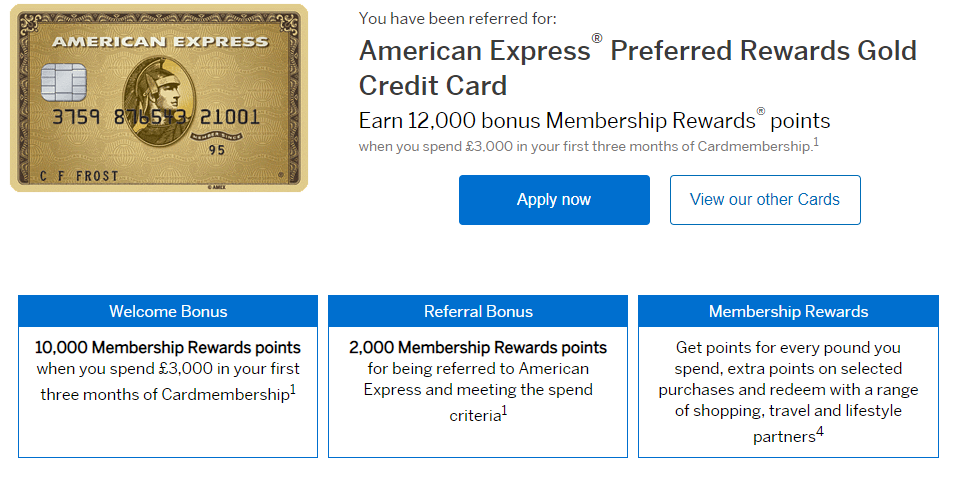

“Preferred Rewards Gold Card:

The sign-up bonus has been halved from 20,000 Membership Rewards points to 10,000 Membership Rewards points

The qualifying spend required to earn the bonus has increased from £2,000 within three months to £3,000 within three months

If you are referred by a friend to the card, you will receive a higher sign-up bonus of 12,000 Membership Rewards points (previously 22,000 Membership Rewards points)

American Express Rewards Credit Card:

The sign-up bonus has been halved from 10,000 Membership Rewards points to 5,000 Membership Rewards points

The qualifying spend required to earn the bonus has increased from £1,000 within three months to £2,000 within three months

American Express Rewards Low Rate Credit Card:

The sign-up bonus has been halved from 5,000 Membership Rewards points to 2,500 Membership Rewards points

The qualifying spend required to earn the bonus has increased from £500 within three months to £1,000 within three months.”

For most readers, the key changes here relate to the Preferred Rewards Gold Card, where the sign up bonus has been halved and the minimum spend increased by 50%.

On the face of it, these are big and very negative changes, but I’m not sure it really makes all that much difference in practice.

Given the rule changes introduced last month, the value of the Gold Card for many serious points/miles collectors was already greatly diminished – because holding any Amex within the last 24 months meant you couldn’t get the Gold sign up bonus, and even if you were eligible for that bonus, getting the Gold would stop you receiving the (substantially higher) Platinum bonus.

For completely new customers, 10,000 points (12,000 if referred) + 2 lounge passes and the solid earning rate, might still seem pretty good for a card that is free for a year.

Sign up bonuses for the BA, BA Premium Plus, SPG/Marriott, etc, cards appear unchanged at the moment.

Referral bonus changes

Perhaps more significant are the Amex changes related to referral bonuses. Many readers regularly refer friends and family members (and perhaps even themselves!) and Amex has provided generous incentives for doing so.

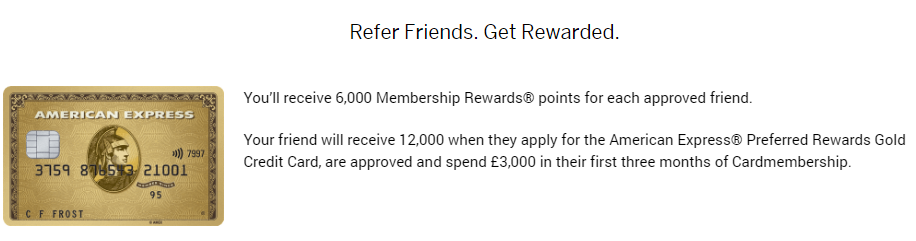

As I recently explained, it’s possible to refer people for (more or less) any Amex card and the reward you receive for doing so depends on the type of card you generate your referral link from, not the type of card your friend or family member applies for. For now at least, that general policy appears to be staying the same, but Amex is cutting the number of points you will receive for referring people from a Gold or Platinum card.

If you have a Gold, you will now receive 6,000 Membership Reward Points per referral (up to an annual max of 90,000 points), rather than 9,000.

Platinum cardholders will receive 12,000 Membership Rewards Points per referral (up to 90,000 annual limit), rather than 18,000.

As far as I can tell, the bonuses you can get by referring from other Amex cards haven’t changed (for now) and are still as follows:

- British Airways: 4,000 Avios

- British Airways Premium Plus: 9,000 Avios

- SPG/Marriott: 9,000 Marriott Bonvoy Points

Bottom line

These latest Amex changes may not be the end of the world, but on top of all the other changes, they certainly aren’t good news

I’ll share what I think is now the optimum ‘Amex strategy’, in terms of what to apply for and when, very soon (assuming there are no more changes for a couple of days anyway!).

What do you think about these changes?

Leave a Reply