Some links to products and partners on this website will earn an affiliate commission.

You’ll often read about American Express cards here on InsideFlyer UK – given the points earning options and generous sign-up and referral bonuses, it’s easy to understand why. As a very infrequent business flyer, for me, it’s the only way I can build up sufficient airline miles to travel the way that we have become accustomed to. While we see new merchants being added all the time, there are still places that do not accept American Express, therefore the savvy InsideFlyer UK reader needs something else in their wallet. For me, that’s my Curve card (plus the Curve app on my smartphone!).

I also have an array of travel-related Visa and Mastercard cards, but these days they are no longer literally in my wallet. This is one of Curve’s superpowers – it’s not a credit card, but think of it as a ‘front’ to all of your Visa and Mastercard credit or debit cards.

Free £5 for signing up to Curve

Use the code INFLY when you sign up and you will receive £5.00 on your Curve card after your first transaction. Yes, even on the free version of the card!

How does Curve work?

Using the excellent Curve app (iOS or Android) you add one or more “funding” cards. You then select which card to use as the source for your transactions. You pay the merchant using the Curve card (contactless or chip & pin), and in the background, Curve authorises a transaction on your funding card. Transactions on your card show as CRV * Merchant Name.

There are no transaction fees for UK purchases (assuming you add a UK-based funding card) and your Curve transactions are still eligible for rewards on the funding card, such as IHG or Hilton points, depending on which cards you hold.

Another big win is that Curve is one of the few products that doesn’t require top ups – because it’s directly linked to the funding card/s, using Curve is very convenient.

A recent update to Curve’s systems means that more details of the transaction are passed to the credit card provider. This may allow you to receive additional credit card benefits if, for example, your credit card offers an incentive for spending in a particular category such as supermarkets, or hotels, etc.

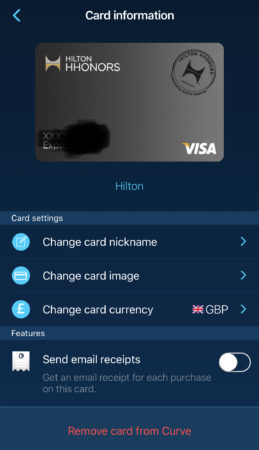

The app generally figures out the type of card when you enter the number, but you can give it a meaningful nickname and change the image to help you recognise it.

Rewards? Now you’re talking

Yes, you can still get rewards from the underlying funding card, and the spend will count towards annual spend targets, such as those for a bonus, or hotel status.

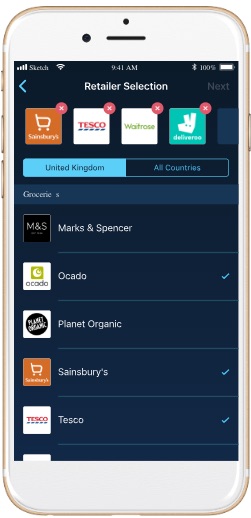

Curve also has their own cashback scheme, offering 1% cashback for the first 90 days at up 3 retailers for the regular (Blue) card, and 6 for the Curve Black card. Using the Curve app, you get to choose the retailers that suit you from a list.

There are a few travel-related retailers in there, such as Booking dotcom, TfL and easyJet, along with more mundane places such as Tesco and IKEA. There is a full list in this Curve support article.

This is a one-time selection, so choose wisely!

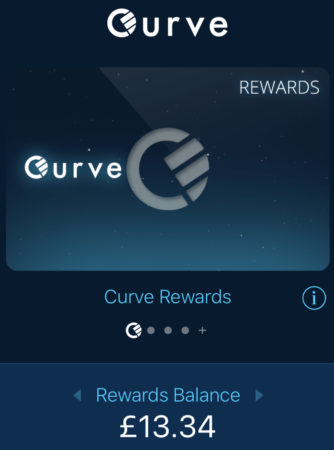

Cashback is loaded to your Curve Rewards card, which shows as a card in the app, with an up to date balance shown beneath it.

When you want to use the Rewards balance, simply switch to the Rewards card before your next purchase or cash withdrawal, remembering to switch back to a regular funding card before you try to make any larger purchases. *

Overseas usage

At weekends, when currency markets are closed, a 0.5% markup is added to Euro and US Dollar transactions, and 1% for other supported currencies. From November, this will be 0.5% EUR/USD and 1.5% for others.

As a general rule, I wouldn’t choose to incur a 3% fee levied by Barclaycard to earn a couple of Hilton Honors Points, or even 4 IHG Rewards Club Points on the Creation issued Premium IHG Rewards Card. The ability to have the transaction charged in sterling to my funding card by Curve means I can still earn points on the underlying card, with no fee charged on the exchange rate.

An additional useful feature Curve offers when travelling, is the ability to lock the card from the app. You can avoid carrying multiple cards around with you, and keep your Curve card locked until you need to use it. That way, if you were to lose your card or have it stolen, it will be useless until you unlock it from the app. Just don’t forget when you’re trying to settle a restaurant bill, or you’re at the supermarket with a large queue of angry locals behind you! *

Which card is for me: Blue or Black?

As mentioned above, there are two cards: Blue and Black. The differences are: cost, colour, cashback retailers and limits on fee-free overseas spending.

The Blue Card is free, while the Black Card costs £50 and at the moment comes with a free Tumi wallet (worth £60). Obviously, you should decide if you want the wallet, and/or will gain from the additional benefits below.

The Blue Card allows you to select 3 cashback retailers, and the ability to earn up to £300 cashback. The Black Card gives you 6 retailers (some exclusive to the Black Card ), with potential earnings of up to £600.

The Blue Card allows up to £500 per rolling month of 0% FX spend, while the Black Card offers unlimited (subject to a fair use policy of up to £15,000 per year fee-free).

Both cards offer the ability to categorise transactions in the app, as well as integrating with Xero online accounting software.

The Black Card ships in a rather funky (if perhaps somewhat over-engineered ‘box within a box’. Removing this lovely round, expandable disk containing your card…

…reveals the Tumi wallet – and a clever empty space that reinforces the idea that Curve is the only card you need to carry

What else?

Besides the flexibility of paying on a choice of cards but only carrying one, earning cashback and no FX fees?

How about time travel?

Well, almost. Within 14 days of a transaction, you can ‘Go Back in Time‘. Imagine you made a purchase using your Curve Card and charged it to your Lloyds Avios Rewards Mastercard. A week later you realised the earnings rate is a lousy 1 point per £5 spent and wished you could have pushed it to your Hilton Honors Visa for a 2 Honors points per £1 reward. *

No problem! Using the Curve app, tap on the transaction and select ‘Go Back in Time’ to shift the transaction and earn yourself some Honors points.

Full terms and conditions can be found on the Curve website.

Bottom line

I’ve had an excellent experience with Curve so far, and they keep adding new features and benefits all the time. You can check it out for yourself here – and get a free fiver for doing so too 🙂 .

Don’t forget to grab your free £5 here! – Just use the code INFLY when you sign up

* Recommendations or advice in this article marked with an asterisk, may or may not reflect embarrassing past experiences of the author 😉

Great article. Thanks.

When I try to download the APP from google play i get the app is not available in my country?

Is there a way to fix such issue? I leave in UK but often travel to Switzerland and Portugal.

Thanks in advance,

Love the curve card… use my promo code to get £5 extra .

My promo code is : C4JHS ..

Thanks in advance for using my code.

is it better than Revolut in any area?

I don’t use Revolut, so can’t really make a comparison, but isn’t Revolut a current account; whereas Curve charges purchases to one of your existing credit cards. Each will have their benefits in certain areas though.

To get 5£: 75XCA