Some links to products and partners on this website will earn an affiliate commission.

Many readers will have received an email from Amex recently advertising a 50% bonus on Membership Rewards Points transfers to Marriott Bonvoy.

Following the recent 50% Hilton Honors transfer bonus, I speculated that a Marriott Bonvoy transfer bonus might be on its way, and I am extremely pleased to see it now actually happen. Make no mistake – this has the potential to be the most important deal of the year for many points/miles collectors here in the UK.

What’s the deal?

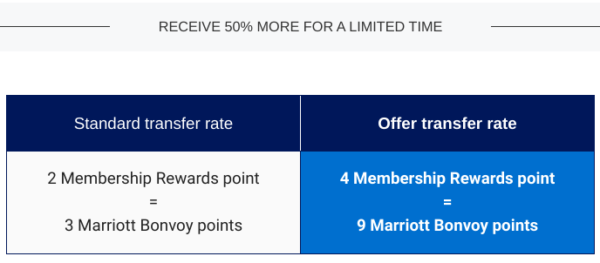

Basically, rather than getting 1.5 Marriott Points for each Amex Point, between now and 31st December, you can get 2.25 Marriott Points.

“Transfer before 31 December 2019 and you’ll receive 9 Marriott Bonvoy points for every 4 Membership Rewards points, when you transfer 1,000 or more.1 That’s 50% more than the usual rate. You can use Marriott Bonvoy points at more than 7,000 hotels in 130 countries.“

Note that Bonus Points can take up to eight weeks to transfer.

Is the offer targeted?

Possibly – but I don’t think so.

Not everyone will have received an email about the offer and there is nothing showing on the Amex website about it. That said, I didn’t receive an email about the similar Hilton offer, but was assured that it applied to all accounts when I enquired. Agents frequently get things wrong of course, but as regards the Hilton promotion, the advice was 100% accurate – in fact the bonus points hit my account just this week.

If you haven’t received an email about the Marriott offer, the best thing to do is to message Amex through your online account and ask them to confirm that you are eligible.

Why is this promo so interesting?

We frequently write about redemption ‘sweet spots’ on the award charts of airline programmes like Alaska Mileage Plan, United Mileage Plus, American AAdvantage (etc, etc). The most common question we get about those awards is along the lines of, “that sounds great, but how do I collect enough of those miles in the UK?”.

Buying miles is always an option (particularly when there is a good bonus), but that’s nowhere near as satisfying as collecting miles and flying for ‘free’.

The great thing about Marriott Bonvoy Points is that they can be transferred to a vast array of different airline programmes at very decent rates. In most cases, 60,000 Marriott Points will get you 20,000 standard airline miles + 5,000 bonus miles, so 25,000 in total.

Given the standard Amex-Marriott transfer rate is 1:1.5, that means you can normally indirectly transfer 40,000 Amex MR Points into 25,000 airline miles of whatever variety you want.

With the current 50% Amex to Marriott transfer bonus, you now only need to transfer 26,800 Amex Points (technically 26,667, but transfers have to be in multiples of 400) to end up with 25,000 airline miles.

In other words, each Amex MR Point can now be transferred into ~0.94 airline miles in pretty much any programme.

You might be thinking that doesn’t seem very impressive, because you can always transfer direct from Amex to BA/Virgin/Singapore/Cathay Asia Miles/etc at 1:1 rate, but that doesn’t tell you the whole story.

First of all, different types of airline miles are better for certain types of redemptions than others. If you want to fly long haul Business or First Class, Alaska or AA Miles are almost always going to be a better option than BA Avios, particularly once you factor in surcharges.

Secondly, airline programmes regularly offer bonuses when you transfer points across from hotel programmes. For example, BA is currently offering a 35% bonus if you transfer Marriott Points into Avios. Frankly, I doubt that the bonus Marriot Points will show up in your account before the current BA offer ends, but there are always going to be similar offers in future. Besides, the real value here is in the regular hotel point transfer bonuses offered by programmes like AA and United rather than BA.

A word of caution…

This is a fantastic deal, and if you play your cards smartly you could bag some truly incredible awards. I’ve only mentioned the relatively obvious options like Alaska/AA/United so far, but I’ll take a look at some of the lesser known Marriott transfer partners like Aegean and Turkish soon.

For many awards though, it is still very much worth considering a direct transfer from Amex to Cathay Pacific Asia Miles. You can check out some of the reasons why here, here and here.

Bottom line

I thought the Hilton transfer bonus was pretty good (and it was!), but now regret not having more Amex Points to send across to Marriott…

Are you tempted by the new 50% Marriott transfer bonus?

If I was going to change my Amex points to Avios, would I better off changing them to Marriott points and then to AVIOS?

It really depends when you need the Avios by. It’s unlikely that the bonus marriott points would show up in time while the current Avios transfer bonus is on. But, if you can wait until there’s another Marriott to Avios transfer bonus (which is very likely to happen, but could be 6 months or a year away potentially), you will do ultimately end up with more Avios.

I would personally recommend transferring Amex to Marriott regardless though as it gives you so many more options than transferring straight to Avios – unless you’re saving for a specific high-value Avios redemption.

Thank you! I’m looking to clear out my account so I can cancel my Amex gold card so This offer works for me.

Very interesting post Joe.

I have been waiting for my Hilton diamond to finish before signing up for Amex platinum( for renewing Hilton status).

You say that the best use for current Amex MR points is to transfer to Marriott- prob because of the current bonus offer? Earlier you have written about transfer of Amex MR to Asia miles.

Marriott being the base currency, I guess, it can be transferred to any airline partner. I already have a large chunk of Marriott, wanted to use for a Marriott package but never seem to want to stay for a week in the same place! I also have a large stash of Avios so i really do not want to transfer Marriott to Avios; I am waiting for better Marriott offers to other airline partners- does that make sense?

So should not one just hold on to new Amex MR points for now if one doesn’t need any more Avios or Marriott points for now- I think then i might want to get the Amex Platinum NOW! What do you say!

Cheers.

Cheers Sharat!

Re waiting before getting plat because of Hilton, what you could do is get the Plat and then just click through for Amex to set up a (new) Hilton account for you, rather than adding your details. I’m sure Hilton would be happy to merge them or let you transfer your points across in that circumstance.

Yep – my current view is that Asia Miles is hands-down the best amex transfer partner in normal times (as long as you can collect 85k-90k to make the most of the programme). But, with the 50% marriott bonus, other airline programmes can work out better and you retain a lot of flexibility (plus you’re not reliant on oneworld availability). As a worst case scenario, you could always transfer to Asia Miles from Marriott and would effectively get 0.94 miles per amex point rather than 1, so it’s not a massive issue considering the flexibility you gain.

Obviously it always fundamentally depends how many marriott points you already have and where you want to fly in the foreseeable etc, but my strong personal view is to load up on as many marriott points as I possibly can during the 50% bonus (not least for the reason you mention – eg. to make a transfer next time AA has a decent marriott to AAdvantage transfer bonus. Asia Miles will still be around after December.

If you need a referral link for the Plat, please feel free to use mine!

😉

Great post! I chatted with online reps, unfortunately I was not targeted for the offer. I don’t have guts to make a try MR transfer.

I would suggest pushing that a bit further with reps. My approach would be to say you saw the offer somewhere and just wanted to confirm your account was targeted.

I did this but the response was:

“Oh! I am so sorry this is an offer based on solicitation and the offer is sent to targeted card members only. “