Some links to products and partners on this website will earn an affiliate commission.

I was surprised (and delighted!) to see an unexpected 50,000 Amex Membership Rewards Points hit my Amex Business Gold account recently…

What???

When I applied for the card, I already had a personal Amex that earns Membership Reward Points (eg. Amex Gold or Plat), so according to my understanding of the rules, should not have been eligible for a welcome bonus on the Business Amex:

“You will not be eligible for any Welcome Bonus award if you currently hold or have held any Membership Rewards enrolled American Express Card in the past six months.”

However, after meeting the minimum spend, this popped up on my account:

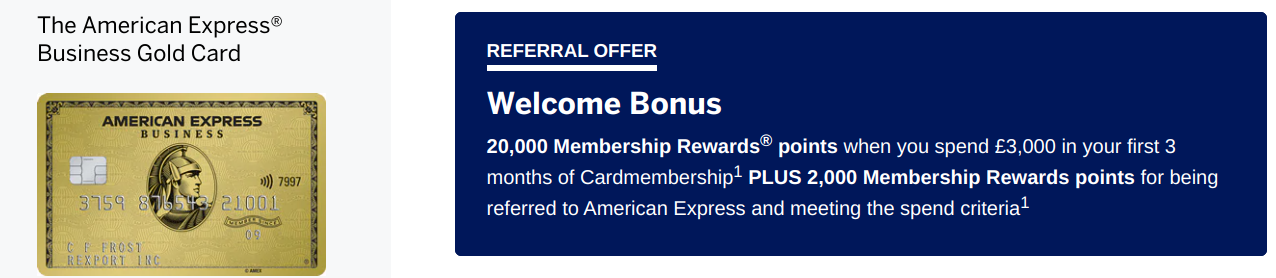

The welcome bonus on the card has now been reduced to 20,000 points (or 22,000 of referred), but was 50,000 at the time I applied.

The point is that even if my understanding of the rules is correct, mistakes can (and do) happen, so it can still be well worth hitting minimum spend targets, even if you aren’t sure whether you will get the bonus or not.

If you would like to see whether you might get the points before committing ‘real’ spend on to the card, you could always just book a refundable hotel stay or flight to see, then cancel that, and direct real spend accordingly.

15,000 reasons to get an Amex Business Gold, even if you really aren’t eligible for the sign up bonus

The reason I applied for an Amex Business Gold had nothing to do with the welcome bonus anyway (which is now 22,000 points if you use a referral link like this one, rather than the standard 20,000).

Instead, my thinking was as follows:

- I could still earn 15,000 Amex Membership Rewards Points simply by adding 5 supplementary cardholders to my account.

- I could cancel my personal Amex card, and then start cycling through the Business Amex Gold/Plat cards. After I also cancel the new Business Gold, I will definitely be eligible for Business Gold/Plat welcome bonuses after just 6 months has passed. I can then repeat that every 6 months. In the meantime, I will also be resetting the 24 month clock on personal Gold/Platinum welcome bonuses.

If you are tempted to apply as well, the requirements for a Business Amex aren’t particularly difficult to meet:

- The business has a current UK Bank or Building Society account

- You/The business have/has no County Court Judgements for non-payment of debt

- You are aged 18 or over

- You have a permanent UK home address

If you’d rather try your luck with the Platinum Business Card (which offers a 45,000 points welcome bonus, but has a £595 annual fee), you can apply here.

Bottom line

I was very happy to get a (free in first year) Amex Business Gold Card due to the 15,000 points offered for adding supplementary cardholders. An unexpected welcome bonus was a very nice surprise on top!

This has happened to me twice. Once with an amex gold and once with BA prem plus. The thing I have realised is in case you can’t link the card with you usual account, then it’s a guaranteed bonus for sure. Both the above required me to create a new username. Obv I had to commit to transferring the points on the gold card at time of cancellation cause I didn’t want to risk requesting a merger of accounts. Anyway I needed to use the points so all ended well. This was in 2018 & 2019

Interesting – I’ve not (yet) come across a situation where I can’t add a card to my normal account, but have had a bit of luck occasionally with bonuses tracking that I probably wasn’t eligible for.