Some links to products and partners on this website will earn an affiliate commission.

United Mileage Plus Miles have, historically, been quite difficult to get hold of from here in the UK, but the Starwood/Marriott merger has changed that. With a few tricks, it is now possible to get roughly 2 United Miles for 1 American Express Membership Rewards Point.

This is a relatively advanced post, so if you’re just getting started with Points/Miles and don’t understand everything in it, don’t worry! – always feel free to ask questions (no matter how simple/silly you think they may be) in the comments or on the forum.

1: United Mileage Plus Bonus

United Mileage Plus is currently offering a 25% bonus if you convert Hotel Points to Miles, up to a maximum of 20,000 Bonus Miles.

You need to register here and the offer ends on 30th November 2016.

Eligible transfer partners are: Hilton, Wyndham, Hyatt, IHG, Shangri-la, Club Carlson (40% bonus), Choice (50% bonus), Starwood and Marriott.

Even with the bonus, the only rate that is really interesting is transferring from Marriott Rewards. If you have SPG Starpoints, you can transfer them first to Marriott Rewards Points (1 Starpoint gets you 3 Marriott Points) and benefit from a much better exchange rate to United than if you transferred directly (note that transferring from SPG will work out better than from Marriott for pretty much any other airline loyalty programme apart from United!).

2: Marriott transfers to United Mileage Plus

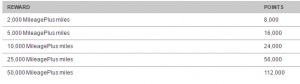

The standard transfer rates are as follows:

At the high end, 50,000 United Miles requires 112,000 Marriott rewards Points, which is 2.24 Marriott Points for 1 United Mile. That effectively works out at 0.746 Starpoints per United Mile given the 1:3 transfer ratio between SPG and Marriott.

Given that you can also transfer American Express Membership Rewards to SPG at a rate of 2 Amex MR Points to 1 SPG Starpoint, you can get 1 United Mile for 1.493 American Express Membership Rewards Points too. This is one of the ways in which the the Marriott/Starwood merger has increased the flexibility, and therefore the value, of Amex Membership Rewards Points – a subject I wrote about recently.

With the 25% bonus though, the numbers actually work out even better (but do remember you are capped at 20,000 Bonus Miles!):

Until 30th November, 112,000 Marriott Points will get you 62,500 United Miles – so 1.792 Marriott Points per United Mile. That means 0.597 Starpoints, or 1.194 Amex MR Points per United Mile. These are genuinely great transfer rates!

3: Marriott ‘Flight + Hotel Packages’

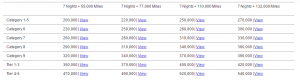

If you have a lot of Marriott Points (or Starpoints or Amex MR Points), one of the very best value redemptions you can make is for a Marriott Rewards ‘Flight + Hotel Package‘.

As you can see, you can normally get 7 nights at a Category 1-5 Marriott hotel (usual maximum cost 150,000 Marriott Points, because Category 5s require 25,000 per night and Marriott offers 5th night free on standard awards) + 132,000 United Miles for 270,000 Marriott Points.

With the 25% United bonus, 270,000 Marriott Rewards Points gets you 7 nights at a Category 1-5 hotel + 152,000 United Mileage Plus Miles (it would be 165,000 Miles, but the 20,000 cap gets in the way).

Even if you value the 7 night hotel stay at zero (!!!), you are getting 1 United Mile for 1.776 Marriott Points – which is marginally better than the 1.792 rate you would get without the 7 nights at a hotel.

If you value the 7 nights at their maximum value (150,000 Marriott Points), then you’re effectively getting 152,000 United Miles for 120,000 Marriott Points. That works out at an astonishing 0.789 Marriott Points for 1 United Mile – or just 0.263 Starpoints / 0.526 Amex MR Points.

In other words, you can effectively get 2 United Mileage Plus Miles for 1.052 Amex MR Points!!!

You might decide that a fairer valuation of the 7 free nights should be half the 150,000, so 75,000 Points, because perhaps you don’t necessarily need 7 nights accommodation and will only stay 3 or 4 nights, or maybe you end up using the Certificate at a lower Category hotel.

In that case, the 152,000 United Miles would be effectively costing you 195,000 Marriott Points – so 1.283 Marriott Points per United Mile (0.427 Starpoints, 0.855 Amex MR Points per United Mile!).

Regardless of how you cut it – it’s a heck of a deal!

4: That’s great Joe, but you need a lot of Marriott Points for this to work – how do I get them?

Spot on – there’s no disguising the fact that this requires a lot of Points.

The bad news is that I don’t really think it can be realistically done without taking advantage of credit card sign up bonuses.

The good news is that credit card sign up bonuses are probably the easiest and cheapest way to earn big chunks of Points/Miles anyway.

As we’re back onto the tricky subject of credit/charge cards, it’s a good time to reiterate that nothing I write in relation to them or similar products (including the following) in any way constitutes financial advice – or indeed advice of any kind. It’s simply some theoretical reflections on how I might, or might not, personally approach the task of getting 270,000 Marriott Rewards Points.

Earning Marriott Points directly isn’t the way forward here – the Marriott credit card hasn’t been open to new applicants in ages and isn’t that good anyway. Fortunately, it is now possible to transfer SPG Starpoints (and therefore Amex MR Points too via SPG) to Marriott Rewards.

Bear in mind that it is possible transfer Starpoints freely between members of the same household and 50,000 Marriott Points per year to anyone for just $10.00 (free for elite members), which potentially makes getting a big pile of Points together a lot easier than might be thought.

Someone referred for the Amex Gold Card (free for the first year) would end up with at least 24,000 Amex MR Points after hitting the £2,000 within 3 months minimum spend, rather than 22,000 if not referred. For the Platinum card (annual fee £450.00) they would end up with 37,000 MR Points if referred rather than 32,000 if not referred.

The referrer also gets 9,000 bonus Points for referring someone for a Gold Card and 18,000 bonus Points for referring someone for a Platinum Card.

A couple then, could easily earn 57,000 Amex MR Points simply from getting a free Gold card each and hitting the minimum spend (with the first person being referred, and then referring the other person themselves).

There is a link that should get each person 20,000 more Points for upgrading a Gold card to a Platinum card and hitting £1,000 minimum spend (you need to pay the fee, but can cancel as soon as you get the Points and get a pro rata refund) – so that’s potentially another 42,000 Points between them including the spend. (I’ve used the link without problem, but I have read that some people haven’t always received the Points so I won’t publish it on here. If you want to try the link, or indeed just want to be referred for a Gold or Platinum Card, email me at [email protected]

Round that up to 100,000 Points for a couple then (assuming they upgrade to Platinum and get the Points), as they are likely to be putting at least some of their normal spend on the card anyway.

100,000 Amex MR Points converts to 50,000 SPG Starpoints, which convert to 150,000 Marriott Rewards points, so that would be more than halfway there!

Bearing in mind that everyone can receive up to 50,000 Marriott Points per year from someone else, if they had parents or other relatives/friends who they could refer for an Amex Gold Card who were willing to transfer their Points to Marriott and share them, it could be a great way to boost the total further.

For example, referring two people would earn 18,000 Amex MR Points for the referrer and 24,000 each for the referred. That’s an additional 66,000 Amex MR Points, which is equivalent to about another 100,000 Marriott Points in the kitty, if it was all shared.

Amex also issue Business Gold and Business Platinum Cards with sign up (and referral) bonuses too.

Another option would be the Starwood Preferred Guest American Express credit card (£75.00 annual fee, pro rata refund offered) which would earn 12,000 Starpoints for someone who was referred, after hitting the £1,000 minimum spend (rather than 11,000 Points if not referred). If that person then referred their partner, the referrer would earn an additional 5,000 Starpoints too, so a couple would end up with 29,000 Starpoints in total. Starpoints convert to Marriott at 1:3, so 29,000 Starpoints becomes 87,000 Marriott Points. (I’m able to refer people for the Starwood Preferred Guest Credit Card, as well as the Amex Gold and Platinum Charge Cards – just email me at [email protected]).

I’m not saying it’s easy to get together enough Points for 270,000 Marriott Points, but it’s certainly possible – especially with a bit of help from family or friends!

5: Why do I want United Mileage Plus Miles anyway?

Another superb question, and one I was fully intending to answer in this piece – but it’s already turned into a bit of a monster in terms of length, so rather than rushing through, I’ve decided to answer that point in a separate post!

Hey,

One question. Do you know if people from a country outside of the uk (e.g. Germany) can apply for the british version of the american express?

Also, you don’t get only 57k as a couple, as you need to factor in the minimum spend, as they also generate miles.

Cheers

Hi,

Yeah – the 57k figure does include the 2k min spend (but I should perhaps have made that clearer).

Basically, if you’re not referred you get 20k bonus after spending 2k, so + the 2k spend = 22k Points. If you’re referred your bonus is 22k + the 2k spend to trigger it = 24k.

So for 2 people that’s 48k + 9k to the first person for referring the second one = 57k total all together.

As regards non-uk residents being able to apply, I don’t really know for sure, but strongly doubt it. I think at the very least you would need a UK address and some sort of credit history here.

If you were moving here and already had a relationship with Amex Germany (or wherever) though I think they could probably arrange something for you.

Perhaps if you had a UK income of some sort it would be possible to arrange a business card based on that.

Personally, I would give Amex a ring (in Germany and the UK) and see what they say.