Some links to products and partners on this website will earn an affiliate commission.

Norwegian has announced a plan explaining how the airline intends to comply with the requirements set by the Norwegian government in order to gain access to a government loan of 2.7 billion Norwegian Kroner (~£210 million GBP).

The main sticking point is that it must convert leasing commitments of NOK 5.3 billion (~£420 million GBP) into shares in the “New Norwegian”.

As regards other key issues, the company mentioned the following in a message to the Norwegian stock exchange today:

- In total, debt must be converted for NOK 8.9 billion

- The existing shareholders will end up receiving 5.2% of the shares in Norwegian

- The lending companies will have 53.1% of the shares and the bond lenders will have 41.7% of the shares

- Changes to flight orders and leasing agreements must be cancelled / terminated

- In the current situation, Norwegian can survive for 6-9 months and spend between NOK 300-500 million per month

- The fleet must be reduced to 110-120 aircraft from the 168 in the fleet today

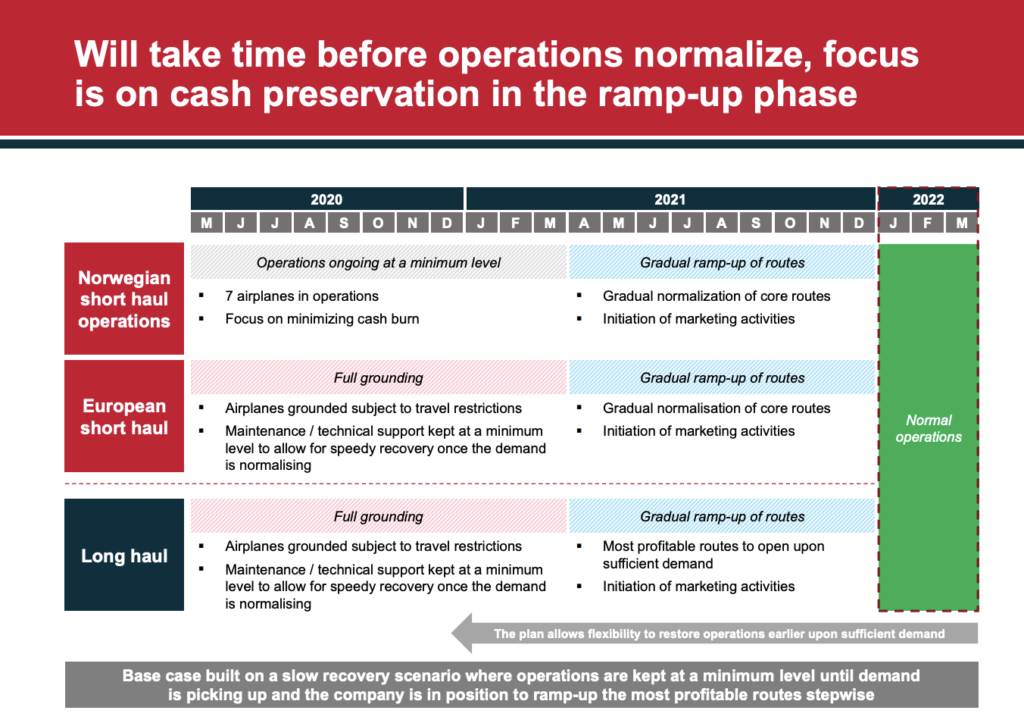

Norwegian does not expect the situation in the industry to return to normal again until 2022. However, there is still positive confidence in the peak season for 2021.

So until March 2021, the focus will only be on keeping just 7 aircraft in the air for domestic operations in Norway.

European flights will only start after March 2021. The same goes for their long haul business – routes out of London Gatwick to US destinations are not scheduled to begin again until March 2021.

Which markets will the “New Norwegian” concentrate on

The main markets in the “New Norwegian” will be the following:

- Domestic in Norway

- Nordic countries

- Flights from the Nordic countries to Europe

- Continued base at London Gatwick with routes to high density destinations in the US (eg New York, Los Angeles and others)

It is a little surprising that they intend to continue with their London Gatwick base, but they must consider it to be financially attractive in the long run (and that the airline will still be in a position to resume those flights next year).

You can read Norwegian’s presentation here .

On 5th April our Norwegian flight Barcelona to Miami didn’t happen nor on 18th April did our Norwegian flight happen from New York to London. We booked the Low Fare for one adult, one teen and one child. So they owe me more than 1000 UK Pounds.

We also have a Ryan Air flight on 4th April London to Barcelona and 3 useless BA vouchers for Avios booked flights. In addition two train tickets to and from the London Airports.

Maxine, I called BA on 0800 727 800 this morning (don’t select any options when you do). I waited on hold for less than 10 minutes, was put through to a rep and had 57000 Avios (immediately) and £190 (up to 21 days) in fees refunded there and then.

Ryanair are trickier…I decided to forego contacting them on live chat (so far the best course of action it seems) and went straight to my credit card provided to launch a chargeback. You can do the same if you paid with a credit (and possibly) debit card.

If your trains have been cancelled, you should be eligible for a refund. The same should be true for your Norwegian flights but I can’t help you there I’m afraid!