Some links to products and partners on this website will earn an affiliate commission.

The American Express Gold Credit Card is almost always the best option on the UK market for anyone who wants to start collecting airline miles / hotel points from their everyday spend. It’s free for the first the year, comes with 2 airport lounge passes and offers 22,000 Membership Rewards Points as a signup bonus (after spending £2,000 in 3 months) if you use a referral link like this one. It really is the perfect ‘starter’ card. Once you’ve collected your juicy signup bonus though, you’re inevitably going to ask a question that I hear all the time: “what are the best American Express Membership Rewards transfer partners?”.

Unfortunately, there isn’t a (good) short answer.

Unfortunately, there isn’t a (good) short answer.

First of all, it depends on the sort of thing you want to use your Amex Membership Rewards Points for: Hotels, Flights, or ‘Other’.

This is a travel website, so naturally I’m going to focus hotels and flights, but the main reason to avoid spending time discussing redemption options like gift cards, merchandise, statement credits, Amazon credit, etc, is because the value you get from spending your points on those things is usually relatively very low (~0.5p per point). I’m also going to ignore Eurostar and Nectar for the same reason, despite them being travel-related.

My view is that you should aim to get AT LEAST 1p of value per point – and hopefully more.

If you adopt the same valuation, that means the sign up bonus for the Amex Gold is worth at least £220, if you sign up using a referral link.

Best American Express Membership Rewards Points Transfer Partners: Hotels

There are three hotel programmes you can choose to transfer to: Hilton Honors, Radisson Rewards and Marriott Rewards (soon to be called Marriott Bonvoy).

Hilton Honors

Each Amex Membership Rewards Point converts to 2 Hilton Honors Points. I generally value Hilton Points at ~0.4p each, so you’re looking at roughly 0.8p per Amex Point (2 x 0.4p).

It’s not a terrible option, but it’s not a good one either

Marriott Rewards

Each Amex Membership Rewards Point converts to 1.5 Marriott Rewards Points. I generally value Marriott Points at ~0.7p each, so that’s equivalent to getting ~1.05p per Amex Point (1.5 x 0.7p).

One of the main reasons I value Marriott Points highly is the ability to transfer them to lots of airline programmes at a favourable rate, so this can be a very good option for more than just hotel stays. I’ll have more to say on that later.

Radisson Rewards

Each Amex Membership Rewards Point converts to 3 Radisson Rewards Points. I generally value Radisson Points at ~0.3p each, so that’s equivalent to getting ~0.9p per Amex Point (3 x 0.3p).

This can be a fairly solid option for hotel stays in some parts of the world, but Radisson’s global footprint isn’t in the same league as Hilton or Marriott, so watch out for that.

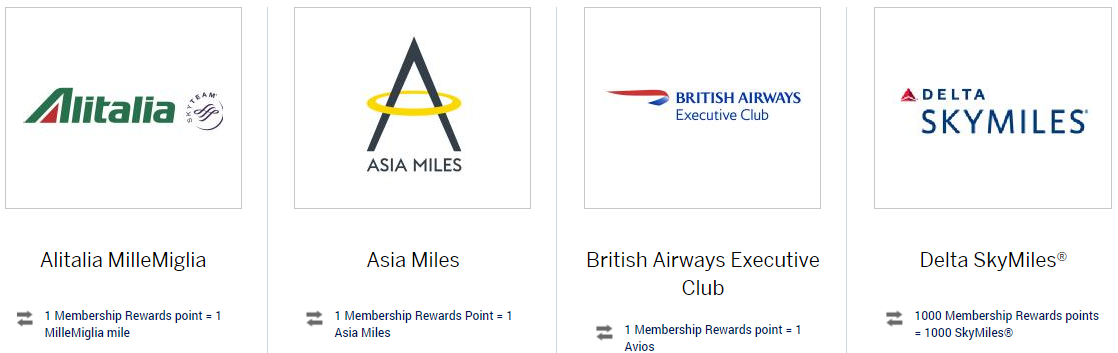

Best American Express Membership Rewards Points Transfer Partners: Flights

This is where things get complicated. There are so many options and so many personal factors involved in deciding which one is ‘best’ for you, that a universally applicable answer doesn’t exist. One of the biggest factors though is, “where (and how) would you like to fly?” – and we can help to simplify things in that regard.

I’m therefore going to spend some time over the next few weeks systematically mapping out the best options for flying to each region of the world from the UK/Europe, in Economy, Business Class and First Class.

I’m not just going to look at the 12 direct transfer partners that Amex offers, but also at whether better value can be achieved by transferring to other airline programmes indirectly via Marriott Rewards.

Bottom line

I think the series will ultimately prove very useful, but expect that refinements may have to be made along the way, so if at any point you think I’ve missed out a great option, please let me know in the comments!

0.7p for Marriott? Seems a bit toppy to me. How did you reach that figure?

I always valued SPG points at about 1.5p and MR points were worth exactly a third, so 0.5p was a figure I was happy with as a baseline.

I got 1.4p at at the Courtyard Taipei and and 1.2p per Marriott point at the Kuala Lumpur Aloft for later this year. Granted these are the exception rather than the rule. But for low end categories 0.7 is on the low side. Once you get further up the categories, it does drop though.

CY Taipei has been outstanding value since the downgrade from Cat 4 to Cat 2 – that one’s a real outlier. I haven’t checked all the March category changes but I suspect that’s one of those that will be rerated. Now’s a good time to get a points booking in for later in the year!

Yep, I can see the argument. Personally though, my Marriott Points have a high ‘floor’ value, because I can transfer them at a reasonable rate to more or less any airline programme, as and when I need to. And, a lot of those programmes can be otherwise tricky to accrue substantial balances with.

If you transfer 60,000 Marriott Points, you usually get 25,000 miles, so valuing Marriott Points at 0.7p each is roughly equivalent to valuing the various types of miles I transfer to at about 1.68p each. Obviously that would be very high for Avios etc, but if I want to fly Etihad First/Biz then it’s a very fair price for AA miles given the award chart. The same applies to many different Alaska redemptions, plenty of United ones (and the transfer rate is actually slightly better there and there’s sometimes a 30% bonus). You could make the same argument for JAL, ANA and others too, depending exactly on where/how you want to fly.

The flexibility of being able transfer to wherever, for the flight you actually want/need at any particular time (and use for hotels as a back up option) gives Marriott Points additional value too.

I don’t use them for hotels much, but got a cracking value per point for a 5 night stay in Istanbul (even by Istanbul standards…), though I accept that if I only used them for hotels, I’d have to accept a lower valuation in general. That said, for people who genuinely pay cash for the top spg/marriott places, the current top level 60,000 per night (48,000 with 5th night free) is remarkable value if you valued the points at 0.7p each.

That’s always my dilemma, hotels or Alaska miles. I’ve been spoiled a couple of times coming back from HK to London in Cathay first thanks to learning from your site to credit my BA first revenue flights to Alaska. Last time I flew Inverness to Chicago via London in BA first for $2000 return and got 48000 Alaska miles for it. Now my problem is whether to come back from HK in CX business for 42000 or top up with Marriott points for CX first again….

I shall be eternally grateful to you guys for the BA to Alaska tip. Best tip I ever got from a frequent flier site, especially now the availability is back to normal 🙂

Delighted to hear it! – it really is an excellent option for many BA flyers.

I’m actually facing a similar Alaska/Cathay dilemma myself at the moment. I have enough Alaska Miles for First, but Cathay Biz is great anyway, gets me nearer to home (MAN rather than LHR), and splurging on First just seems a bit extravagant on this trip (travelling by myself, have flown Cathay First not too long ago) given what good value the Biz redemption is. As far as ‘dilemmas’ go, it’s a very nice one to have of course!

I really want to try JAL First (between USA and Asia) soon-ish as well, so reckon I’ll stick with Biz and save the miles this time. Maybe. 😉

I can’t really bring myself to use 1.68p when I can buy AA or Alaska miles at roughly 1.5p often enough…

However I’m looking forward to the “why you should almost always be converting Amex points to Marriott points” series…

Excellent point re whether we should ever value points/miles at a higher rate than what they can be (fairly easily and regularly) bought for in cash. In general, I’d agree with you and say no – which is one of the reasons why I don’t like transferring Amex points to Hilton. But valuation is complicated (particularly when it involves points to points transfers where cash isn’t really in play – should valuations lean more to being illustrative of ‘fair’ redemption value in that context? Maybe).

Regardless, I do think the extra value I’ve given Marriott points is reasonable though, due to their remarkable flexibility and the fact you can’t buy them at a sensible price anymore.

Haha, actually, I think KrisFlyer may feature too and even Avios on occasion – but yes, transferring to marriott will probably be part of the answer fairly often…