Some links to products and partners on this website will earn an affiliate commission.

One of the great things about American Express Membership Rewards points (loyalty points earned via the American Express Green, Gold and Platinum cards) is their flexibility. For anyone collecting miles and points they are, in my opinion, the best currency to have a stockpile of.

I say this because the transfer options are very wide, and it is really easy to move them around. For example, if I see a redemption opportunity with British Airways (perhaps because I have a Companion Voucher from the BA Amex, which you can hold at the same time), I could transfer them across into Avios. Likewise if there was something that I fancied from Etihad Guest (who do offer some great value redemptions), it would be no problem to send my points there. If I just had my points with Avios, I would not have the flexibility to choose here. Your Membership Rewards points can go wherever there is value.

The Membership Rewards airline partner options cover all three major alliances (Oneworld, Star Alliance and SkyTeam), so there is an enormous range of airlines that you can potentially apply your points to.

But they’re not just for airlines…

There are various options for Membership Rewards points beyond flying. One potentially good use is exchanging them for hotel points: in the past I have transferred my points to Starwood Hotels’ loyalty scheme, Starwood Preferred Guest (SPG) at a rate of 2 MR points to 1 SPG point, which I then used for a points-redemption hotel stay in New York. You can also exchange them for gift cards and even use them as statement credit although, although, as Ian said here, this is one of the worst options you could take so we don’t recommend it.

However, if like me you are an Amex credit card “churner” (i.e. you open your Amex credit card account for the bonuses, get the bonuses, close it and then re-apply in six months to do the process over again) you will quite regularly find yourself closing down your Membership Rewards account.

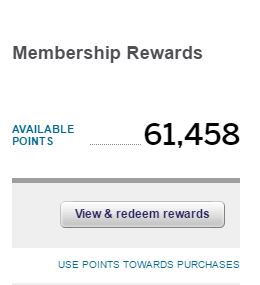

I’m thinking about this because it is coming to the end of my year with the American Express Gold card. Before I close the account I need to transfer the points somewhere so I don’t lose them. I currently have over 61,000 points.

If I transferred these points to British Airways Avios I would have a healthy balance. However I do have other ways of collecting Avios – through flying, my British Airways American Express card, and Tesco Clubcard to name my three most lucrative options. My main hotel chain is IHG, but they are not a direct transfer partner (you can send points to Virgin Flying Club and then on to IHG, but this is not very efficient), so I could add to another balance, such as SPG or Hilton – but as I don’t have any redemptions in mind with them, it seems like a bit of a gamble.

I think that I will leave them with American Express as long as I can and if nothing better catches my eye, I will send them across to British Airways – after all, I know that I will be able to use them!

But what if I do? I’m going to be left with a small number of points that are “untransferable”!

Tidying up the smaller points balances

One top tip when closing down an Amex card is, rather obviously, to make sure you transfer all the points. But it’s not immediately obvious how to do it. For example, British Airways allow a minimum of 1,000 points in multiples of 500, so I would be able to move 61,000 points into Avios, but would have 458 points left over.

If they are still there when the account closes, these will be lost.

This is where the rather wonderful Nectar option comes in. You can transfer Membership Rewards point to Nectar on a 1:1 basis, and crucially, there is no minimum transfer amount. So those 458 spare points will not be lost on closure of my account – I transfer any remaining points to Nectar prior to closure, which gives me 0.5p/point and a nice little boost for the Christmas shop at Sainsburys!

Slightly OT:

On the topic of tier levels on BAEC, ive been reading the benefits of each tier today but cannot see why someone would just for the purpose of gaining enough TP’s take a flight from LON to Hong Kong to earn enough tier points for silver as read over on HFP today.

The flight is costing nearly £700 to gain silver tier?

Is £700 and having to take a flight to HK on purpose just to gain a few benefits really worth it or am i missing a trick here?

So you get lounge access, reserved seating and 50% more avios and a few more small benefits, is this really worth all of the above.

A good question, but one that’s very difficult to answer given that it’s so heavily down to individual circumstances. It may be that the person in question can justify the spend based on the subsequent lounge access (NB when flying any Oneworld airline), bonus Avios, additional baggage etc. But just because it works for them doesn’t mean everyone should, as a rule, shell out a load of cash (+ time + effort) for BA Silver.

It also may well be that they’re slightly playing down the value of the HK flight – if for example they get a HK weekend out, it may not be a case of it being totally wasted time and cash (and frankly if they’re not factoring in some sort of enjoyment when flying to such an interesting destination, they’re a bit silly).

I thought you could pick up an annual lounge access pass for £150 – £200. The bonus avios i see as a non starter as you only get 50% but would need to fly lots to get a decent return but then if you flew lots you would probably have silver tier anyway?

Extra baggage allowance you usually get 20-23kg on long haul anyway, do you really need anymore than that per person, over on HFP they recommneded taking the HK flight purely to earn 600 tps, no mention of a holiday so looks like take a flight costing £700 purely to gain silver.

To me it seems a big outlay in cash and time for a tier.

It wasnt Hk but Chicago in the end, reading it again it has been mentioned maybe have a weekend away in Chicago to make use of the flight at £680 but Harry has also asked is it really worth the outlay in cash and time to gain silver.

Of course i agree if you had planned to go to Chicago anyway and managed to bag the mispriced fare then fine but i have seen crazy statements before of people flying all over the world to the strangest locations taking nearly a week of airtime to get silver / gold which seems madnesss for the return (mind you we are all a bit on the mad side point chasing) ?

Hi Adam,

Yeah I pretty much agree with you, but there is a fairly substantial group of people who are really into TP/Mile Runs.

I imagine the main reasons you could be tempted are ‘shiny badge’/ status (not a good reason at all in my book, but if you get a kick out of it fair enough…); ‘adventure’ – doing slightly crazy-seeming things sometimes can be fun and if you’re a bit of an aviation geek I can sort of see the attraction here, though I would want at least a couple of nights at the destination too personally; ‘genuine economic incentive’ If you know you’re going to be changing roles at work or retiring and going travelling etc – basically flying a lot the next year, the bonus Avios and other benefits could make sense. I think some people also just see it all as a bit of a game/fun and enjoy the planning etc as part of the playing – I certainly know people with more expensive and considerably more tedious-seeming hobbies!

I didnt want to mention is one of the reasons purely for the status, look at my silver luggage tag (Wow)! ?

I can see why some would plan a massive tp run for the challenge if no committments at home, maybe a good basis of another great article on here!

Perfect timing for this article. I am also coming up to the end of my first year with Amex Gold and I am wondering what to do with the points. I love the idea of them being so transferable and hate the idea of having to send the points to some location where they are effectively “locked” (I am aware that some transfer partners can then allow the points to be transferred again to others such as Virgin to IHG). Since I’m not saving up for a trip in particular, I really am at a loss where to credit the points to. Is there a way to transfer them to someone else with a MR rewards account whilst I wait for the 6 months to pass before I can reapply for the card?

It’s definitely “Tricky Question Day” today 🙂

This one is particularly difficult to answer, not least because the answer is “contractually yes, but actually no…”

The Gold (and Platinum) Cardmember Agreement is pretty clear that you CAN do it:

If you end your Card Account agreement and there are no other Linked Cards on your Points Account, or if you end these Terms and Conditions, you will have 30 days from the date you request this to redeem your Points. You can also transfer them to another Points Account, including transferring to a Points Account held by someone else (for a fee that we will inform you of at the time). If you do not transfer or redeem your Points within 30 days, they will be forfeited.

Historically, that fee was £15. The problem is, if you ask Amex to make this transfer, bitter experience has shown they will refuse – despite what the ts and cs say. Given that that is a breach of contract, you could I suppose bring a claim against them in court or complain to the Financial Ombudsman (a much better initial option), but be prepared to face a drawn out saga.

While Amex would not then, in theory, be permitted to penalise you for bringing this claim when you apply for subsequent cards, it’s hardly going to result in them viewing you favourably. Frankly, unless Amex change their approach, I would just rule it out as an option.

You’d wonder why they persist in leaving the entry in the T&C when they are not inclined to allow it to be done. Amex used to allow you to transfer points to another card member even without closing your account, I did it a couple of times. But they removed that from their T&C around 3 years ago.

Anyway, some options are:-

1) Transfer to SPG. It’s a poor 2:1 transfer, but you are putting your points in a bank that lets you move them to just about any airline. If you have a nice round 40K or so, then remember that when transferring the 20K SPG to an airline, you’ll get a 5K bonus. So basically 40K MR will end up as 25K in an airline. Also with the recent news regarding Marriott/SPG, You could end up doing MR-SPG-Marriot, which would give you 1.5 MarriottRewards for each Amex point.

2) If you don’t want to pay £140 to continue with the Amex Gold, but are prepared to pay £5 a month to retain your MR points balance, phone Amex and downgrade to the green card. That has a £60 a year fee, and will keep your MR pot live. When you know what you want to do with your MRs, transfer them and close the green card to get a pro-rata refund.

Yes, bizarre that it remains in the ts and cs. If they don’t mean it, take it out!

Thanks for the help guys! Much appreciated!

Another option I’ve used in the past is the Amex Gold CREDIT card. I’m not even sure if this is still available, it isn’t listed on the Amex site. I have switched from the Preferred Rewards Gold card previously to the fee-free gold credit card, which also earns Membership Rewards points at a rate of 1 per £. At the time, I was able to link it to me existing Membership Rewards account, meaning I could close my PRG account and save the annual fee . Of course, one of the reasons for cancelling the card, is to apply again later for a sign up bonus, for which you need to wait 6 months from when your Membership Rewards account is closed. Keeping the MR account open with the credit card delays the start of this 6 months, but does buy you time to decide what to do with your balance without paying the card fee. Might be worth asking Amex if this is still available?

OT again.

Just received an email offer from AA, get 35% off when transferring or sharing aa miles. 60k share miles for $400.

If your partner had no AA miles and you wanted EY 1st / Biz for you both, is this ok as i remember readong here you need just over 60k AA for the a380 EY 1st experience.

Terrible deal – don’t do it!

You can book for anyone using AA Miles in your own account anyway, so no need to transfer if you’ve got enough.

Even if you would need to transfer to have enough in 1 account, there are almost always better ways to top off an account.

They were selling Miles with a much better bonus earlier in the year – a 35% bonus on sharing Miles means your $400 is basically buying 21,000 Miles (and allowing you to transfer 60k, but if you had 60k why would you transfer? -just use the original account to make the booking!).

Good point Joe, not that i have 60k AA miles yet to book 1st and didnt know about the previous AA purchase miles offer, that sounds better value.

Was the previous AA offer more cost effective than the recent SPG miles purchase offer?

I remeber you advising me that transferring or gifting AA miles was expensive.

I seem to remember AA selling Miles for about 1.3p per Mile before the Summer, June maybe? That’s about as low as I’ve seen them and isn’t bad if you have a specific high-value redemption in mind (like you do). The 35% SPG Starpoints discount in May meant that AA Miles could be had for a little bit less than that.

You should check out my RocketMiles post from earlier – you can essentially buy 4,000 Miles for ~1p each even if you don’t actually need a hotel stay. You can book for other people and still get the Miles, which is worth bearing in mind if you don’t have any travel lined up yourself.