Some links to products and partners on this website will earn an affiliate commission.

Forgive me the headline (an homage to some talented people at BuzzFeed), but I really do think there is an excellent case for getting an Amex Platinum at the moment!

I am fully aware of how odd that may initially sound, given it has a hefty annual fee and that almost all of its key benefits are travel related (and therefore aren’t much use right now). Spend a minute reading the arguments below though and let me know in the comments if you agree or not…

Why right now is a great time to get an Amex Platinum Card

1. Increased earning rate

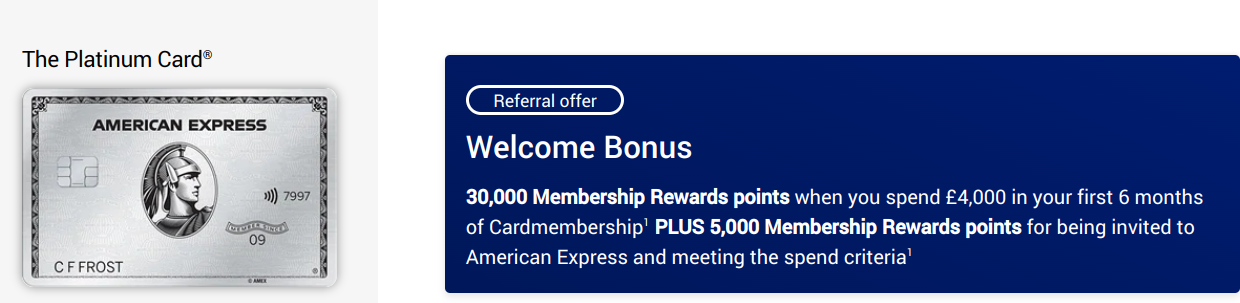

Until 20th July 2020, Platinum cardholders earn double Amex Membership Rewards Points on all spend. This means that on top of the 35,000 bonus Points you would receive as a welcome bonus for spending £4,000, you would also earn 8,000 Points for the spend itself rather than the usual 4,000.

In total then, (as long as you used a referral link like this one when applying) you would earn 43,000 Amex Points if you spent the full £4,000 by 20th July.

To earn an additional 5,000 bonus Points, all you have to do is add a (free) supplementary cardholder to your account. That means you would actually earn 48,000 Amex Points in total!

2. Increased redemption rate for statement credits

Amex has also doubled the value that Platinum cardholders receive when they use Points towards purchases. The normal rate is 0.45p per Point, but until 20th July 2020 it is 0.9p per Point.

This is a very generous offer and if you redeemed your full 48,000 Points against purchases, you would effectively be able to get £432 worth of free stuff!

The Platinum Card has an annual fee of £575 , but it’s important to note that it is refundable on a pro rata basis. So, if you cancelled after say 2 months, your refund would be £479, meaning the card only actually cost you £96. In return, you would have received £432 from your 48,000 Points, so would make a profit of £336.

It’s even possible to hit the spend target and cancel the card even quicker if you wanted to pay less in fees. Also, you may even be offered more bonus points for keeping the card!

And both yourself and the person you nominate as a supplementary cardholder would receive the benefits below.

3. Hotel elite status that lasts for years

Platinum cardholders receive an array of elite status for various hotel loyalty programmes. Unlike the other travel benefits (like airport lounge access) that require you to keep the card, you keep the elite status perks regardless of whether you keep the card. Platinum supplementary cardholders can enjoy elite status too.

You may think that elite status is no use at the moment because you can’t travel, but look at how long you would actually keep the status for:

- Hilton Honors Gold – valid until 31st March 2022

- Marriott Bonvoy Gold – valid until 28th February 2022

- Radisson Rewards Gold – valid until 28th February 2022

- MeliaRewards Gold – valid until 1st March 2022

- Shangri-La Golden Circle Jade- valid until 31 December 2021

It is possible that you won’t be doing any travel in the next 18-22 months, but there is a very good chance that you will be!

Bottom line

As strange as it may seem, now really is a superb time to apply for an Amex Platinum Card.

You can easily walk away with £100s is profit AND a range of hotel elite status that will benefit you into 2022!

Remember to apply using a referral link (this is mine, feel free to leave your own in the comments) in order to get 35,000 Points as a signup bonus rather than the standard 30,000.

One important thing to watch out for though – you will not receive a Platinum signup bonus if you have had a personal Membership Rewards Points earning card in the last 24 months (eg. Platinum, Gold, Green, Rewards).

Convinced that now is a good time to get a Platinum Card, or not? – let me know in the comments!

Please feel free to use my referral link.

http://amex.co.uk/refer/jAMESWyjUa?XL=MNANS

You get some more points, I get some more very needed points, happy days 🙂

Stay safe

It’s great to help each other, especially in these difficult times – so I would be delighted if you could use my referral link to apply for your AMEX card (Gold, Platinum, BA etc.):

http://amex.co.uk/refer/aTHINSBrhz

Have a great day and stay safe!

Please feel free to use mine as well! You don’t have to get an AMEX Platinum, you will also get bonus welcome points by clicking “View other cards”!

http://amex.co.uk/refer/lIHUAMYO9S?XL=MIANS

And here is mine, if someone is generous enough to use my link:

http://amex.co.uk/refer/nIKULJEtEU

Every little helps! I shall be grateful if someone could use my link as well.

Thanks.

http://amex.co.uk/refer/nEERAGjtRT?XLINK=MYCP

Extra points would be great for me also! Let me know if you use it and I’ll try and return the favour in the future if I need a referral.

http://amex.co.uk/refer/pETERWbWDo?XL=MIDNS

Does the sign up exclude BA Amex cards in the last 24 months?

Hi Tim,

Having a BA Amex is absolutely fine re the Platinum bonus.

The rule is that “you will not receive a Platinum signup bonus if you have had a personal Membership Rewards Points earning card in the last 24 months”. So, BA cards, Marriott, Nectar, etc are all fine (as is having a Business Plat). The only restriction is if you have had a personal Plat, Gold, Green or Basic, in the last 24 months.

If you do decide to apply, I’d be much obliged if you used my link! http://amex.co.uk/refer/jOSEPDni3f?XLINK=MYCP 😉

See that you replied, I have used your link. Spend them wisely my friend!!

Many thanks!! – They will certainly be well spent!

I’m sold! Will look at signing up over the weekend, and will choose one of the commenters at random to use their link.

If anybody would like to use mine, then please feel free, and thanks in advance if you do:

http://amex.co.uk/refer/aDDaMMlVui?XLINK=MYCP

Stay safe and well everyone!

Feel free to use the link below guys:

http://amex.co.uk/refer/yEWTUTU2WA

This is for gold card but you can choose any card you like. Cheers!

You have been referred for an American Express Card.

35,000 free points if you use my referral code:

http://amex.co.uk/refer/wILLIHXGQ5?CPID=999999554

Hi Joe

Really interesting article. I would appreciate getting your advice on whether I should swop my BA Premium AMEX for the platinum card.

Would you be able to email me?

Thanks

Hi Daniel,

Cheers – happy to help. Drop me an email at [email protected]

To get a bonus of 35,000MR Points, please use my referral: : http://amex.co.uk/refer/dANIEMG34K?XL=MIANS