Some links to products and partners on this website will earn an affiliate commission.

I published an article yesterday about why right now might be the best time to get an Amex Platinum Card, but (despite the many benefits and pro rata refund) the headline £575 price tag of the Platinum can be off-putting. It is therefore time to have a look at the Amex Gold instead – which has the delightful advantage of being completely free for the first year (just cancel anytime before the start of the second year).

The first 2 reasons why now is a good time to get an Amex Gold are the same as with the Platinum, but there are some important differences to “Reason 3”, so skip to that if you’ve read the previous article. In particular, there’s a Gold-specific trick for giving yourself a ‘points advance’ that could be very useful in light of the Marriott transfer bonus…

Reason 1:

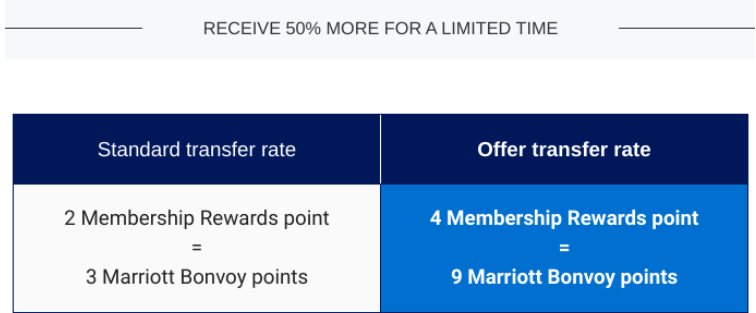

The current 50% Membership Rewards Points transfer bonus to Marriott Bonvoy is arguably the deal of the year. It runs until 31st December 2019, so you’ve still got plenty of time to apply now, rack up a load of Amex Points, and then make a transfer before the end of the year.

You can generate massive value, regardless of whether your focus is free hotel stays or free flights.

Reason 2:

Christmas is coming!

I am not for a second suggesting that anyone should ever spend more than they can afford, but it’s just a simple fact that December tends to be an expensive month for most people, so it makes sense to earn some points back from that spend.

With the popular ‘Shop Small’ promotion returning, having an Amex can even save you hard cash this festive season.

Reason 3 (Tricks to boost your points balance!):

The changes Amex made to sign up bonus eligibility this year have undoubtedly hit a lot points/miles collectors in the UK hard. But, even if you aren’t eligible for a sign up bonus, you can still earn a surprising number of points – as I’ll explain in a minute.

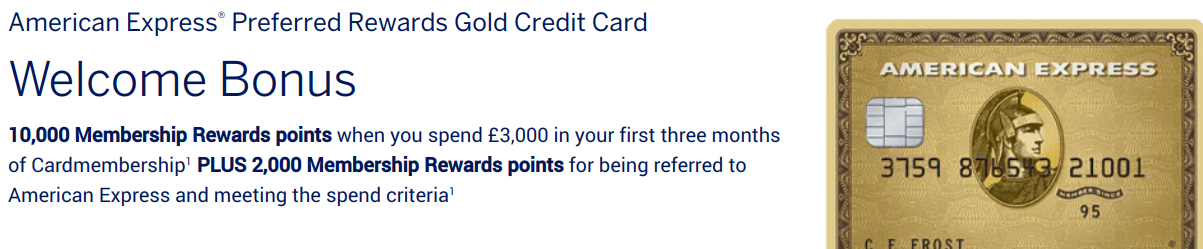

If you haven’t held any personal Amex cards (being a supplementary cardholder or having a business Amex is fine) in the last 24 months, then you are eligible for a sign up bonus on the Gold Card. Using a referral link like this one, you would earn 12,000 bonus points for getting a (free in the first year) Amex Gold and spending £3,000+ in your first 3 months.

You would also earn at least 3,000 Points from spending the £3,000, meaning you would have a total of at least 15,000 Membership Rewards Points. That’s not bad, but there are a couple of ways you can supercharge your earnings.

Every time you refer someone for ANY Amex Card (it doesn’t have to be for a Gold) you earn 6,000 bonus points, up to a maximum of 90,000 per year. At the most basic level you can therefore earn a decent amount of points by referring your partner/family member/friend and having them refer you next time you need a card.

It is also possible to ‘self refer’, as I have previously explained here (note that the amount of points you receive has changed since that article). Remember that you will earn 6,000 points when you refer someone (including yourself) for any personal Amex card – so you might fancy picking up a few of the different free cards that Amex offers…

To avoid any potential unpleasantness with Amex though (however unlikely), it’s probably best to play the game in ‘2-player mode’ and have your partner/friend provide your referrals while you provide theirs.

Over the course of a year, it would be very easy for a couple to amass 42,000 bonus points just from referrals (with the first cardholder referring their partner for 4 cards and the partner then referring them for 3).

Amex is also currently offering 3,000 bonus points for adding a free supplementary cardholder to an Amex Gold account.

Even if you aren’t eligible for the sign up bonus, it’s therefore possible for a couple to collect 48,000 bonus points in total without much effort. You could, of course, be more aggressive as regards referrals if you wanted.

You might not want to apply for a bunch of different cards within the space of a few weeks though, as it could hit your credit score, so how do you get the points in your account before the Marriott transfer bonus ends? Create your own ‘points advance’ of course! – you can learn how to do so here.

The rules governing the offers listed could be changed at any time, which is why it makes sense to take advantage now while you can.

Bottom line

It really is an very good time to get an Amex Gold card – even if you aren’t eligible for the sign up bonus!

If you want to earn even more points, consider the Amex Platinum as well. It’s not an ‘either/or’ situation, you can have both a Platinum and a Gold at the same time…

Another nice post Joe. Cheers.

> If you want to earn even more points, consider the Amex Platinum as well. It’s not an ‘either/or’ situation, you can have both a Platinum and a Gold at the same time…>

I missed the deadline earlier this year when the rules got changed hence never got down to getting a Gold, instead took the BA Premium Plus.

I was going to get a Platinum to maximise on MR as haven’t held a MR card for 24 months, so getting a Gold before that will not be very much beneficial.

Yep – definitely get the Plat before the Gold in that case!

Does each supplementary triggers a different 3,000 bonus as with the Plat?

Ah of course, only the first is free.

Exactly – just first supp is free

Are you sure each supplementary triggers 5,000 bonus?

It certainly did last week 😉 – but these things can change of course. The bonus comes through within a few days though, so you could even cancel the Plat first month and pay nothing/very little, so not a huge risk.

I’m 90% sure you only get more than one bonus if they are all ordered simultaneously.

I did mine separately.

I thought you were one of those who did them at the same time. I must have misread.

But I assume still pro-rated refund so might still be worth it depending on your plans.