Some links to products and partners on this website will earn an affiliate commission.

We recently covered a brief history of Curve here on InsideFlyer, and the most recent entry on the timeline was the launch of Curve Metal in January 2019. Metal is the premium offer from Curve, but are the benefits worth £14.99 per month?

[Remember that whichever Curve Card you choose (even the 100% FREE Blue Card!), you will earn a boosted £10 sign up bonus just for using the code FLYR3 . Sign up here now – it only takes a minute]

Card Options

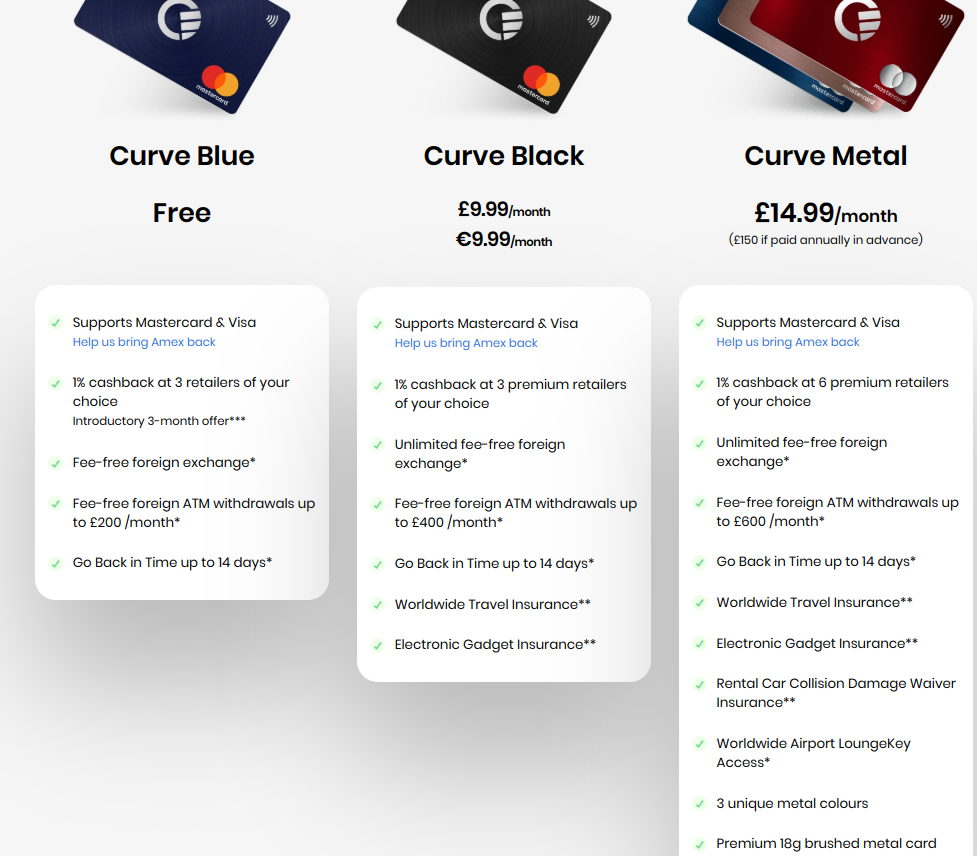

We won’t spend much time going over old ground, so here’s a very quick reminder of the 3 types of card that Curve offers, Blue, Black and Metal

Black vs Metal

I’m going to assume that if you’re reading this article, you have at least some interest in the premium features of a card with a fee, so will just compare the benefits of the Black Card to Metal. Blue still has some valuable travel benefits such as fee-free foreign exchange and ATM withdrawals, but for the frequent traveller, the spend limits on those will probably be insufficient.

1. Common Features

There are a number of common features across Black and Metal:

- Unlimited fee-free foreign exchange

- Worldwide travel insurance

- Electronic gadget insurance

While the insurances are listed on both, there are higher levels of cover on the policy provided to Metal cardholders.

- Cancellation £10,000 Metal vs. £3,000 Black

- Curtailment £10,000 Metal vs. £3,000 Black

- Abandonment £10,000 Metal vs. £3,000 Black

- Personal accident £40,000 Metal vs £30,000 Black

Both include £15,000,000 emergency medical expenses and £1,000,000 personal liability, which compares well with other bundled insurance policies, such as those from packaged current accounts.

The Black Card offers 1% cashback at up to 3 retailers (including travel companies like Marriott and Easyjet, as well as supermarkets, Amazon, etc), while the Metal allows you to pick 6.

2. Metal-only Insurance Features

Besides increased coverage detailed above, there are some features only offered with Metal:

Rental Car Collision Damage Waiver – £25,000 cover limit with a £50 excess

Baggage Cover Up to £1,000 of cover and £500 single item limit

As ever, with insurance products you should satisfy yourself that the cover is appropriate for your needs by reading the full terms and conditions.

One notable exclusion (which is common on most insurance policies) for regular InsideFlyer readers regards cancellation and curtailment cover:

Any costs paid for using any airline mileage reward scheme, for example Avios (formerly air miles), or any card bonus point schemes, any Timeshare, Holiday Property Bond or other holiday point’s scheme and/or any associated maintenance fees.

Of course, Avios bookings through BA Executive Club are cancellable until 24 hours before departure, minus a £35pp fee, so you have limited exposure if that’s how you normally redeem your points/miles. There are exceptions in the points/miles world though, such as Iberia partner awards.

One minor detail, but very positive thing that I noticed was that the contact numbers for claims and emergency assistance are regular geographic (London) numbers. I’ve been caught out before by insurances that have expensive-to-call non-geographic numbers for assistance. You don’t think about it at the time of needing the insurance, but your next mobile phone bill reminds you!

3. Lounge Access

Curve lists LoungeKey access as a benefit of the Metal Card. According to the info page here, you simply sign up and can then use your Curve Metal to access any LoungeKey lounge for £15 per visit.

4. Metal

Everyone has plastic cards. Stand out from the crowd with one that is made of metal and weighs a whopping 18g. All my other cards weigh a feeble 5g (yes, I checked…).

Conclusion

If you travel a lot, and the cover is sufficient for your needs, the travel insurance could be good value versus a standalone annual policy, or that offered with a bank account.

If you rent cars regularly, the rental car collision damage waiver (CDW) could save you a fair bit , especially in the US where a CDW is a chargeable option from the rental company, and generally with hefty excesses – but make sure the cover meets your needs.

If you’re currently on a 2 year break from American Express following their recent changes, Curve Metal could be a good alternative to Platinum. It’s less than 1/3 of the annual fee, leaving you with £425 a year to cover lounge access. At £15 a go, that’s a lot of lounge time!. Of course, you miss out on the hotel status benefits from the Amex Platinum, but depending on the hotel scheme, you’d likely retain those for almost 2 years if you timed it right.

If American Express funding was to return to Curve, and Metal offered fee-free loading, Metal would be even more compelling – but that’s a complex situation at the moment (read the latest from Curve on this), so don’t make a decision based on that.

Metal is being positioned by Curve as a premium product providing a valuable toolkit for the frequent traveller – it will be interesting to see how the offering continues to develop.

Try Curve Metal now and get a £10 sign up bonus when you use the code FLYR3 – meaning your first month would effectively only cost £4.99!

If you remain unconvinced and want to try out Curve Blue or Curve Black first, you can still get £10 for doing so, sign up here using the code FLYR3.

I think the lounge access benefit of the metal card is a load of bull. Red by Dufry gives lounge access for $10 per go after spending circa £1500 at LHR and then making 1 purchase a year. Occasional lounge visits can easily be attained for around the £15 mark if needed. A Priority Pass or Dragon subscription is much better value if you fly frequently and are not aligned to an alliance.

I can see value in the rental CDW cover – you’re basically paying £48 a year for that and a metal card. It is all the asterisks though…

For black: I’ve been using black since day one when it was £50 with a cushy wallet. How are Curve going to cope with all the likely rejections from September onwards?! Will people really accept getting an SMS message to confirm their transaction when they buy a sausage roll at Greggs?!

If that does not happen, then black at £9.99 per month looks promising. It’s all about the details of the travel insurance though. A good comparison would be Nationwide Flex+, the key differences being the breakdown cover. Not typically needed if you have a lease car or newish car or no car.

I am tempted to shift from legacy black to £9.99 black due to the gadget cover that Hiscox does not cover properly.

Two other points to note are: mobile phone insurance if your insurance provider does not cover that, then Nationwide Flex+ wins easily. Also, a joint account with Nationwide Flex + is an abolute winner for two people as you’re comparing £13 with £20+.

Some good points, although spending £1,500 at LHR is easily done, it’s not within everyone’s reach. It is disappointing that the lounge access ended up priced as it did, and it hasn’t convinced me to cough up for Curve Metal. That said, most of my leisure flying is Avios redemptions in Club or First, so already get lounge access. Judging by the amount of people posting photos of their Metal card on Twitter, there’s probably a market for it whatever the benefits!