Some links to products and partners on this website will earn an affiliate commission.

We’re big fans of Curve here at InsideFlyer, and if you haven’t tried it out yet, check out my previous article and gain yourself £5 for trying it. I covered the main features and benefits in that article, but wanted to focus on the travel features of Curve in this one.

Fee-Free Currency Conversion

The majority of credit cards and a number of debit cards will charge you a non-Sterling transaction fee when you spend overseas. This is usually around 3%, which in almost all cases is not offset by any rewards you may earn for spending on it.

Curve is different. Curve allows you to charge overseas spending to your underlying points or miles earning card in UK pounds without adding any non-sterling transaction fees. The currency conversion is done by Curve using wholesale exchange rates. Full details of the current sources, currencies and weekend exceptions can be found in the Curve Terms and Conditions.

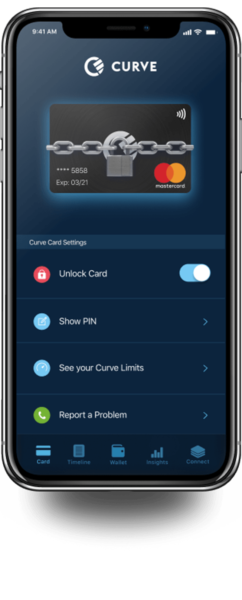

Card Security

The savvy traveller probably has a veritable arsenal of credit cards, each with their own benefits, rewards and spend targets to hit. What we don’t want to do is carry all of them down to the beach every day while on holiday. Depending on the location and your degree of trust in your holiday accommodation, you might not want to leave them all in your hotel safe/on top of the fridge in your self catering apartment/hidden under your sleeping bag in your tent. Personally, I like to leave all mine in the guarded vault here at InsideFlyer Towers and just slip my Curve card into the free Tumi wallet I received with my stole from my wife when she applied for the premium Curve card.

On top of only having one card to look after, I can add to my security by locking the card using the Curve app on my smartphone. Until I unlock it, that card is useless, even if I lose it.

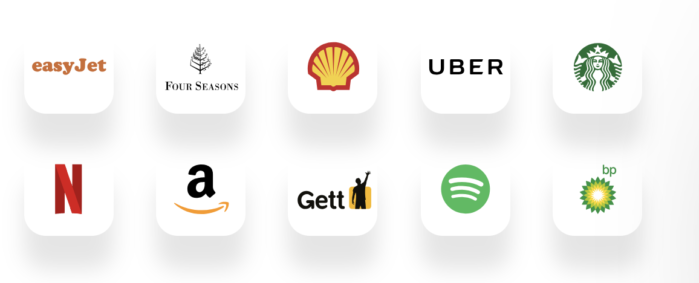

Cashback Rewards

In the previous articles we’ve talked about the cashback rewards retailers that are available. If you’re about to head off for 2 weeks in the sun, don’t think you have to miss out on rewards.

There are plenty of retailers to chose from that operate worldwide so you can continue to earn while you’re away.

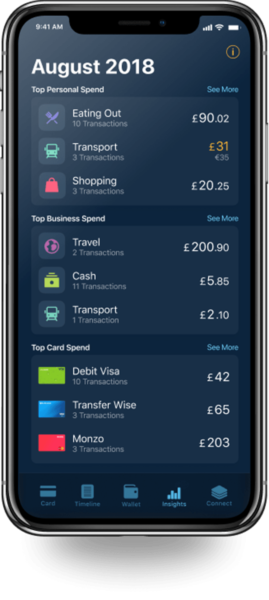

We spent how much on eating out?

Not that we ever do much with the information, but it’s sometimes useful to know what we spent our money on while on holiday.

Maybe next trip you’ll think about an all inclusive resort.

Maybe it works out better to pre-book your car hire in the UK.

Maybe we shouldn’t drink so much on holiday?

Whatever your reasons, the Curve app can show you a summary of spending by category.

Try Curve and get £5 for your troubles

Hopefully you’ve found these travel features of Curve useful. To apply, download the Curve app for iOS or Android, or visit the Curve website and they will text you a link to download it. Don’t forget to use code INFLY when signing up to get your free £5 after your first transaction.

Keep an eye on InsideFlyer for more Curve news, offers and features coming soon – particularly more details on the news that it will soon be possible to add American Express cards to Curve.

Anyone else had problems with Curve CS agents replying to enquiries, been a week and nothing!?

Are you covered by the underlying credit card’s financial securities or not as this is a debit card ?

You are not, but do have Mastercard chargeback protection. The Curve FAQ gives more details. https://support.imaginecurve.com/hc/en-gb/articles/213620489-Am-I-covered-by-section-75-of-the-Consumer-Credit-Act-

Very poor customer experience – any hiccup and you are on your own with Curve.

Agree about their poor service, they take ages to reply, I no longer use because of this.

CS used to be excellent but now it’s hopeless. The merchant identification feature introduced in September means it’s no longer useful for generating points with either.

I’ve stopped using Curve as my main card as I don’t see any real advantage to it now. Instead I use a mixture of Revolut, TransferWise and Barclaycard Platinum VISA when I’m travelling.