Some links to products and partners on this website will earn an affiliate commission.

Cashback offers are becoming more and more popular. Topcashback is a regular favourite on InsideFlyer UK – as it’s an easy source of “free” cash or points with minimal effort on your everyday purchases. Lloyds Bank also offers a lesser known cashback scheme for its customers called ‘Everyday Offers’, with time limited offers for a variety of different companies that change regularly – but often include travel related services. What is really interesting about the Lloyds Bank cashback programme is that you can stack it with other offers.

What do I need?

Some pre-requisites first:

- You need to be a Lloyds Bank current account customer.

- You need to be an online banking customer.

- For true InsideFlyer travel hacking – ideally you would also have a Lloyds Bank Avios Amex, but this also works with other Lloyds debit and credit cards.

If you have all of these – you can then activate your offers via Online Banking for primary account holders cards.

How does it work, and how can I stack it with other offers?

Once activated, you just shop at the retailer in line with the offer terms. This cashback is paid as cash into your Lloyds current account.

As the offers are applied to your card account, you can stack them with other offers:

- If you have the Lloyds Avios Amex, you will earn Avios as usual at 1.25 per £.

- If there are cashback site or Avios/Flying Club shopping portal offers, you can also click through those as normal.

- If the company has specific offers/discount codes for its own membership scheme, these generally seem to be stackable as well.

Generally, offers can be used multiple times unless otherwise stated, but it would need to be on separate days. If you make multiple transactions at the same company on the same day. they will try to pay the cashback on the highest transaction.

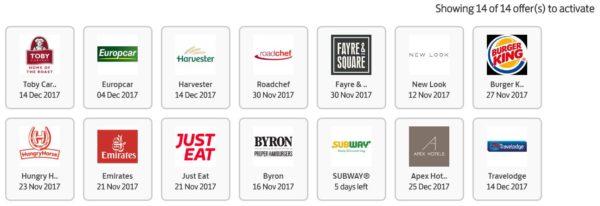

Current travel offers

These are the offers showing for me, I’m not sure if they are targeted – but chances are you will get at least some of the below:

Travel offers for me are:

- 10% off at Europcar (up to £30)

- 8% off at Hilton London hotel stays over £75 (excluding Hampton and Garden Inn)

- 5% off with Emirates (up to £60)

- 10% off Travelodge (up to £50)

- 10% off Apex Hotels (up to £60)

Conclusion

I’ve used a previous Hilton offer, and it tracked without issue and stacked with the Flying Club shopping portal and Hilton’s own bonus points offers. I know some people have had issues with Lloyds IT tracking things in the past, but I personally have had no issues.

If you have a few stays coming up at Hiltons in London over the next 2 months, this could prove fairly lucrative!

This also represents a good opportunity for those who avoid credit cards and prefer to use debit card instead – and being paid in real cash straight into your bank account is very attractive.

Very much targeted. I’ve got none of those. Only Singapore Airlines for travel. Don’t ever get any of the ones you’ve shown, only stuff like Co-Op, Waitrose, New Look which I never shop in and occasionally a parking one. Waste of time.

I had major issues getting one to track and be paid last year.

That’s rubbish Dave!

Personally I’ve never had any issues with Lloyds IT but I know others have had significant issues.

I couldn’t find anyone else to confirm with though before I published to check the targeting. Still worth checking back every once in a while!

It’s probably something to do with me only using my debit card about twice a year, You must buy lots of fast food with yours looking at those 😉

Took 5 months to claim and receive approx. £4.50 from Lloyds, from a Waitrose spend. 4 phone calls, lots of time on hold, wasn’t worth it but it was the principal of it.

Same with my Santander account – 2 years it’s been open and I only have ever had one offer and that was an energy company.

Haha, it’s all USA or Europe spend. I literally only use the account for the Avios Amex with 0% Forex.

So basically only food, hotels and outlet shopping go through it, I’d have thought they’d be trying to encourage me to diversify my spending but apparently not!

I treat it as a bonus if it turns up rather than factoring it into any spending decisions 🙂