Some links to products and partners on this website will earn an affiliate commission.

Here’s the email in full:

We are extremely sorry that the top-up functionality of your Amex wallet is currently disabled.

Like thousands of other UK merchants, Curve has a valid merchant agreement to accept Amex payments into its e-wallet. However, on Tuesday evening, Amex decided to terminate this agreement and block all Amex transactions to Curve with immediate effect.

Amex has given no good or fair reason for their decision and we believe it is entirely disproportionate and discriminatory to Curve and all our (joint) customers. UK payment regulations clearly state that Curve should be allowed to access the Amex payment network on a level-playing field with every other fee-paying and legitimate merchant.

Rest assured that you can still spend the funds that you have already topped up to your existing Amex Wallets. If you have contacted us for support, we apologise for the delay in response and will endeavour to do so as soon as possible. We will update you as soon as we have any further information.

With your interests in mind, and our mission to deliver a truly innovative product, we intend to fight Amex’s decision with our full might. We believe financial freedom is the future and we are prepared to fight for yours.

Forgive the lack of analysis, but I really do need to get some sleep!

|

|

Until tonight’s excitement, the article below is what you were going to receive in the morning. I suppose the stuff about the new products is still partially relevant…

Curve Adds Amex Functionality For All + Releases New Products

“During Beta testing, at least 500 Curve users spent more than £1 million on their Amex cards by paying with Curve and the reviews were phenomenal. We are now excited to be taking the Beta public. Gone are the days of hearing ‘Sorry we don’t take Amex here’. Enjoy using your Amex all over the world with Curve, without ever missing reward points or paying hefty foreign transaction fees when overseas.

- Unlike Visas/Mastercards linked to your Curve account (where transactions are instantly and automatically recharged to the linked card), with American Express you need to first load funds from your Amex onto your Curve via the app

- No ATM withdrawals using Curve when it is connected to Amex

- There is a 0.65% fee on Amex transactions, if you have the free Curve Blue card

We’ll be exploring more about how the new Amex/Curve hookup works in practice soon, so look out for that.

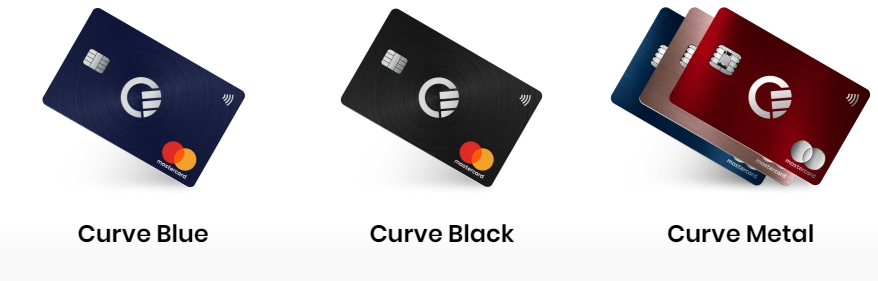

New Curve products

New Curve Black

-

All your cards in one

-

0FX on all cards – (£15k per year fair use policy)

- £1,000 Amex top up per month (then 0.65%)

-

Travel Insurance – Medical, Delayed Flights, Personal Items etc

-

Gadget Insurance

-

Go Back in Time all transactions up to £1000

-

£9.99 per month

-

No Minimum Period / Ability to break contract

Curve Metal

-

All your cards in one

-

Beautifully crafted Metal Cards. Choice of Blue, Red(Limited Edition) and Rose Gold card.

-

0FX on all cards – (£30k per year fair use policy)

- Unlimited Amex top ups

-

Travel Insurance – Medical, Delayed Flights, Lost Baggage , Personal Items etc

-

Gadget Insurance

-

CDW Car Insurance

-

Go Back in Time all transactions up to £1000

-

£14.99 per month

-

Minimum 6 month period

Don’t forget that the standard Curve Blue card is still free – in fact they will give you £5 after your first transaction if you use the code INFLY when you sign up.

You can see a comparison of all 3 cards side-by-side here.

Conclusion

It’s good to see Curve and Amex finally back together! (Ok, that closing line definitely didn’t age well…)

What do you think about the new Curve Black and Curve Metal?

Well, that didn’t last long, did it…

And Billhop have quit amex too…

Well… So much for the promise of getting this feature here in Europe in 2019 😅

Back to square one… Again !

Can’t say that I’m surprised that AMEX pulled the rug from under Curve. They’ve never had the best track record so far. They botched the initial launch by promising everyone on Twitter that we’d all be able to add AMEX back in November, then backtracking that into a statement about the UK only closed beta. Now with this revelation, my Curve card is definitely getting shelved…

I signed up for the Black Curve sometime last year and it has been great. And free. The only reason I did sign up for it was mainly due to the partnership with Amex as that is the main card that I use. I also did the Beta testing as well and it worked absolutely fine.

Just over the weekend I upgraded to Curve Metal, got charged the initial £14.99 and was looking forward to 4 months subscription free (after the first subscription payment had cleared – and paid using the Amex card btw!) and also the unlimited Amex topups.

I suspect that I am going to now have a lengthy conversation with Curve Support because I recall as part of the Ts & Cs that you can’t ‘downgrade’ to your previous version of Curve Black. Or something along those lines. But I didn’t mind so much given the partnership with Amex. We’ll see how it pans out I guess, but pants news nonetheless.

Pretty poor show from Amex & Curve, you would of thought any issues were ironed out during the Beta test and a binding agreement met before launch.

Apparently, the Amex statement says “following the Beta test we informed curve we would not participate in the further roll out”…I supposed Curve didn’t have a binding agreement with them and proceeded anyway.

This is a HUGE blow to their business, it would have been a great way to use Amex abroad without the 2.99% fees…

Aside from the Amex issue….. Can you withdraw money from an ATM with a Mastercard Credit card attached to your Curve card (e.g Virgin CC) or will you get charged cash advance fees from Virgin.

I have been reading various articles and info on the curve website but can’t find a definitive answer. I just want to make sure before I do it? Has anyone got any experience? Also if it is an issue can you ‘go back in time’ and move the transaction to another (debit) card to avoid the bank fees

I would imagine if you used the actual card (your Virgin) then yes, you would be charged the fees associated with that card issuer’s Ts & Cs, as it would be no different than making a withdrawal from that card irrespective of whether you had the Curve card or not. And furthermore, any transactions made with the actual card are outside of Curve anyway and don’t show as part of the history.

If you used the Curve card to make the withdrawal, then at the point of withdrawing the cash, whichever card you have associated as your ‘primary’ card for transactions will be tied to the withdrawal. I suspect you can reallocate the transaction using the ‘go back in time’ functionality, but as I’ve done this with card transactions, I can’t comment on whether you can do that with cash withdrawals (although I can’t see any reason why you wouldn’t be able to).

With Curve Blue, you can withdraw cash fee-free up to £200.00 a month. For Black it’s £400.00 and for Metal it’s £600.00 and you can see that information here.

https://www.curve.app/en-gb/cards

My current issue right now is that I have had an e-mail back from Curve giving me a 14 day cooling off period by law followed by an additional 14 days cooling off to see how I like using Curve Metal. Which will be no different than using the Black card apart from the look and feel of it. The thrust of their e-mail was that it is unlikely that there will be any quick resolution, so if using Amex is important to you, you can cancel, and if not, then use it, and if you like it, keep it. But for £14.99 per month (even with the gadget and travel insurance), it’s probably not going to be worth it. Although I do like red and I do like metal… 🙂