Some links to products and partners on this website will earn an affiliate commission.

I LOVE miles that have a hard expiry date – i.e. those that expire after a certain period of time, irrespective of whether your account is “active”.

Not really… I’m just being provocative… but I do recognise that higher levels of breakage – the industry term for miles that are issued but never redeemed – can help with a loyalty programme’s profitability and therefore reduce the temptation to devalue. So by being clued-in – and by reading InsideFlyer UK you are certainly ahead of the pack – you can benefit from the relative lack of reward chart devaluations, whilst other members see their miles expire unused every few years.

Joe wrote a post recently that was essentially a plea for ideas about how to use some miles that are due to expire shortly. I can’t really help you there mate, but I thought readers might benefit if I outlined my strategies for avoiding situations such as Joe’s.

1. Do the Miles Really Have to Expire?

The first element I consider is whether the loyalty programme offers a way to avoid the “hard expiry” of miles. The most obvious example is Lufthansa’s Miles & More. Members who have, and regularly use, a co-branded credit card do not have to worry about the expiry of their miles. I recognise that this credit card is no longer available in the UK. But I still have one – there is no annual fee – and it sits in a drawer, and it is set up for my Spotify subscription so that I automatically use it every month.

Other frequent flyer programmes might have a policy whereby their members with elite status can avoid the expiry of their miles. You are almost certainly never going to find yourself in the situation of being a frequent flyer with a certain airline, but then having no use for those miles. (unless you are a millionaire captain-of-industry-but-never-take-holidays) But a strategically-timed status match might just earn you some breathing space to get those miles spent usefully.

2. Know What You Want to Spend Miles On, Before You Bother to Earn Them

Sometimes you end up with orphaned miles… it happens… But before I’ve even earned any kind of miles, especially those that come with a hard expiry date attached, I like to have a reasonable idea of what I think I might want to spend them on. Thanks to airline alliances, I don’t have to choose to earn miles with the airline I’m flying. The website wheretocredit.com also saves me lots of time in figuring out my options.

For example, besides M&M (dealt with in point 1), I collect “hard expiry” miles from ANA Mileage Club and Turkish Airlines Miles & Smiles. (for what it’s worth, this is essentially due to very attractive reward charts) My current balances are almost irrelevant, but I know with 100% certainty that:

- 55,000 ANA miles will get me a return flight in Business Class between Argentina / Chile and Central America / Colombia / Puerto Rico (this might not work for most, but my travel patterns makes this a real possibility and a great bargain)

- 68,000 ANA miles will get me a return flight in Business Class from Europe to the Middle East / Africa

- 45,000 Turkish miles will get me a one-way in Business Class from Europe to almost anywhere Turkish Airlines flies

So if I’m happily chugging along earning miles from various activities, I know what my targets are. If I happen to find myself with 74,000 ANA miles and 33,000 Turkish miles and a paid Star Alliance flight, a Hilton stay (double dip miles) or a car rental need comes along, I know that I “need” Turkish miles and I don’t really need ANA miles –> my choice is made for me. (assuming the earn rates aren’t outrageously unbalanced)

If I don’t know what I’m going to spend them on, I simply don’t bother to earn “hard expiry” miles in the first place! 5,000 Aeroplan miles that I know I can eventually use (since they won’t expire with account activity) are worth a lot more to me than 15,000 KrisFlyer miles that I simply don’t have the inclination to learn about…

3. Know How to Top-Up Your Mileage Balance on Short Notice

Now, there is absolutely no way that I (or most readers) manage to organically collect 74,000 / 33,000 miles in some random loyalty programme. This is where transferable loyalty currencies come into play. Why do I think that Starwood’s Best Rate Guarantee is the best thing going? Because those 2,000+ points per one-night stay add up fast. Or why do we recommend buying Starpoints during promotional discounts? Because Starpoints are an incredibly valuable and flexible resource – whenever my ANA miles are about to expire, I top up my account and book the exact reward I’ve long had my eye on.

I know that I only really need to aim for 5 or 18 thousand ANA miles from flights, hotels, etc.. Why? Because whenever AwardWallet tells me that I have a chunk of ANA miles expiring in a few months, I can convert 40,000 Starpoints into 50,000 miles and my reward is soon booked!

The impact of the Marriott Rewards merger remains unclear, but I am cautiously optimistic due to Marriott’s own Travel Packages, which are an alternative method of converting hotel points into airline miles at a reasonable rate.

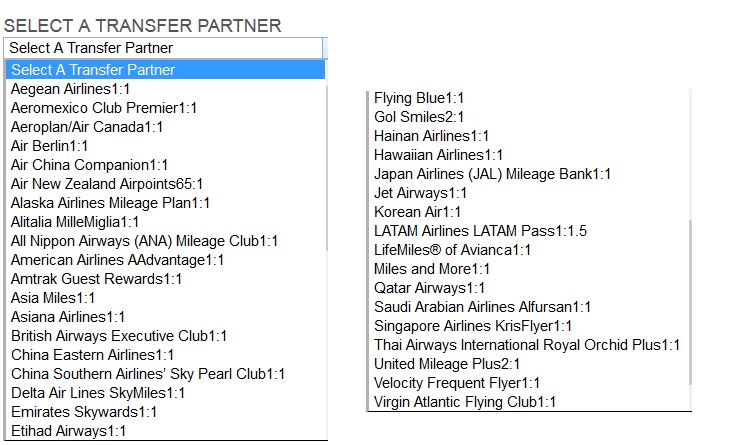

Another great method of earning a transferable loyalty currency is American Express Membership Rewards. Perhaps our Joe is “mid-churn” but a travel hacker should always consider whether yet another sign-up bonus compensates for the loss of the flexible-currency-value of an accumulated balance of MR points.

And, finally, it is a great idea to know which airline programmes tend to offer their miles for sale at a discount. Worst case scenario… you can top-up your account by buying the miles you’re missing.

4. Be Flexible and Pro-active

Now I know that this is often easier said than done and people often have their hearts set on specific destinations. But sometimes you have to run with the travel hacks as they present themselves. Qatar Airways offers ridiculously cheap flights to Japan? Even if you hadn’t been contemplating a trip to Japan, GO VISIT JAPAN! Got 80,000 Singapore miles expiring, GO TO SINGAPORE! (or whatever other decent use you can find) Got those 68,000 ANA miles I mentioned? Well, instead of going to California for your holiday, figure out how you can make Zanzibar, South Africa, Mauritius, Dubai, Seychelles, etc. etc. etc. work for you. Instead of burning those AA miles in 2018 and wasting your Krisflyer miles, you can burn those KrisFlyer miles reasonably well, then go to California in 2019 with your AA miles.

I’ve never met a true travel fanatic who wasn’t always thinking about the next trip after the one already booked… And some of the best travel stories I’ve heard are from people who took a cheap Ryanair flight for a weekend getaway to somewhere they’d never heard of, or who booked a Business Class mistake fare to somewhere they’d never previously considered.

Conclusion

Unfortunately I can’t really help Joe out of his current conundrum. But hopefully you have found something useful within the strategies I use to avoid being like Joe!

Leave a Reply