Some links to products and partners on this website will earn an affiliate commission.

First up I will address one issue here. For this ‘£10’ claim to strictly work, you have to see a Nectar point as entirely equivalent to 0.5p in cash.

I accept that’s a slight stretch. But given that it applies to your Sainsburys, Argos and eBay shop, I think it’s reasonable to assume you can spend £50 across those three without it being deemed an ‘unnecessary’ spend.

Through a current Nectar point bonus with Sainsbury’s bank, you can get a generous Nectar point bonus on life insurance policies, as follows:

- If your monthly premium is under £8.50 (minimum is £5), you’ll get 10,000 Nectar points (worth £50)

- If your monthly premium is £8.50-£20, you’ll get 16,000 Nectar points (worth £80)

- If your monthly premium is over £20, you’ll get 22,000 Nectar points (worth £110)

The minimum policy term is 1 year, and the policy is actually provided by Legal & General.

To benefit from the bonus Nectar points, you need to buy the policy by 30 April 2021.

EDIT: With thanks to reader Ian, if you are eligible and take out the over 50s product, you can very easily make a profit here. Per Ian’s comment, he is paying £6 a month for a year (so a total of £72) and getting a 20,000 (worth £100) Nectar points. He’s also getting the double points at Sainsbury’s for a full year (see below).

Which one is best?

We are not financial advisors, and so this article is targeted at playing the Nectar scheme rather than the quality (or not) of the life insurance product (which I know nothing about really, other than the figures it throws at me).

For the purposes of this featured “hack”, I am therefore focusing solely on the minimum £5 premium payable for a year (the shortest term available). It may be that one of the above works better for you than this “bare minimum”. I’ll leave that to you to work out (taking any necessary, qualified advice!), but certainly the Nectar points rebate could give you some serious added value.

How to get the deal

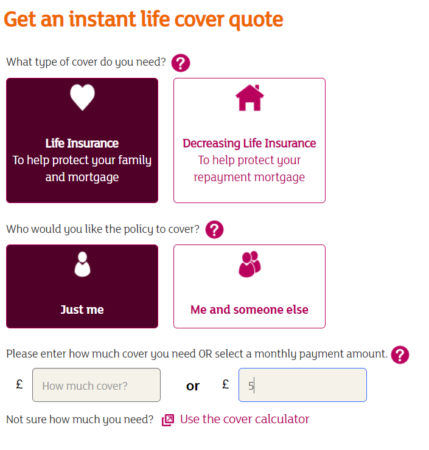

You first of all need to go to the Sainsbury’s Bank life cover page, and get a quote:

The minimum monthly payment amount is £5 and, per the image above, you can add that as an option to ensure you’re paying no more.

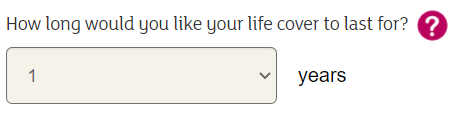

You then add a few details, including how long you want the policy to last. Again, per our “hack”, this needs to be 1 year:

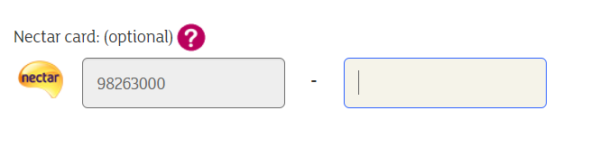

Finally, you must enter your Nectar card details, and submit your quote request:

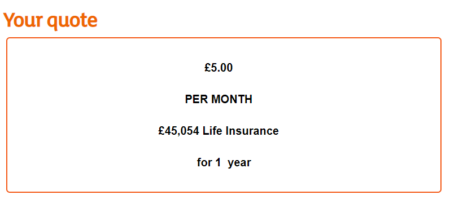

You’ll get an instant quote which you can then proceed with. In my case, I was offered the following cover for a 1 year policy at £5 a month:

To be clear therefore, I am getting 1 year’s life insurance with cover of £45,054, for a total of £10. That’s the payment of £60 in premiums, less the £50 I will receive back in Nectar points for taking out this policy at £5 a month. The cover you get for your £5 payment will depend on your circumstances.

I am not going to go anywhere near commenting on the adequacy of £45,054 life cover over a year. However, if you are looking at options or feel your current cover may not be sufficient, getting whatever additional amount you can from Sainsbury’s Bank for just £10 for a full year’s cover may give you the required boost or some peace of mind while you look at other options. Or it may not. I’m not a financial advisor, I am a Nectar scheme analyst!

When do you get the bonus points?

Once you’ve paid 5 months’ premiums, the bonus Nectar points will be added to your account within 60 days. Given that the minimum term of the life insurance product is one year, that’s fine. If you cancel your payments after receiving the points, I believe that they will still be owed so I wouldn’t recommend it.

There’s another reason why some people should really go for this…

In addition to the Nectar points giving you 1 year’s life insurance for just £10, you’ll also earn double points at Sainsburys (shopping and fuel) for that whole year.

You’ll earn Nectar points from the first pound you spend at Sainsbury’s. However, if you spend £2000 or more in the insurance cover year, you’ll earn an extra 2000 Nectar points, which is worth £10. Any more than that, and you’re in profit.

So if you’re a heavy Sainsbury’s shopper anyway, this offer could not only cancel out the £10 paid, but also lead you to make an active profit on the cover. It’s also fair to say, in response to my opening caveat, that a “heavy Sainsbury’s shopper” can view Nectar points as more or less equivalent to 0.5p cash.

Right, I am off to take up hang-gliding…

Please note that this article is a journalistic view on how to use the Nectar loyalty scheme to your advantage. It is not financial advice. We make no comment on the quality or adequacy of any financial products featured.

I just took out an over 50’s policy.

£6 per month, 20 k nectar and double for a year on sainsbury’s shopping.

Only £1.2k cover but a healthy nectar bonus which is a bit better than a younger person’s bonus for such a low premium.

You’ve done very well! Thanks for flagging the over-50s product, I have edited the article to include this as clearly there’s an easy profit to be made on this one for those eligible.

When I try to apply for the Over 50s insurance it doesn’t give a 1 year option – instead I will pay until I’m 90. Looks to me that the Over 50s product is different to the original. Is yours also until you’re 90?

The over 50s T&Cs I see state:

2. After you’ve paid 5 months’ premiums, we’ll give you: 22,000 points (worth £110) if your monthly premium is over £20, 16,000 points (worth £80) if your premium is £8.50 – £20.00 or 10,000 points (worth £50) if your premium is under £8.50

3. We’ll add the points to your Nectar account within 60 days

Yes I see that but the original hack applied to a 1 year fixed policy. Over 50s don’t seem to be given this option

It still seems worth it though for the over 50s. So I would be looking at £5 per month and (quoting the Ts & Cs), ‘After you’ve paid 5 months’ premiums, we’ll add 20,000 points to your Nectar account within 60 days’. So it could take 6-7 months for the points to be added, which is still a decent return.

Also, ‘Double points stop when the policy is cancelled or you stop paying premiums’ and ‘By the 10th of each month, you’ll get a bonus point award equal to the total of your qualifying points during the previous month, up to a maximum of 20,000 points’.

So you could either wait until the 20,000 Collect £100 of Nectar points hit your account and then cancel (I can’t see anywhere that the points are returned if you do cancel the policy), or receive those points and then continue to take advantage of the Double Nectar Points until you hit that 20,000 threshold. I guess how much you spend at Sainsbury’s will guide the decision, so I will probably cancel after the ‘ Collect £100 of Nectar points’ has been added to my account.

All done: “We have received your application and we’re pleased to confirm that your cover will start immediately.”

Just to update, I received 20,000 points to my Nectar account on the 30th July, so all is good! And with the Nectar – Avios conversion route, I might take advantage of that to boost my Avios account as we have a Companion Voucher that needs using by the middle of November.