Some links to products and partners on this website will earn an affiliate commission.

There’s no question that the recent radical changes Amex made to the way sign up bonuses work were a significant blow to many points/miles collectors in the UK. The situation may not be as bleak as it first appeared though…

What were the changes?

Basically, there were 2 big negative changes, which together completely changed the ‘churning’ game:

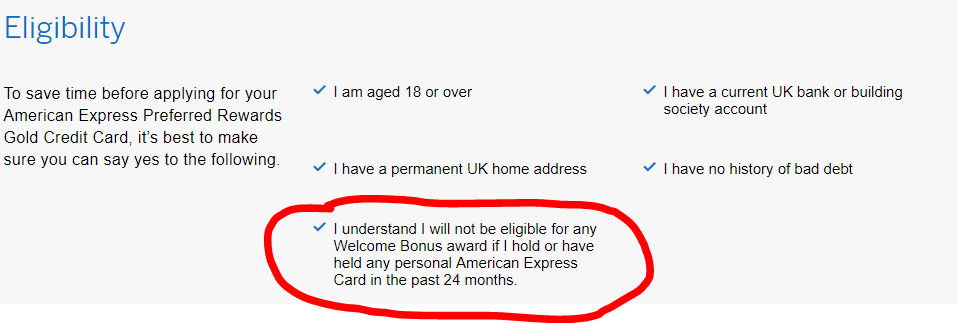

- Your sign up bonus eligibility used to depend on whether you already had (or recently had) a card of the same reward ‘family’ – so if you had a BA free card, which earns Avios, you couldn’t get the bonus if you applied for the BA Premium Plus because that is also an Avios earning card. You would still be able to get a bonus if you applied for a Gold/Platinum (Membership Rewards) or SPG/Marriott card though, despite having a BA Amex already. The different types of reward currencies were essentially seen as completely separate from each other. That has now changed and sign up bonus eligibility is based on holding any personal Amex card (with a couple of exceptions I’ll explain later).

- You used to have to wait 6 months after cancelling a card in order to get another sign up bonus in the same reward family. So, cancel Amex Gold, wait 6 months, apply for Amex Platinum (both earn Membership Rewards Points) and you’d get the Platinum sign up bonus. You now have to wait 24 months before reapplying, if you want the sign up bonus.

There was just one (small) ray of hope that we noted at the time:

The British Airways Premium Plus and the Amex Platinum are only impacted by the 24 month rule, not the ‘any Amex card’ rule.

So, if you have a BA card (or SPG, Nectar, etc) but haven’t had an Amex Gold/Plat (Membership Rewards Points earning card) in the last 24 months, you will still be eligible for the Amex Platinum sign up bonus.

In the same way, if you have an Amex Gold (or Plat, SPG, Nectar, etc) but haven’t had an Avios earning card (BA free, BAPP) in the last 24 months, you will still be eligible for the British Airways Premium Plus sign up bonus.

Note carefully that these exceptions only apply to the expensive Platinum and British Airways Premium Plus cards, not the free Amex Gold or free BA card, etc.

Even a minor silver lining is better than nothing, but it was difficult to get excited about the above.

Why ‘sign up’ bonuses aren’t as dead as we first thought…

As Rob over at HFP has noted, the Gold and Platinum Business cards are still an option for those who meet the criteria, as are the Amex International Currency Cards. Those options are only available to a relatively small subset of readers though, so I’m pleased to say there’s also something available to everyone.

We’ve written before about the fact that it is possible to ‘self-refer’ when applying for a new Amex card – so that you receive points both for the referral and for signing up (I’d strongly recommend having a read of that article here, if you’re not sure what I’m talking about).

One of the interesting things about the way the referral process works is that the number (and type) of points you receive for referring someone (including yourself) depends on the card you generate the referral link from, not the new card you are applying for.

So, for example, if you have an Amex Platinum card, you will receive 18,000 Amex Membership Rewards Points as a referral bonus, regardless of whether you refer yourself (or anyone else) for the free BA card, the BA Premium Plus, The SPG/Marriott card, the Nectar card, or whatever.

Here is what you can expect as a referral bonus when you generate a referral link from the main travel-related Amex cards:

- British Airways: 4,000 Avios

- British Airways Premium Plus: 9,000 Avios

- SPG/Marriott: 9,000 Marriott Points

- Gold: 9,000 Membership Reward Points

- Platinum: 18,000 Membership Reward Points

There was speculation that following the sign up bonus changes, referral bonuses would no longer be paid out if the person referred wasn’t eligible for the sign up bonus – but our own experience and that of readers suggests that, so far at least, that speculation was inaccurate. At time of writing (28th March 2019), referral bonuses continue to work in exactly the same way they did previously, including the ability to self refer.

To be clear, a Platinum card holder for example, could refer themselves for a new free card (like the Amex Gold, Nectar, or BA cards) whenever they wanted and would receive 18,000 Membership Rewards Points each time. That may not be quite as good as getting the 20,000/22,000 Amex Gold sign up bonus, but it’s actually substantially better than the sign up bonus on the other free cards.

Bottom line

You used to be able to ‘double dip’ and get the referral bonus AND the sign up bonus, so things aren’t as good as they used to be, but the idea that ‘churning’ is dead in the UK, certainly isn’t true either – at least for now.

Amex may well decide to change the way referrals work at some point in the future, so I would enjoy this one while you can.

Can confirm referral bonuses still working this week.

Can you refer yourself for gold from platinum? I didn’t think you could hold a gold and a platinum for some reason.

Yep – these days it’s fine. You didn’t used to be able to, but when they changed the Gold from a charge card (like the plat still is), to a credit card, it became possible.

Do we still get the 20K MR upgrade bonus when moving from gold credit to plat charge?

My current gold credit card is the only Amex card I ever had. I signed up for it 3 months ago. It fits my spending patterns really well (1 bonus on FX and 2 Bonus with Amex Travel) much better then the platinum except for the relatively low referral bonus. I am contemplating doing the following if the upgrade bonus still applies:

Upgrade to Plat and get the 20K and pay 450GBP

Refer myself to the BA Amex and get 26K Avios+ 18K Self-Referral.

Refer myself to the gold back again. Earn 18K Self-Referral and reset the clock to get another full year for free.

Cancel the Plat after 3 months and receive pro-rata refund (maybe 3/4 of 450 = 337gbp).

Repeat after about 2 years.

I know I can churn the SPG/NECTAR while having the plat for referral bonus however I am concerned this will hurt my credit rating. My UK credit history is only 3 months old. And I do not want to risk approval on the ICC USD green card for my US travels…I need to wait another 3 months before I am allowed to apply for it….

Hi Sam,

Nope – unless you happen to have one of the old gold charge cards, you don’t normally get the 20k bonus when upgrading to plat. The call centre sometimes still says that you do get the bonus (as happened with me), and if they say that, then just make a note of the agent name and call time and you will eventually get the points (but it can be a hassle).

The rest of the plan sounds solid enough though (as long as you are happy applying for 3 cards in the space of a few months – personally I only apply for something about once every 3 months, but there’s no particular science behind that- it’s just what I’m comfortable with) – and remember you’d get 9k for referring yourself for the plat if you used a link generated from your gold.

In case I ask for plat upgrade and in the process void the gold, is it considered as a request for an additional credit card in terms of cumulative credit allowance and effect on credit rating? if so then I will follow your advice and apply for plat separately using a referral link then cancel the gold. Then l receive 9K on gold and 5K on plat for getting referred. Close enough to 20K upgrade bonus anyways…

I believe so, yep – since they changed the gold from a charge card to a credit card anyway. I don’t think you would get the 5k btw, but could be wrong. You should certainly get the 9k.

Can anyone advise on how I should proceed with bonuses? I currently have a blue ba amex (i downgraded in jan), nectar amex (got card in jan). I cancelled my gold in jan also with view of reapplying.

Also i had no idea i could refer myself for another card. If i look on my current amex page (ba blue and nectar) if i refer it only gives option of referring for the card i have. How do i refer for a different card?

Many thanks, getting a tad confused by it all!

Hi Nando,

For (self)referring different cards – just click your link (when signed out of your amex account) scroll to the bottom of the page and you should be able to choose any of the cards. THere should be 3 different types to click on too – charge, credit and business.

In terms of strategy going forward, it’s a bit of a tricky one actually given that you’ve got had the Gold recently and currently have the BA card. I think the best advice (unless you can wait 2 years, or can get the business cards etc in the meantime) is to cancel the BA card asap, get yourself a platinum (despite no sign up bonus, prob best option is going via a cashback site), then using that to refer yourself for the gold/ba free/nectar/whatever to get 18k per referral.

Hi Joe,

Thanks for the advice. I think i’ll get the platinum for the first time, I’ve always been tempted. This referral trick makes it a great selling point 😛

I was a bit stuck on the referral bit but found your other article linked. Great explanation for us dummies.

Thanks,

Nando

No worries! – Glad you found the other article, I really should have linked to it when replying actually.

Looks to me like this has just been changed back to the old way where you can only refer to the family of cards you own?

Just tried generating a link with a Gold card and can only be used for a Gold, Platinum or Green application.

Interesting – I just checked all mine (Plat, Gold, BA) and they still work fine at the moment. All I had to do was scroll to the bottom (as usual) and click on ‘charge’ ‘credit’ or ‘business’ to see the full range – including the cashback cards etc.

Could you send me ([email protected]) a screenshot of the bottom of the page where it shows the options?

Hi Joe,

Any update on this…..i dont seem to be able to refer any other cards from my SPG card.

thanks

Stuart

Hi Stuart,

Strange – all mine still seem to be fine, though I can only check Plat, Gold and BA cards. Have you followed the steps here?: https://insideflyer.co.uk/2019/04/refer-friends-family-amex-card-plus-earn-18000-points/

The amounts you get for referring are now lower though: https://insideflyer.co.uk/2019/04/big-amex-changes/

Hope that helps!

thanks Joe but but there doesn’t seem to be a way to refer to another card when referring from SPG , the steps shown on the article are no longer there…if you want to email me directly i can send you a screenshot

Hi Stuart, cheers for the update! That’s really odd – if you wouldn’t mind sending me a quick screenshot ([email protected]) that would be great. Have you tried testing it with different browsers/devices (scrabbling at straws here, but you never know! 🙂 )