Some links to products and partners on this website will earn an affiliate commission.

Overnight, Amex has made sweeping changes to the way sign up bonuses work – and for most UK points/miles collectors, it’s very bad news indeed.

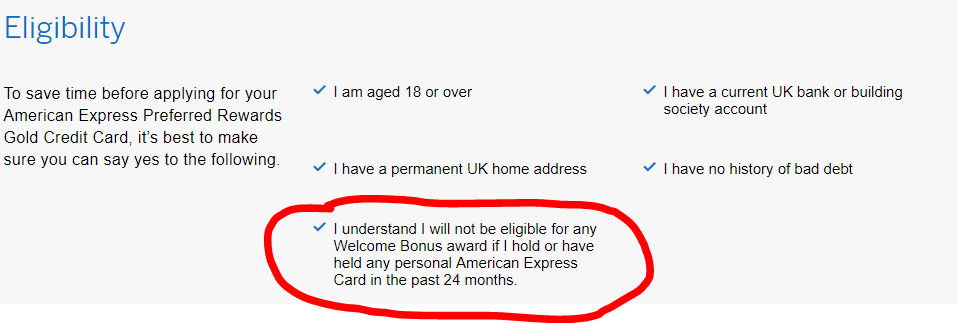

The headline is that cardholders will no longer be eligible for sign up bonuses if they currently hold ANY personal Amex card, or have done so in the last TWENTY FOUR MONTHS.

In effect, what this means is that churning as we know it is over and you’re likely going to earn far fewer points/miles from American Express in future.

Let me be clear – there are 2 big negative changes here compared to how things worked until yesterday:

- Sign up bonus eligibility used to depend on whether you already had (or recently had) a card of the same reward ‘family’ – so if you had a BA free card, which earns Avios, you couldn’t get the bonus if you applied for the BA Premium Plus because that is also an Avios earning card. You would still be able to get a bonus if you applied for a Gold/Platinum (Membership Rewards) or SPG/Marriott card though, despite having a BA Amex already. The different types of reward currencies were essentially seen as completely separate from each other. That has now changed and sign up bonus eligibility is based on holding any personal Amex card (with a couple of exceptions I’ll explain later).

- You used to have to wait 6 months after cancelling a card in order to get another sign up bonus in the same reward family. So, cancel Amex Gold, wait 6 months, apply for Amex Platinum (both earn Membership Rewards Points) and you’d get the Platinum sign up bonus. You now have to wait 24 months before reapplying, if you want the sign up bonus.

In combination, it’s difficult to overstate how profoundly these 2 changes alter the UK points/miles earning landscape.

Ray of hope?

We’re very much scrabbling around for silver linings here, but there are a couple of exceptions to the above that make the changes slightly more tolerable:

The British Airways Premium Plus and the Amex Platinum are only impacted by the 24 month rule, not the ‘any Amex card’ rule.

So, if you have a BA card (or SPG, Nectar, etc) but haven’t had an Amex Gold/Plat (Membership Rewards Points earning card) in the last 24 months, you will still be eligible for the Amex Platinum sign up bonus.

In the same way, if you have an Amex Gold (or Plat, SPG, Nectar, etc) but haven’t had an Avios earning card (BA free, BAPP) in the last 24 months, you will still be eligible for the British Airways Premium Plus sign up bonus.

Note carefully that these exceptions only apply to the expensive Platinum and British Airways Premium Plus cards, not the free Amex Gold or free BA card, etc.

Bottom line

These changes may seem a little shocking, but we can’t really call them a surprise. Early last year, Amex made the direction of travel pretty clear and in some ways I’m surprised the good times have gone on this long. There was speculation back then that sign up bonuses might even become ‘once in a lifetime’, so although these changes are undeniably very bad, they could have been even worse.

I suspect we’ll be writing about the changes (and the best strategies to maximise your points haul despite them) for a long time, but for now, HFP has you covered with a typically thorough overview.

Disappointed that will earn fewer points in the future, but makes sense from AMEX point of view.

I hope referrals t&c’s dont go through a similar update as then it will be really difficult to justify staying with AMEX

If referral bonuses haven’t changed, presumably you could still hold a free Amex Gold, self-refer to the free BA card for the higher Gold referral bonus, cancel BA once bonus triggered (if any spend required?). Rinse & Repeat?

The thought certainly did cross my mind. The call centre is apparently saying you don’t get the referral bonus unless the person you refer is eligible for their bonus, but I’m very sceptical about whether that’s accurate. Unless and until Amex officially update the terms on referrals, I’d say you’re onto a winning strategy there – though I wouldn’t be surprised to see them change how the referrals work at some point.

When making a self referral do you use a different email than the one currently registered? I current hold an amex gold but want to get the ba pp and will be self referring but wasnt sure if this would affect the welcome and referral bonus?

Thanks

I did it with same amex account, same email address, etc, but that was a test really to see what happened.

Forgive my curiosity but did you have any issues with it after it went through?

Nope – no issues at all.

I don’t see a way to cross refer from BA to Gold and vice versa any more. Can only refer to the same card type.

Damn. After your recent post about how to churn I was about to refer my wife and start the process. Then let her refer me after 6 months.

That’s really annoying.

Aye – awful timing for you John!

I can’t see how they can hold back a referral bonus. I refer you as my mate, how ther hell am I suppose to know that you held some other Amex issued card 18 months ago ?

Exactly – but I can certainly see them changing the system/making it less generous.

Wow, just as I had jumped on the bandwagon this week.

So as I’m still a newbie to all this, can someone comment on this please?

I’ve just received my first ever Amex – a gold preferred rewards card.

I’ve obtained a supplemental card for my wife.

I’ve just referred my wife for a gold preferred rewards card.

I will be ordering a supplementary card for myself.

Soon, I will get my wife to refer me to the BA PP card.

I will at some point refer her to this BA PP card too.

We should both get referral and signup bonuses when we hit minimum spend as we’ve not had any other Amex cards – ever.

I will cancel one of the BA PP cards as soon as possible as I only want the signup bonus and any referral (that might still be valid given the changes today) against one card but will keep the other to hit the spend to obtain a 241 companion voucher.

My goal is to earn 200k avios by August 2020 to use for flights in late July 2021.

What if anything can we do next other than wait 24 months?

Thanks.

Hi Aston,

That sounds like a solid plan. Tbh, I’m not entirely sure what the policy for referrals is right now (having been told contradictory things), so until we get some data points over the next week or 2, it’s hard to say.

The ‘good’ news is there’s always been ways of getting Avios one way or another – some of the best low hanging fruit is now gone, but I hope and suspect we can come up with something new…

Can you explain me your way of thinking please? In my perception with this construction you still refer to yourself, which makes you not entitled because you have a personal card.

If I am correct; the welcome bonuspoints are over now but the referralpoints aren’t? So I would still be able to refer myself and partner for (which cards at the moment as they aren’t seperated by loyalty program anymore)?

I currently hold a Rewards Gold and my partner a partnercard in my name.

It’s a great question. The honest answer is that until we see some data points, it’s impossible to say 100%. You’re probably right though, yeah.

I’ll be reducing my Amex spend accordingly. I’ll definitely be reconsidering the value offered by the £450 platinum card. Our two £75 Starwood cards are definitely getting cancelled.

Time to refer the wife, luckily never done this before and in a few weeks was about to take out gold again on my account.

Referrals won’t change as this is a bloodline for amex, New clients. Maybe they will amend the referral wording to state the referer will not get bonus if referral has had card in last 24 x months..

I have self referred just this week from Gold to British Airways PP. The existing rules don’t indicate any issued with that, so I can report back. But so far, no quick referral points on my gold account yet.

Just checked today and the 9000 points for self referral to BAPP have landed. So when my BAPP arrives I’m using it to pay a holiday balance in the first month to hit spend threshold, grabbing the 25000 sign up points, and closing the account for a pro rata refund of the annual fee, then starting the 24 months wait.

Meanwhile, I will be referring my wife for a gold card, and then she can self refer to a BAPP at some point as well.

At this rate 24 months will fly by.

Good to hear – yeah that sounds like a decent plan.

Thought it was going to be so easy. Nee BAPP card turned up today so activated and added to Amex online account, to find that the new card has a tiny limit of £1500. As current gold has a huge limit I’m going to ask if they can split the limit between the cards.

Thought I was on to a winner with a quick online chat to Amex. They said they can split my limits equally across both cards. But then said my cards were not linked on my profile, despite the fact that I have added the BA to my online account and can see everything about it.

Confused, and have to wait several days.

Very strange – not really sure what to suggest apart from waiting. The £1500 limit on the BAPP is an absolute joke regardless! – hitting the 10k would take forever (though do remember you can pay for something on your card and then pay off the balance multiple times in a month, if required).

Joe that was my plan if necessary. Spend 1000 then pay it and then spend 1000 more and so on. Will wait a week and see. My deadline is when the holiday balance is due by early May.

Aye, should work fine – but £1500 limit is still completely ridiculous on a premium card. Particularly one literally designed for booking flights…