Some links to products and partners on this website will earn an affiliate commission.

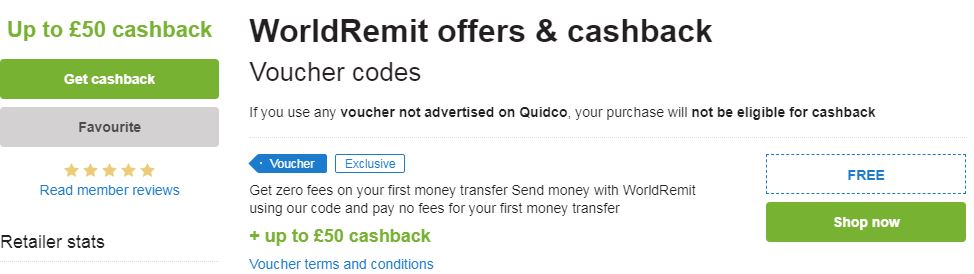

Quidco is currently offering an exceptionally good deal for anyone that makes use of FX transfer services, via WorldRemit with an exclusive cashback and WorldRemit promo code combo.

WorldRemit is one of the refreshing new breed of money transfer services that, in return for a small fee, transfers your cash at better rates than your bank. Note that WorldRemit’s FX rates are not as competitive as the likes of (the excellent) Transferwise or Revolut. However, a £52.50 kick-back on a £250 transfer will leave you massively better off, even where you convert it straight back (see below).

The first bit of good news is that via the Quidco WorldRemit promo code (FREE), that fee is waived.

Much more interestingly, however, if you sign up as a new customer via Quidco and transfer £250 or more, you’ll get bonus cashback of £50. That’s a massive rebate and makes any FX transfer of £250+ superb value.

Alternatively, you’ll get £30 cashback for registering and transferring £100-£249, or £15 cashback for registering and transferring £50-£99. Clearly, the £250 options is the one to go for if you can.

There’s a little more too…

Quidco are also offering a £2.50 bonus till midnight tonight for anyone that clicks on the £2.50 offer link on their homepage and spends £5+.

What’s the catch?

Well the catch is that to really benefit, you need a foreign bank account to send the £250 to. HOWEVER, a lot of people have their own personal “foreign” bank account, and anyone can arrange this, very easily, via Transferwise or Revolut. Just set up an account in Euros, make the Worldremit transfer this account and you’ll get the spot rate converted amount (which you can convert back to GBP if you want) plus the £52.50 cashback.

If you don’t want to do this for whatever reason, if you have a friendly family member or similar in foreign climes, now is the time to send them some cash that they can give you as spending money when next you’re over. Add to that the likelihood of the pound having plummeted after 11 December, and you could be seriously quids-in.

And finally…

Sign up to Quidco via this link, and you’ll get a bonus £10 with your first purchase!

This was amount was being advertised on Topcashback last night as well.

All of a sudden they have dropped this down to just over £15.00!

However be warned!

I was getting a lower rate from WorldRemit of 1.10088 to Transferwise’s 1.12310 of euro to £’s

Plus, have you seen the amount of negative reviews that people have posted over the last 2 years on Topcashsback.

There seams to be a general consensus that the the larger the possible cashback the bigger the change that no mater how careful you are cleaning you cookies , that you will never see that advertised cashback.

I cannot speak about Quidco, however I have done all the old routine with Topcashback. Cleaning Cache and Cookies, waiting 4 months, being fogged off with time honoured copied and pasted messages and low and behold then they use their trump card thats in their terms and conditions that people should never base their purchase on any potencial cashback!

I’ve heard every excuse in the book.

Miles, what this is effectively doing is undermining people actually wanting to use their portal for any cashback!

Maybe you could just remind them of that once and a while.

Thanks

To be fair to Miles… this is Quidco not TopCashBack. And Quidco – in my opinion – have gone full circle and are now better at tracking than TCB. As for Miles’ amazing foresight on EURGBP… well… not quite convinced on that one.

🙂 Yes, I take no responsibility for FX losses based on my wild speculations…

In my experience Quidco is rubbish and TCB is good (for tracking and/or claiming later). Ultimately I suspect it’s simply a matter of what weird cookies are lurking on your computer.

Hi!

So I did this yesterday, and quidco already tracked my cashback, which should be paid some time at the end of January. Many thanks for this! Also the USD/GBP exchange rate was OK ~$1.256 vs. market rate $1.272 at the time of exchange (better than a credit card spread, but not as tight as transferwise).

Always pleased to help. To the extent this works for you (and I appreciate some may have issues), it really is £50 or so in your pocket.