Some links to products and partners on this website will earn an affiliate commission.

As we will be working with Curve here at InsideFlyer, we wanted to highlight some of the key features of Curve, and share a great offer with our readers.

Cashback

For your first 3 months, enjoy 1% cashback at a choice of retailers. Curve Blue (free) allows you to choose 3 retailers, while Curve Black (£50) allows 6, and with additional exclusive retailers to choose from.

0% FX Fees

Foreign currency transactions are converted to UK pounds with no additional fees. Curve Blue has a limit of £500 per month on fee-free overseas spending, while Curve Black is unlimited (subject to fair use policy). We’ll have another article out shortly, focussing exclusively on the travel benefits of Curve, so keep an eye out for that.

As ever, always refer to the published terms and conditions for details on limits, supported currencies and rates used at weekends.

Time Travel

Purchases of up to £1,000 can be moved between funding cards for up to 14 days after the transaction. Perfect, if you accidentally spend on the wrong card.

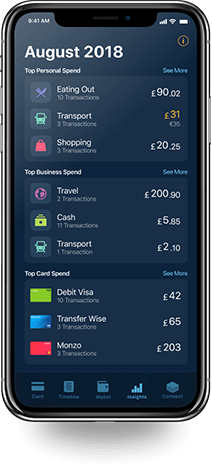

Spending analysis

Transactions in the Curve app are categorised, so you can review how much has been spent on transport, or in supermarkets, etc. You can also review how much has been spent on each funding card.

If you are spending for business purposes, the app allows you to identify a transaction as being a business transaction, as well as sending you an e-mail receipt when spending on a particular card.

If you need to do some more detailed analysis, you can link directly to Xero online accounting software, or export transactions to a CSV file. If you are one of the many people frustrated by Creation’s refusal to offer a transaction export feature, Curve is your answer. Link your Curve card to your Creation card (more than likely you have one of the IHG Rewards cards for InsideFlyer readers) and still benefit from the rewards on spending, while adding the ability to export your transactions to a CSV file.

It’s a Mastercard

OK, so a tenuous benefit I admit, but bear with me as there is some substance to this. From time to time, Mastercard might be the sponsor of an event and be the only supported card type, or offer discounts and benefits to Mastercard holders. Curve gives you the flexibility of spending on your choice of card, but still presenting a Mastercard where required.

It looks cool

Really scraping the barrel here! As is the trend with some other card providers Curve now has a minimalist look with no ugly card number spoiling the sleek look of the front. Instead, the card number is printed on the back. There is an argument for security here, in that when spending via contactless, you are fairly likely to hold the card the “right” way up, so there is no chance of anyone shoulder-surfing your card number.

Conclusion

Hopefully you see enough benefits listed here to try out Curve for yourself. I’ve been using Curve for some time, and even had the original card that was categorised as a pre-paid corporate card. This meant that it cost retailers more to accept, which did limit acceptance. That is why I made sure to use it to pay a parking fine from a station car park that I felt was unjustified. With the new cards acting like debit cards, acceptance is everywhere Mastercard is accepted.

My wife just took out the Curve Black (although the Tumi wallet mysteriously found its way into my jacket pocket rather than her handbag 😉 ) which gives us both a great option for fee-free overseas spending, and allows her to carry just the one card, rather than the array of hotel and airline branded credit cards that I present her with from time to time.

Did someone say free money?

We seem to be developing a habit here at InsideFlyer UK for telling you about free money offers, such as the recent ones from Quidco or TopCashback. Well, here’s another one:

To apply, download the Curve app for iOS or Android, or visit the Curve website and they will text you a link to download it. Don’t forget to use code INFLY when signing up to get your free £5 after your first transaction.

Keep an eye on InsideFlyer for more Curve news, offers and features coming soon.

A couple of weeks ago it was mentioned that they were teaming back up with Amex do we have a date for this yet and will there be still 0% FX fees

Indeed, it’s been well reported that Amex is coming back to Curve, but no details to announce just yet.

I’ve been using Curve for a few weeks and I’m loving having less clutter in my wallet – it’s a really great product and the sign up process is quick. Worth giving it a go. If you do, I would be grateful if you use my referral code: DL6G8JZE (we both get £5 credit)