Some links to products and partners on this website will earn an affiliate commission.

I was alerted to a news story on the BBC yesterday that caused me quite substantial mental anguish. I love to bag myself a deal or points wheeze, but I equally like doing so for others.

So if only this lady had contacted me before she spent £18,000 on a debit card… (ignore the focus of the story on her being charged twice, that’s a mere side issue).

What was she thinking?

This is a classic example of spending which MUST be put through a credit card: she really has foregone bagging a free holiday (or two) as a bonus to her new car.

Let’s take a very basic example, and assume she spread the £18,000 cost of the car between two of the most straightforward Amex credit cards, the Amex Gold (£8k) and the BA Premium Plus (£10k). By my workings out, here’s what she would have earned:

Amex Gold (£8k of the spend)

- Signing up via a referral link, she would have earned an instant 22,000 Membership Rewards points for reaching the £2k spend threshold.

- The £8k spend would have gained her an additional 8,000 Membership Rewards points

- Plus, the card would not have cost her anything, as it’s free in the first year.

BA Amex Premium Plus (£10k of the spend)

- Signing up via a referral link, she would have earned an instant 26,000 Avios for hitting the £3k spend threshold.

- The £10k spend would then have netted her an additional 15,000 Avios.

- The £10k spend would also have gained her a BA Companion Voucher, meaning she could redeem her Avios for two people, but only pay the Avios required for one.

I do accept that Amex may not have granted her £10k credit on the card (my credit line is currently £8,700). However, she had £18k in her bank account, so could have paid £5k, paid the card off, then paid the other £5k. When you’re making an £18k spend, businesses tend to be pretty flexible in how they accept your money.

What could that convert to?

At this point, Joe would tell you in excruciating amounts of detail that if you somehow convert these Membership Rewards Points to Marriott Rewards Points, then Alaska Miles, then AA Miles, then into Zimbabwean dollars, then phone a secret number in a suburb of Abu Dhabi at midnight, you’ll be able to redeem them for a First Class Etihad flight between Jakarta and Addis Ababa – because the champagne’s great (Ed. See me! 😉 ).

I’m going to go with a simpler example (I’m a simpler man), and stick with good old BA (not least as that allows us to deploy the Membership Rewards Points and Avios in the same pool, and use the Companion Voucher).

- The Membership Rewards Points convert to Avios at a 1:1 ratio. Therefore, that’s a neat 30,000 Avios.

- The Avios gained from the BA Amex card total 41,000.

So, our stockpile is 71,000 Avios, plus a Companion Voucher.

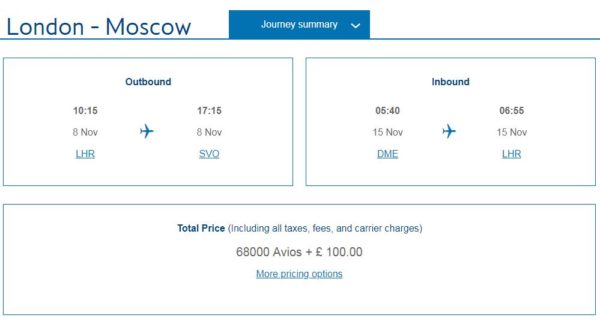

While I would personally wait to save a little more Avios to use them (and the Companion Voucher) on a longer-haul USA or Asia flight, one obvious use of the current haul is Business Class return flights to Moscow.

68,000 Avios plus £100 gets you two Business Class return trips from London to Moscow in (amongst many other dates) November this year:

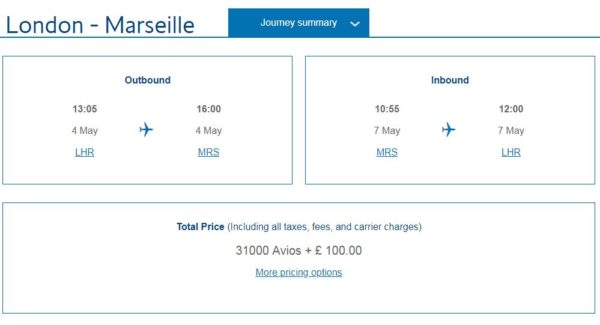

However, if you deployed the Companion Voucher, you would only be paying 34,000 Avios, leaving you with a still very substantial balance of 37,000 Avios. That could then be used on two Business Class return flights to, for example, the beautiful French city of Marseille, which would cost a total of 31,000 Avios, plus £100 (18,000 + £50 each) for an extended weekend in May:

So, two Business Class flights to Moscow, two Business Class flights to Marseille – and you still have a balance of 6,000 Avios. That could be put towards a night at a hotel (at an admittedly poor redemption value) or saved for a future flight.

I’d say that’s a pretty good additional benefit to a car purchase, and it certainly stacks well against the NOTHING extra she received for paying with her debit card.

These are very much just my initial thoughts, without any real advanced Deeney/Sowerby-style in-depth hacking options. If you can think of a better way to spend the £18,000 across credit cards, or a better way to convert the points earned, feel free to post your suggestions.

Finally please, please – don’t ever spend £18k on a debit card. If you ever feel yourself in that position, just get in touch with us. We’re here to help…

Even that example is an inefficient way to split your spend if you only want Avios. You’d be better off only spending the minimum to hit the signup bonus on the gold card and putting the other £16k on the BAPP:

Gold: £2k = 22k + 2k =24k MR = 24k Avios

BAPP: 16k = 26k + 24k = 50k Avios

Total: 74k Avios, so an extra 2k via this route

Sorry, extra 3k not extra 2k

Fully agreed Mike. My sole reason for the more equal split was the likely credit limit issues on the BA card. That said, the £10k spend is likely to exceed that and if you can persuade the dealership to accept 2 x £5k, no real reason why they shouldn’t accept 2 x £8k.

Have you tried buying a car on a credit card? Seriously: when was the last time you spent £18,000 on a car? Because clearly you haven’t.

I haven’t, but a few years back I bought a painting for $170 million on my Amex:

https://nypost.com/2015/11/18/billionaire-bought-170m-painting-with-his-amex-for-the-points/

Yes, that is me.

Precisely. I’ve tried with my last three cars at 3 different main dealers and been told no, you can only pay up to grand as the deposit. Balance must be debit card or transfer.

Do dealerships take Amex though? The last time I tried I git the big No!

Some certainly do! https://www.autotrader.co.uk/car-finance/guides/buying-a-car-using-a-credit-card

In this case, simple answer is I of course don’t know, because I don’t know the dealer. The fact that they accept debit cards show they’re not a “cash or bank transfer only” dealer. At the very least, if they don’t accept Amex you should be using a Hilton Visa or SOMETHING that gave you a rebate on that £18k spend.

She paid 18k for that car in the first place is the most shocking thing.

When I bought my last car I paid on debit card, the option was there for credit card (Visa or Mastercard) but at a 2% fee it didn’t seem worth it. These days with dealers not being meant to charge card fees I’d imagine that a lot less dealerships take credit cards.

Dealers are not meant to charge credit card fees on advertised prices, but cars are normally bought after a bit of haggling. I am sure that “How do you intend to pay?” will come up and the negotiation somewhere, and the answer will affect the ultimate price being charged.

Depends what her spending limit is on the Amex cards , mine if only £5k , and i have a very good credit rating, cant see her being able to spend £10k on a new Amex card

Last time I applied for an Amex credit card, they gave me £8500. On a previous occasion they gave me £12,000. I’m not poor, but I am not rich either. There are some fairly big limits out there.

Any deal which results in the dealer being happy to take a credit card, is almost guaranteed to not be a good deal. The dealer knows the dealership will be hit with 2-3% in card fees, that’s 2-3% that could otherwise be realised in by a lowering of the price if paid for by a debit card.

The autotrade article says:-

“Many dealers won’t accept a credit card, and even those who do, sometimes have a limit on how much you can pay by card, or charge up to an extra 3% for paying by card.”

If you aren’t being charged for paying by credit card, you can almost guarantee the charge is in the deal.

Last time I bought a car, the max the dealer would put on a credit card was £3K, I’m sure I likely paid £50-£60 for the pleasure that was was built into the deal, but it suited my purposes.

It is unlikely to be 2-3% these days unless it is PayPal more like less than 1%

Most dealerships would require debit card payments so it is not that bad and you can’t blame them. That said in the past I have managed to use a Visa to purchase a car but not an Amex.

Like said previously, Amex is rare to be accepted by a car dealership, they would lose too much unless the price has been inflated to compensate for the Amex charges.

Simple way round this was to use Curve linked to a decent point paying visa / MasterCard as treated by the terminal as a MC debit card.

Very few car dealerships accept Amex and some don’t take credit cards at all.