Some links to products and partners on this website will earn an affiliate commission.

Unless you are truly obsessed with miles and points, you might struggle to understand what they are truly worth. Is 25,000 points per night a good deal or a bad one? It depends on the loyalty programme and the underlying cash rate for the night(s) of your stay.

One of my main travel hacking strategies is using the cost of simply buying points as a proxy for the “value” of a point. Here at InsideFlyer UK, we tend to point this out most frequently when SPG would sell their Starpoints at a 35% discount, or Hilton Honors sell their points at a 50% discount. If I can buy enough points for a “reward night” and spend less than the cash rate, why wouldn’t I go for it?

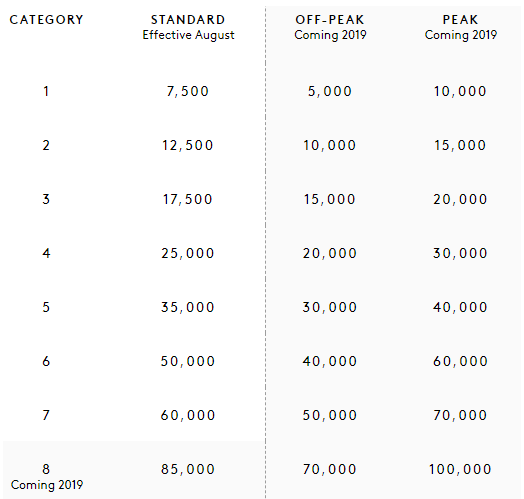

Marriott Rewards, however, has not been known for selling their points at a discount. And full price surely doesn’t make much sense right? So what can we use to figure out a “rule of thumb” valuation for Marriott points? Especially since a new award chart is coming on 18 August…

Sadly, the number isn’t 42, as Hitchhiker’s Guide to the Galaxy readers are well aware. But in a similarly arbitrary fashion I have decided to value Marriott points at 0.8 US cents (or 0.6p) each.

How Did I Reach This Figure?

Well… my first point of reference is reasonably well understood. We’ve written about it so many times that you hopefully are aware that Starpoints could often be bought for 2.28 cents apiece. Divide by 3 for Marriott points (1 Starpoint = 3 Marriott points) and you end up with the gruesome 0.76 US cents.

Why Did I Round Up to 0.8 Cents?

When it comes to “rules of thumb”, simplicity is key. So what happens when you apply a value of 0.8 cents to the Marriott award chart?

- 7,500 points * 0.008 = $60

- 12,500 points * 0.008 = $100

- 17,500 points * 0.008 = $140

- 25,000 points * 0.008 = $200

- 35,000 points * 0.008 = $280

- 50,000 points * 0.008 = $400

- 60,000 points * 0.008 = $480

Nice round numbers… so you can quickly judge whether you should pay $110+tax for that Category 2 hotel, or just spend points.

If you prefer sterling, 0.6p isn’t exactly correct at current exchange rates, but the maths are similarly simple.

- 7,500 points * 0.006 = £45

- 12,500 points * 0.006 = £75

- 17,500 points * 0.006 = £105

- 25,000 points * 0.006 = £150

- 35,000 points * 0.006 = £210

- 50,000 points * 0.006 = £300

- 60,000 points * 0.006 = £360

The Earning Side of the Equation

In the new Marriott loyalty programme, members will earn a minimum of 10 points per US dollar spent. This is another good reason to use a USD based valuation (i.e. 0.8 cents). So, depending on your level of status, you will be earning a rebate (in the form of points) that is equivalent to the following:

- Member – 10 points per USD –> 8% rebate

- Silver – 11 points per USD –> 8.8% rebate

- Gold – 12.5 points per USD –> 10% rebate

- Platinum – 15 points per USD –> 12% rebate

- Platinum Premier – 17.5 points per USD – 14% rebate

(and don’t forget to use a cashback website such as Topcashback to earn another rebate when booking those Marriott stays)

Conclusion

Even though my analysis is somewhat based on round numbers rather than an exhaustive analysis of room rates for select hotels in each award category, I think that having a simple rule-of-thumb valuation for Marriott Points will be valuable. Many readers won’t be particularly familiar with Marriott Points, and all of us will be experiencing the new award chart for the first time.

What do you think? Makes sense? Or do you have a different take on it?

“Unless you are truly obsessed with miles and points”

I’m guessing that includes everyone who is a regular reader of this site!

🙂

I’ve always gone on looking at the cash price and then take a view how many points I’ve got banked and how easy it is to replace them. Sometimes it’s really obvious but when it isn’t these calculations can be really useful thanks.

Not convinced 🙂 I am actually beginning to think that there are a lot of smokescreens here (eg the delayed launch of Cat 9 and peak) which cover an underlying truth.

Fact – most of us prefer to redeem at high-end properties

Fact – it is high end properties which are generally going up in price, with low-end going down

Fact – we’re forgetting about peak/offpeak which you can reasonably assume will be ‘peak’ at the time you want to redeem!

Essex House in New York, for example, is going from 45k now to 60k. At ‘peak’ that will be 70k.

My personal view is that I will drop my Marriott valuation from 0.5p to 0.4p after January.

If I only had a modest balance I would be happy saying that you should hold your points until you can get 0.6p, because that will be possible at times, but those who earn a lot of Marriott points and need to ‘burn as they go’ are likely to be at nearer 0.4p.

Can’t say I agree with you, especially with the notion that most people prefer the high-end properties (London bankers, yes… families / middle class travellers not so much) or that they are going up in price (Marriott yes but SPG no and who ever aspired to more than maybe a handful of Marriotts). But we’ll see how it plays out and, yes, peak / off-peak will be a devaluation in disguise…

Don’t forget though that we still have the backstop of the airline mileage transfer. If you genuinely think you can only get 0.4p on hotel stays, then you should be transferring everything to an Asian airline or Alaska Airlines as they would be sub-1p miles with the 60K –> 25K miles ratio.