Some links to products and partners on this website will earn an affiliate commission.

Multi currency accounts and cards are currently something of a trend, and there’s good reason for that. Avoiding extortionate foreign spend fees or punitive exchange rates can make any holiday better value, and when your pound barely gets you a Euro, that’s a concern.

While TransferWise remains my currency exchange of choice (not least for its new multi-currency account option), the Post Office’s latest option is a THIRTEEN currency prepaid Mastercard, that can be ordered online.

Getting something for (almost) nothing

Key to this card, whether you consider it particularly good value or not (the rates are ok, but not great), is that you’ll get £8.40 cashback via TopCashback, which converts to 880 Avios. You need to load £50 onto the card into one of the 13 currencies, so you can do that once (for a currency that works for you), spend the balance, bag the cashback, and you’ll have done well from this deal.

What currencies are included?

One prepaid Mastercard card for 13 currencies:

- Euro (EUR)

- US Dollar (USD)

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Croatian Kuna (HRK)

- New Zealand Dollar (NZD)

- Polish Zloty (PLN)

- Pound Sterling (GBP)

- South African Rand (ZAR)

- Swiss Franc (CHF)

- Thai Baht (THB)

- Turkish Lira (TRY)

- UAE Dirham (AED)

Would I use this card on an ongoing basis?

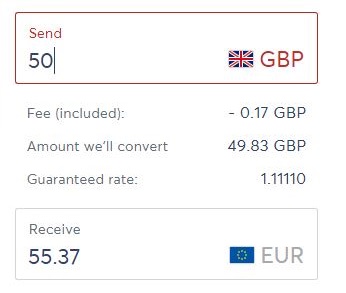

No – I’m taking the cashback, spending the Euros and then sticking with my TransferWise multi-currency Debit Mastercard. At the time of writing, £50 with Transferwise gets you €55.37:

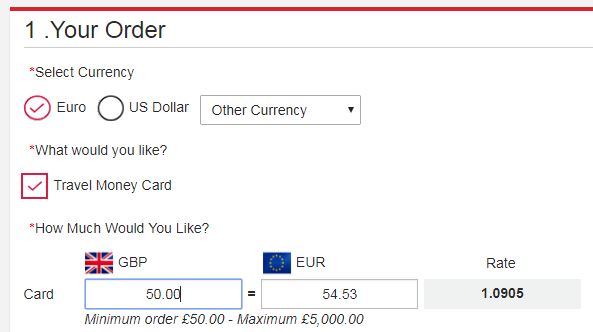

That’s compared to €54.53 with the Post Office Mastercard:

Plus 1,575 Avios (£15) bonus for all new members

All new TopCashback members can also bag an exclusive 1,575 Avios (£15) bonus with the first purchase via TopCashback, just for signing up through the InsideFlyer link.

Note that there are some retailer exclusions for earning the bonus (full list at the bottom of the page here), but with thousands of retailers to choose from, you shouldn’t have any trouble finding something suitable!

Hi

Why are these currency cards so popular unless you want to bag a good rate weeks/months before you go abroad.

Halifax Clarity uses what seems to be the same rate as TransferWise above but there are no fees. The only cost if interest from when you withdraw cash but this can be stopped by paying off the about withdrawn the day you take it out rather than waiting for the bill.

I don’t disagree that they’re not really for everyone. The thrust of the article was really just the easy Avios.

That said, I do like TransferWise for converting my Euro balances to Sterling and vice versa. I’m not sure if they’re strictly speaking allowed to promote themselves as such, but these multi-currency accounts also let you trade FX, if that’s your thing.

Not all people are card savvy. Some reasons why they are popular may be:-

1) Seen as a way of locking in a rate

2) topping up is seen as a novel way of saving for holiday spending money.

3) If lost/compromised, the max at risk is the balance on the card

If I trusted the cashback 100%, I’d just buy a 50 quid prepaid card and pay the £3 commission…