Some links to products and partners on this website will earn an affiliate commission.

If you visit sites like InsideFlyer, you probably already have some knowledge of the American Express Platinum Charge Card and its many benefits – including things like:

- Unlimited Priority Pass airport lounge access for yourself and 1 guest

- Travel insurance for your family

- Starwood Preferred Guest/Marriott Rewards Gold

- Hilton Honors Gold

- Radisson Rewards Gold

- Shangri-La Golden Circle Jade

- Melia Rewards Gold

The benefits are undoubtedly excellent, but there’s a rather hefty £450 annual fee too, which is less pleasant.

One of the big perks of the Amex Platinum that I don’t think gets enough attention is the fact that you can nominate a supplementary cardholder for free and they then receive the same benefits as the primary cardholder.

This is particularly useful if you travel frequently with family or (the same) friends, as with 1 primary cardholder and 1 supplementary cardholder, you can get 4 people (the 2 cardholders + 2 guests) into Priority Pass airport lounges for free. If you value lounge access at £15 per person per visit, that’s a saving of £120 on every return trip. If you take 4 return trips a year, you’ll have saved more than the cost of the annual fee, before even taking the other benefits into account.

Naturally, I would only suggest giving a supplementary card to someone you’ve known a long time and trust (and even then, you can always keep hold of the actual card yourself of course – they don’t it to access most of the benefits).

You said £170…

I did.

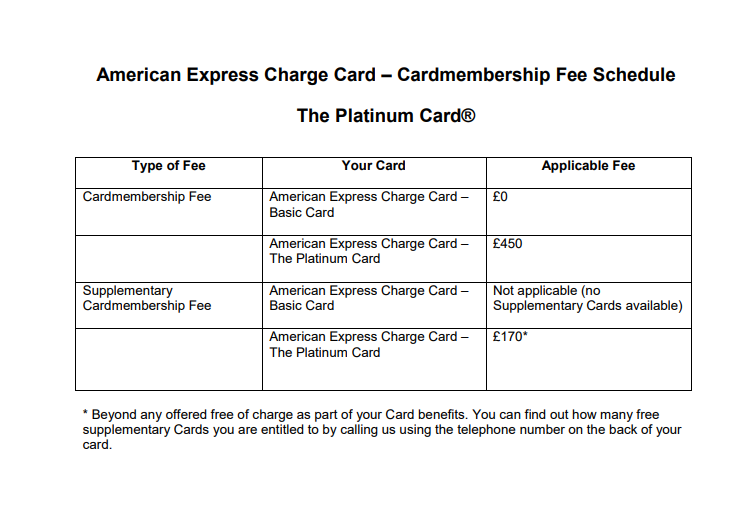

The first supplementary card perk is a little underrated, but if you dig into the Amex terms and conditions you’ll find something potentially even more interesting. Scroll down to Page 12 of this document here and you should see the following:

The interesting part is the bottom row: you can buy additional supplementary Platinum cards for other friends/family (on top of your first free supplementary card) for £170.

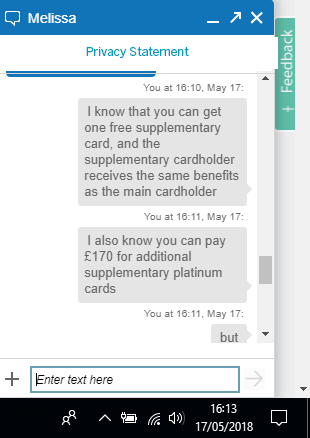

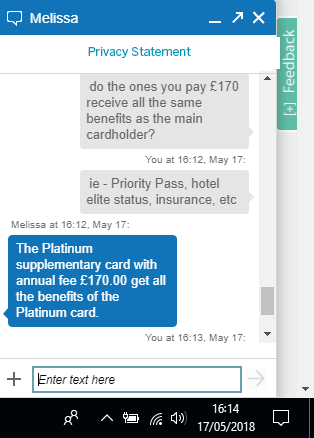

I wanted to double check that these additional cards include all the same perks, so sent Amex a message and they were happy to confirm that is the case:

Bottom line

Ok, so you also need a trusted friend or family member who already has a Platinum card, as well as the £170 mentioned in the title, in order to benefit from this – but many readers will be in that situation, so I thought it was worth sharing.

I like to churn my Amex cards for the sign up bonuses, but I also like the benefits of holding an Amex Platinum, so this is definitely something I can potentially see myself taking advantage of when I’m mid-churn.

I wonder whether you get a pro rata refund on paid supplementary cards if the main cardholder cancels?

I plan on churning my Plat for an HSBC Premier World Mastercard.. just need to get over the faff of getting a Premier account. I’ll then be back to Plat at some point in the future to renew my benefits and get a new sign up bonus..

Let me see if I’ve got this right… 🙂

1. You set me up as a supplementary cardholder

2. Card arrives in my name to Deeney Mansions and you hang on to it

3. I send you £170 to cover annual fee (and buy a few extra rounds down the pub)

4. I / You? call Amex and get me a Priority Pass and the hotel statuses

Sounds promising. Beats hotel hopping between dodgy Hiltons on a fast track…

You’ve set yourself up there Joe for being the main card holder now for ALL InsideFlyer UK contributors ? wonder if Amex have an upper limit for supps? ?

I can pay you in monthly installments right?

No more churning for you!

Haha, yes I can see myself ending up with a lot of Platinum cards in a drawer next churn.

And up on a fraud charge when Amex realises that 17 people completely unrelated to you don’t all live at your address having stated that they do 🙁

Haha – nah, supp cards don’t have to be for members of the same household as far as I’m aware. In fact, isn’t one of the advertised benefits of adding supps that the travel insurance extends to the supp cardholders household family as well as themselves?

Exactly right!

Interesting. When I asked they told me it did not include the priority pass.

Aye – I never believe the first agent, so rang to double check as well and was told the same as by the online agent. That said, I suppose it’s not completely impossible that both of them may have been wrong. I’d like to hear from some people who have actually done it to be 100% certain.

I have 3 iof my children aged 23-30 and canconforn

They have priority pass cards and Dan sign a guest in with it

Apologises – clumsy fingers as sit on runway waiting for French ATC to be ace properly

Thanks for confirming Iain!- for grown up children (or other family members) it really is a cracking deal. £170 for Priority Pass, decent range of hotel status + insurance etc, is a steal.

It’s been a while since I held a plat card, but I vaguely recall there was a difference between the first and subsequent supplementary plats, but I can’t remember what it was (other than the fee).

Indeed.

Historically it was certainly the case that you didn’t get everything – but I can’t recall the details off the top of my head.

I erroneously added two supplementary cards last week (both were my wife) and was charged a 170 fee. The extra card is now cancelled, but I did receive three priority pass packs in the post…

Cheers Fahd!

Did these come with the platinum card at the same time? Just received a £170 supplementary card however no PP came with the card so wondering if these will come separately or need to chase Amex

I did this recently. Amex now asks to be sent by post some documents before validating the supplementary cardholder:

– A photocopy of your Supplementary Applicant’s Passport, Identity Card, or Photo Drivers Licence

– ONE of the following original documents as proof of their address:

Original Bank or Building Society statement*

Original Electricity, Gas or Water statement

Original Landline Telephone statement

Original Council Tax statement for current period

Original Annual Mortgage statement

Original Cable, Satellite or Internet bill

Original HMRC or other Government issued correspondence i.e. tax bill, income tax bill

Original Graydon/Companies house document (for UK business applications only)

*We can also accept an online/internet printed Bank or Building Society statement that has been stamped within their local branch – see note below.

Please note:

Original document should be an item that has been sent to their address.

Original document should be dated within the last 3 months if issued monthly, or current if issued annually.

Original document should clearly display their full name (as it appears on your application).

Printed Bank or Building Society statements must have a legible branch stamp.

All original documentation will be returned to you. Whilst we take every precaution, American Express does not accept any responsibility for the loss or damage of returned documents.

Thanks for the info Remy – good to know!

To verify they live at the same address is it ?

Doesn’t have to be same address for supp cardholders – unless I’ve missed something obvious….

Which perks specifically aren’t available to the over 70s ?

Is it only the travel insurance which is invalid whilst absolutely everything else is valid (including car hire excess etc…) ?

Is it all of the travel insurance or just certain parts ?

Cheers.

Pretty sure it’s just the travel insurance.