Some links to products and partners on this website will earn an affiliate commission.

Anyone looking to maximise their miles, points or travel value will be presented with a massive array of travel tips, tricks, deals, loyalty schemes, credit cards, airlines, hotel chains, blogs etc.

While what works best for you is obviously very, very subjective, here is our updated list of what we consider to be 10 of the very best travel tips to maximise the value you get from your travel. Some of the top travel tips tips might be well known to you already, but we’d like to think that whether you’re a novice or a seasoned traveller, there’s something in our list that will be of interest or use to everyone.

Tip 1: Use your miles for DISCOUNTED Business Class redemption flights

This tip takes age old advice, but goes even further. The age old advice? Using your air miles for Business Class flights. Given that you will always end up paying several hundred pounds in taxes and fees on a redemption flight (i.e. even an Economy one), you will invariably find that, as a result, you are much better off redeeming your miles on a high value Business Class flight, where the amount of cash you pay is relatively low compared to the value of the ticket.

However, we do not like to stop there. There are a number of ways you can take this value further, by using your miles on discounted Business Class redemption options, where not only do you get the added value of a Business Class redemption, but the price is slashed. Examples are as follows:

Lufthansa Mileage Bargains

The monthly set of Lufthansa short and long-haul flights, offered at around 50% of the miles ordinarily required.

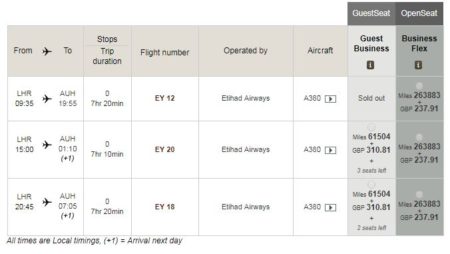

Etihad GuestSeat

The Etihad GuestSeat is the super saver option for Etihad redemption flights. While short in supply, if you can bag one you will find that the miles required are reduced considerably from the standard OpenSeat redemption, as the following random example illustrates:

As you can see, 61,504 miles plus £310 for a Business Class flight from Heathrow to Abu Dhabi is not at all bad, and noticeably better value than the OpenSeat option of 263,883 miles plus £237.91.

British Airways “Companion Voucher” – two-for-one redemption

Another classic tool for the frequent traveller, but often overlooked, is the British Airways American Express Card. Spend £10,000 on the Premium Plus card (£20,000 on the standard card) in a year, and you’ll get a reward flight “companion voucher”.

The companion voucher entitles you to one “free” redemption flight when you pay for one with Avios – you will however need to pay the taxes and fees on both flights. Here is a little tip on getting the companion voucher most cost-effectively.

Put simply, the companion voucher enables you to redeem your Avios stash in any class, and then get an identical second reward ticket without spending a single additional Avios.

When used wisely, this can save you a massive amount of Avios and secure a pair of top value redemption flights with British Airways.

Tip 2: Take out the American Express Gold charge card

The American Express Gold charge card is widely seen as one of the very best value “travel-related” credit cards available in the UK. The reasons are clear:

- It is free for the first year, and you can cancel without quibble at the end of this year.

- If you spend £2,000 on it in your first 3 months, you will get 20,000 Membership Rewards points. These convert to 20,000 air miles in a number of schemes, including Avios. 20,000 Avios will get you a return flight from the UK to, for example, Moscow, Istanbul and Malta.

- You get two free executive lounge visits each year with the card.

If you want to earn 22,000 bonus points (rather than 20,000), sign up to the card via this link.

(See Tip 10 for a great way to load spend onto your credit card, and hit the above spend targets without really spending.)

Tip 3: Make good use of Tesco Clubcard

You might not expect a supermarket loyalty scheme to feature in a “top 10 travel tips” list, but there’s a very good reason for this: very cheap Avios and Virgin Flying Club miles.

Tesco Clubcard points can be converted to British Airways Avios Points at a rate of 1 Clubcard Point to 2.4 Avios. The smallest amount you can convert is £2.50 (250 Clubcard Points), which gets you 600 Avios.

For Virgin Flying Club, the rate is slightly more generous, with 1 Clubcard Point converting to 2.5 Flying Club Miles. For £2.50 of Vouchers (250 Clubcard Points), you will therefore receive 625 FC Miles.

Putting a value on frequent flyer miles is extremely subjective, but you really want to be trying to get at least 1 pence worth of value per Avios/Mile, which means that by converting your Clubcard Points to BAEC or Flying Club, you should (conservatively) receive 2.4x or 2.5x face value respectively.

Tip 4: Redeem your Avios wisely with the British Airways Reward Flight Saver

As noted at tip 1 above, one of the major issues with redemption flights is the notorious “taxes and fees” hit. There are few things more dispiriting in the loyalty traveller game than finally redeeming your hard-earned frequent flyer miles, only to find that you’re also having to pay substantial amounts of hard cash to cover taxes, fees, fuel surcharges etc. That’s what makes the BA Reward Flight Saver (RFS) such great value.

Put simply, RFS applies to Avios reward flight bookings on British Airways flights of 2,000 miles (in distance) or less: so essentially it applies to intra-Europe flights. It rather wonderfully caps all taxes and fees at £35 return for Economy Class and £50 return in Business Class.

RFS will therefore apply to your BA reward flights booked both through Avios.com and the BA Executive Club.

One “advanced” tip: RFS is not a fixed £35/£50 for returns, that figure is actually 2 x £17.50/£25 for each leg. As such, given that taxes on inbound UK flights (i.e. your return flight) can be extremely low, you may be better off booking the outward flight using RFS and the inward flight with the full tax (if it is lower than £17.50/£25, which it may well be). This will of course require you to make 2 separate one-way bookings.

Tip 5: Hotel status “fast tracks”, in particular Hilton Gold

Elite status fast-tracks are a great way to get valuable status with hotel chains without having to meet the sometimes exhausting stay requirements otherwise required.

Via this link for example, you will be enrolled in a Hilton HHonors Gold Status fast-track scheme, which will grant you Gold status if you make four stays at a Hilton hotel within 90 days of signing up for this offer.

The benefits of Gold status are substantial, including all the silver benefits above (except for a 25% rather than 15% points bonus), plus:

- 25% bonus on base points earned

- 5th night free on awards

- Late check-out

- Complimentary fitness center & health club access

- Free bottled water

- Free breakfast (including at Waldorf Astoria properties)

- Guaranteed room upgrade

- Frequent upgrades to Executive rooms (with Executive Lounge access), regardless of the room purchased

- Free internet access

Hilton HHonors also offers a great Gold status fast-track offer to Accenture employees only, that also gives you the substantial side-benefit of free instant Silver status. To benefit, you need to enter your HHonors details (or sign up if you are not already a member) here, and provide your Accenture email address.

The other fast track status challenge worth shouting about is the Starwood Preferred Guest option.

Starwood Preferred Guest offers an official status challenge, that is set to run through until 30th June 2018. You can find the SPG status match / challenge landing page here.

Signing up is simple and your options are either to:

- Go for Gold – requires 9 nights in 3 months

- Aim for Platinum – requires 18 nights in 3 months

What are the benefits of SPG Platinum Status?

The benefits are set out in full here, and include:

- Three Starpoints for every U.S. dollar spent on eligible stays — a 50% bonus over Preferred.

- Your choice of welcome gift upon arrival — choose from bonus Starpoints, continental breakfast or local amenity.

- An upgrade to best available room at check-in — including a Standard Suite.

- Complimentary in-room, premium Internet access.

- Complimentary health-club, Club-level and Executive-level access.

- Guaranteed room availability when your room is booked by 3 p.m., 72+ hours prior to arrival.

- Marriott Rewards Gold Elite, via the easy status match.

Tip 6: Book travel through TopCashback

We are massive fans of TopCashback at InsideFlyer UK, and it’s a key weapon in the arsenal of anyone looking to keep their travel spend down to a minimum.

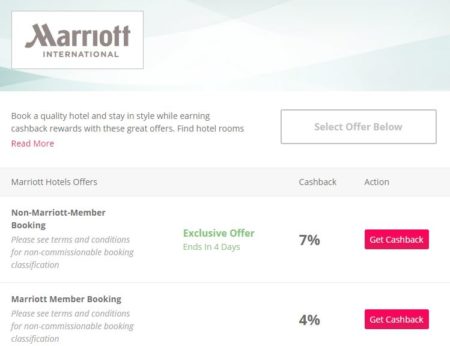

Whether it’s air travel, rail travel, hotels or even rental cars, you will invariably be able to chip off a bit more of the price by simply booking through TopCashback. By way of example, at the time of writing you can get 4%-7% cashback on Marriott bookings:

It is, of course, free to use, and to the extent you use it for things you would have bought anyway, it is probably as close to free money as you’ll ever get.

Finally, we are delighted to announce that if you sign up to TopCashback via this link, you’ll get a £15 sign up bonus (convertible to 1,575 Avios!) when you spend £10 at any retailer.

Tip 7: Start your journey outside the UK

With its Air Passenger Duty and expensive landing slots, flying from the UK often results in a number of costs being added to the price of your ticket. The solution? Leave the country.

Qatar flights from Scandinavia are one of the very best ways to secure a non-UK bargain, but there are numerous other options, including BA flights starting in Dublin. The savings don’t merely apply to cash flights either, you can save a small fortune in taxes and fees on, for example, your Avios reward bookings by redeeming with Iberia from Spain or Airberlin from Germany (with the latter, you need to book via BA Executive Club).

Obviously this doesn’t quite make sense as a tip – you can’t “start your journey” outside the UK as you’ll need to get to your “starting point”! With that in mind, tip number 10 should come in useful…

Tip 8: Book “low category” chain hotels

I am frequently asked what the best value hotel points redemption options are. Two obvious answers are IHG PointBreaks (see Tip 9) and SPG Category 1/2 weekend stays, which can be extremely good value (see further below).

However, Hilton can easily challenge both of these excellent redemption options, with their own Category 1 hotel redemptions. Hilton Category 1 is a collection of Hilton-brand hotels worldwide where you can get a reward night for just 5,000 Hilton HHonors points (yes, I know, these hotels are not called Category 1 hotels any more, but that’s how we fondly remember them – and it’s catchier than “5k Honors points a night” hotels).

There’s no time limit or other restrictions on these redemptions, save the standard rules on the rooms being subject to reward availability. Year-round, you can get a night at any of the Hilton Category 1 hotels for a wonderfully low 5,000 HHonors points.

The full list is available here, and you can narrow it down by country (or US state).

Bear in mind that Hilton Gold members (get fast-track here) will get breakfast for free, so you’re getting a night and breakfast for the 5,000 points. Plus, a lot of the Category 1 hotels are Hampton by Hiltons, which include free breakfast for everyone, even on reward stays.

A night in a Hilton, with breakfast, for 5,000 Hilton HHonors points? That really is value.

Tip 9: Book IHG PointBreaks as quickly as you can… if they work for you

Intercontinental Hotels Group (IHG) quarterly PointBreaks require a mere 5000 IHG Rewards Club points per night, and are widely regarded as one of the very best value “miles and points” redemption options available.

The global list of participating hotels is here. It’s rarely the most glamorous list of hotels, but for 5000 points a night it remains a great deal. Availability is limited, so the key with PointBreaks is to jump on it as soon as the list is released and if you see a hotel that works for you, book it – you will almost certainly have bagged a bargain.

Clearly, if you’re not already a member of IHG Rewards Club, then this offer won’t be much use to you. However, you can join here and then participate in future PointBreaks, should you have racked up enough points.

Tip 10: Preload spend onto your credit card using Zeek

One of the issues with the massive points bonuses on credit cards such as the Amex Gold (see Tip 2 above) is the need to make a fairly substantial spend in a short period of time – what if you don’t actually need to make that spend?

That’s why gift cards can be a great option. Spend money on the gift card now, but then spend the gift card itself only when you need to. In addition, online gift card retailer Zeek offers sometimes substantial discounts on a huge range of gift cards. You can even get £3 in free credit, just for signing up.

In short, Zeek offers you a straightforward way of loading the spend on to your credit card that will earn you the bonus points or miles that will really start to take you places.

Disagree? Have a better tip? Feel free to discuss the above or your own in the comments below. We are very open to the debate!

Thanks, some really good advice and a few useful reminders to even regular IF readers. There’s one caveat though…

Re point 10, remember you have no creditor protection for gift cards if the retailer goes out of business. Buying anything via credit card gives general automatic protection if that does happen, BUT I’m not sure if that applies to gift cards bought directly from the retailer, let alone when they’re bought via a third party.

Zeek is great for imminent purchases, as the risk of unexpected retailer insolvency over the space of a week or so is minimal.

If you need to ensure you hit a spending target, my basic advice would be to plan the timing of your application. Applying in November gives you chance to include Christmas spending for example. If you have a large purchase such as a car / holiday / home improvements / travel pass to make this year, again make sure it falls your qualification period.

Perhaps not quite as expensive, but remember that UK firms are no longer allowed to charge extra for paying by credit card. What about ensuring your car / house insurance renewals fall into your allotted time. That could represent £1000 of your target!

Just short of your target, try these: –

– fully fuel your car (£70?)

– stock up on supermarket booze offers, especially spirits that don’t go out of date (£100?)

– bulk buy non-perishable household items, such as cleaning products, oils, tinned items etc (£50?)

– future buy Christmas or birthday gifts for relatives (£100?)

Hope this helps some folks reach their target!

Steve

Great points Steve, thanks.

Re your final list, I would add: Load up an Oyster card with your credit card, then get it refunded to your debit card. It works…

Remember to factor in the value of your time.

Yes this is all about getting a great deal – but it is dead easy to get lost down the rabbit hole and spend days and days planning/checking/hacking/faffing for little incremental benefit. It’s really ok to get a good deal rather than spending all weekend getting a really good deal.

Very good point – a good deal or redemption is still good, even if it’s not ‘perfect’ and can be a lot quicker.