Some links to products and partners on this website will earn an affiliate commission.

It seems like I hear more and more from people beginning to doubt whether chasing airline Miles / Points is really worth the bother these days. With frequently cheap cash fares and loyalty programme devaluations, what’s the point of Points / Miles?

In this three part series I am taking a look at the arguments, before sharing some tips to ensure you can still make the most of your Points / Miles!

You may remember that I ended Part One on the rather gloomy conclusion that it’s basically game over for airline Points / Miles collectors.

I looked at how a combination of frequently brilliant cash sales, and frequently terrible award chart devaluations has rendered our hobby a bit pointless (‘scuse the pun).

For travel in Economy, we are now in a situation where you can easily end up paying more in hard cash for taxes/surcharges on top of your Miles, than you would if you just bought a ticket!

For travel in Business / First Class, things are only marginally better.

All of that is true – but it’s only half the story!

For all the issues raised in Part One (and I do believe the industry, and therefore our hobby, has undergone a significant structural change over the last few years) I still think Points / Miles are brilliant!

The most obvious counter-argument to the great sales around at the moment is that they might be cheap, but if they aren’t to places you want to visit or for dates you can travel on, then they aren’t much use to you.

Deeply discounted sales are now frequent, but not necessarily regular – and they often have quite limited booking/travel windows. If you can take advantage opportunistically you can get some fantastic bargains, but you can’t rely on them.

Of course, in order to use Points /Miles there needs to be award space available, but if you are able to book far in advance or last minute (which is often when cash fares are expensive) – and ideally have at least some degree of flexibility – then there are rarely significant issues.

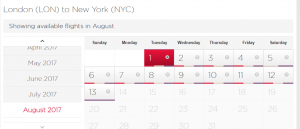

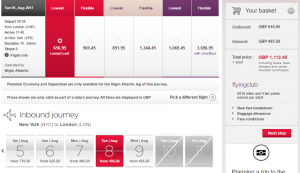

In a post last week about the current Virgin Atlantic award sale I mentioned that award space for next Summer is more or less wide open to a lot of popular destinations in all cabins.

That is at a time of year where Economy cash prices are through the roof!

If we look at Economy flights to New York as an example, 24,500 Virgin Flying Club Miles (or £80.00 of Tesco Clubcard vouchers) could save you over £800.00 (70+%) per person!

For most families, that’s the sort of difference between being able to comfortably afford an amazing holiday to America or not even being able to consider it.

My feelings towards British Avios are certainly a little frostier than they used to be, but you can still get enormous value from them. Just last week, my fellow contributor Ian wrote about how he received almost 10p of value per Avios (and the current record in the comments on that post stands at a superb 19.9 pence of value per Avios!).

Economy

In terms of Economy redemptions, Avios can still be great for short-haul on BA during expensive times of year and all flights on low-surcharge partners like Air Berlin, Cathay Pacific and American Airlines (except transatlantic!).

If you can keep your flights under 3,000 Miles at a time (one-way), you’re only going to be charged 12,500 Avios in Economy at most – even during Peak dates or on partner airlines.

That opens up brilliant deals like Dublin/Shannon to Boston on Aer Lingus, Berlin to Abu Dhabi on Air Berlin, USA to Caribbean or Central America on AA, West Coast USA – Hawaii on AA, as well as pretty much anywhere in Asia on Cathay Pacific and JAL, or most of South America with LAN.

Those sort of flights can regularly cost £500+ Return, or you could use 25,000 Avios (£110 of Tesco Clubcard Vouchers) + a handful of £s in taxes

Some people think that redeeming Points/ Miles for Economy flights is a waste, but there’s really no such thing as a ‘right’ redemption – only what is right for your circumstances.

On a (slightly) more objective note, I think most people would agree that, as a rule of thumb, if you are earning Avios (or Virgin FC Miles) for less than 1p each, and then getting more than 2p in genuine value per Avios, then it’s hard to argue that’s it’s wasteful!

I see ‘genuine value’ as being whatever I would otherwise have had to pay. and been willing to pay, for something directly comparable.

So, if I live in Dublin and I need to fly to Boston and back on set dates, and my options are either paying £600 for the cheapest Economy direct flights, or 25,000 Avios + ~ £50.00 in taxes, I would be getting more than 2p per Avios in ‘genuine value’ if I used them.

Premium Cabins

Yes, sales are frequent and I don’t think Business Class has ever been as cheap as it can be today – but paying cash for premium cabins is often still very expensive if you can’t get a good sale rate for your destination or travel dates.

Many people can afford (and justify) spending a few hundred more to fly in comfort and style, but not a few thousand more (I’m not even going to mention First Class prices!).

Miles / Points can make travel in Business and First Class consistently (relatively) affordable.

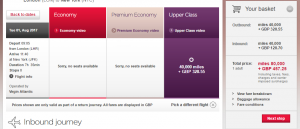

Virgin Atlantic Flying Club, for example, charges pretty hefty taxes and ‘surcharges’ for Miles redemptions in Upper Class – about £450.00 for Return flights from London to the USA. That may seem like an unreasonable price for your ‘free’ flight, but is still about the same as Economy ticket much of the year, and a lot less than an Economy ticket during peak times.

East Coast destinations require 80,000 Miles on top of course, but what do those Miles really cost?

Well, naturally it depends on how you acquire them – but I suspect that Points / Miles collectors in the UK get most of their Virgin Flying Club Miles from credit card sign-up bonuses and Tesco Clubcard transfers.

Tesco Clubcard vouchers transfer to Virgin FC at a rate of £1.00 : 250 Miles, so if you collect Clubcard Points at face value (£1.00 for £1.00) and then transfer them across, you are essentially paying 0.4p per Flying Club Mile.

80,000 FC Miles would therefore cost about £320.00.

In other words, Miles can effectively give you the option to upgrade from what you might otherwise pay for a cash ticket in Economy, to Upper Class (Business) for ~ £160.00 each way between London and New York. I’d say that’s a pretty good deal!

It’s not easy to earn infinite amounts of Points /Miles that cheaply, but up to about 200,000 a year isn’t terribly difficult – and that’s enough for 2.5 Returns in the example above.

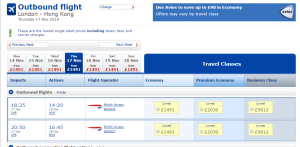

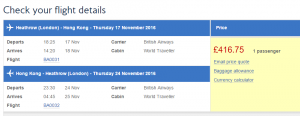

In Part One of this series I mentioned as an example of how Miles are rubbish these days, that British Airways now charges up to 150,000 Avios + £527.00 for a Return in Club World (Business Class) to Los Angeles – and that definitely seems like a lot of money and Miles.

If we use the same Points/Miles acquisition cost as in the Virgin example (~0.4p per Point) though, it begins to look a bit less scary.

150,000 Avios at 0.4p each = £600. The taxes/surcharges of £527.00 are comparable to what a cash Economy ticket would cost, much of the time, to LA – so the 150,000 Avios are effectively giving you the option to upgrade from Economy to Business Class for £300 each way.

Ok, so £1,130.00 in total might not be a complete steal, but it’s a lot better than paying £2,000-£6,000 for cash Business Class tickets – and that’s the point I’m trying to make here really: that Miles /Points can make things affordable that otherwise wouldn’t be.

It’s also worth pointing out that the 150,000 Avios figure is for Peak dates, for much of the year you only need 120,000.

Anything else?

Apologies for the ‘War and Peace’ length of this piece dear readers, but yes!

The flexibility that Points / Miles can give you makes a simple comparison to the cheapest Return ticket unfair.

If we just stick with Avios and Virgin FC Miles for now, they both allow you to book one-ways for half the number of Miles of a Return, whereas paying cash for a one-way flight can (ludicrously) cost much more than buying a Return. I like to hop around a bit when I’m travelling (not literally…) and being able to book multiple one-ways using Miles, rather than trying to stitch together a complex multi-destination itinerary on a paid ticket, is a great benefit.

Both programmes also allow you to cancel a reservation with a full refund of Miles and taxes/surcharges for just £30-£35. This is a huge benefit compared to paying cash, where buying a flexible ticket would normally cost you a lot of extra money.

Conclusion

Points / Miles are still brilliant. They allow you to affordably book one way flights, travel last minute, fly at expensive times of year, and enjoy premium cabins.

Basically, Miles can make things possible that otherwise wouldn’t be – and that’s powerful.

I hope I’ve shown in this piece that even just using Miles / Points in a fairly standard sort of way can still save you a lot of money. With a bit of flexibility, organisation and creativity though, you can do much (much) better – and that’s what I’m going to look at in Part 3.

Relatively easy to earn 200,000 miles a year? Can you give a breakdown of your earnings in a typical year please?

Sure!

To be fair it might be a bit harder going forward because there seem to be less Clubcard opportunities these days and the MBNA bonuses might be drying up, but over the last few years my own earnings have been something like this:

~ 150,000+ from Credit Cards – I apply for a new card every 3 months and haven’t had to apply for anything with less than a 20k signup bonus (apart from the Hilton Card) – but I suppose I am able to apply for Amex small Biz cards and do take advantage of offers like the bonus for upgrading to plat and the brilliantly generous 10k per additional card holder x 5 etc. I think 100,000-120,000 is easily achievable for anyone who gets 4 cards a year though, particularly if they can refer a couple of friends/family members occasionally.

100,000+ (£400 in vouchers) from Clubcard. I do shop at Tesco, take advantage of wine bonus point offers, a few other bits and pieces that not everyone might do, but I’m certainly not as committed as some collectors!. For most people (at least those follow blogs like this and hfp a bit!) I think £300 per year (£75 per quarter) from bonus offers like insurance, blinkbox, game preorders, delivery saver, and topcashback over the last few years has been achievable without a huge amount of effort. I’m not necessarily either condemning or condoning multiple accounts, but it does happen… – and obviously many people have partners or family members who aren’t very interested in Points/Miles who they earn on behalf of.

50,000+ from everything else – free Miles, spg games, (really)cheap Miles, rocketmiles, actual flying, etc. Easily 10-20k a year for most people I think.

So I’d say 170,000-220,000 in total would be pretty typical annual range without having to work very hard or chase every deal.

Thanks! I guess I haven’t been aggressive enough in my CC strategy. I could easily apply for the Amex small biz cards but haven’t done so, for some reason. Need to get on to that!

Cheers

James

Bear in mind, too, that the BA Amex 241 can, if used strategically, effectively double your annual Avios haul.

Yeah they are a nice option if you find yourself in a quarter when it hasn’t been quite 6 months yet since you cancelled a personal Amex and there are no good MBNA bonuses. It’s also worth noting that you can get some great cashback on those as well – £50.00 for the Gold and £90.00 for the Plat is regular.

Already an AMEX Gold, partner is already a supplementary card holder, can I still invite her and become a supplementary card holder of hers, earn the bonus then recommend me again? When closing the account do I have to of already transferred AMEX points?

Yep absolutely – 9k referral for you and 22k signup bonus for your partner (and vice versa). Just remember to leave it 6 months after you cancel your card before being referred for a new one. Also yes, definitely transfer your Points out before cancelling!

Great thanks! Shame you cant keep hold of the points. Unsure how i want to use them and don’t want to lock them Avios

Some fair comments about the amazing sale restrictions in place like you have to fly between certain times but if you were planning those dates then the deals wipe the floor with biz full avios redemptions.

I agree also its got to work around you, you shouldnt necessarily change your hol dates to get one class up if you dont want to hol on that month etc.

I still find E redemptions using avios in some instances good value and lots more availability, yes i dont like the fact i might have to pay £500 in taxes but when you trying to book a premium route, non stop only service available in a certain high season month of the year that 65k avios saves us £900 off the cash price.