Some links to products and partners on this website will earn an affiliate commission.

Following on from our recent article on American Express travel offers, I thought it worth flagging some additional travel-related cashback opportunities. These might be useful if you don’t have an American Express, or more likely you’ve already redeemed your Amex offer for the retailer in question, but have another visit to them planned.

So, let me introduce the Nationwide Select credit card…

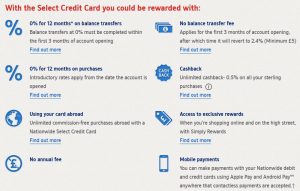

Unlike many of the Amex cards, there’s no airline or hotel points awarded on the Nationwide Select card, but it does offer 0.5% cashback on sterling spend as well as fee-free overseas spending, so it is a useful travel tool in it’s own right.

The principal additional benefits come from the Simply Rewards programme. Simply Rewards is run by Visa Europe, with Nationwide presenting their own branded portal. Other banks may offer this, from what I could find an Irish bank, Permanent TSB, provide this, but Citi have just ended their participation with a move to Mastercard.

DISCLAIMER: I’m not suggesting you take out any of this card, nor would I specifically recommend it. I am merely passing on some of my experiences with some of the travel related cashback offers.

Relevant Offers with Simply Rewards

Given that this is a travel site, I will obviously focus on travel related offers, but generally you will also find a number of chain pubs and restaurants, as well as sportswear manufacturers. Amazon have also featured previously with a pretty generous £25 back on a £100 spend (gift voucher, anyone?).

One of the benefits I really appreciate on these types of offers is that they generally stack with other offers or discounts and you don’t miss out on loyalty benefits.

Right now, I see the following:

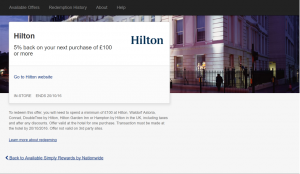

Hilton – 5% back on spend over £100

This offer varies, sometimes it’s 10%, and sometimes the spend threshold is £75, £100 or £150. The spend needs to be in one transaction, i.e. one stay. I have used this on pre-pay rates and pay on checkout rates with success. Obviously if you are paying on checkout, and have charged food or services to your room, you will get cashback on the total if the hotel processes it as one transaction.

PROs

- You would probably book direct anyway to ensure HHonors points earning and status recognition.

- HHonors points awarded on invoice total before cashback.

CONs

- You may be sacrificing additional HHonors points if you have the HHonors Barclaycard. Compare what 3 points/£ is worth to you versus the offered cashback.

- If you don’t collect HHonors points or have status, you could potentially get a better cashback rate via hotels.com or similar (but I doubt this applies to any readers of InsideFlyer UK!)

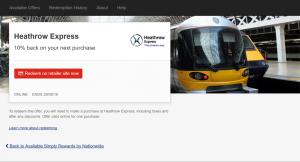

Heathrow Express – 10% back (no minimum spend)

This might offer an alternative, more flexible option than the American Express offer which requires a £50 spend. Given that the standard (“Express”) fare is only £36, you’d have to be buying multiple tickets or travelling in Business First to benefit from the American Express offer.

PROs

- Easier to trigger for occasional Heathrow travellers than the American Express offer.

- Still get Heathrow Rewards or Avios (Avios requires access to a dedicated page, and does not offer any of the discounted advance fares).

CONs

- Potentially lower rate than the American Express offer if you are spending just over £50.

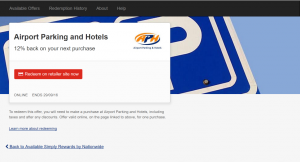

Airport Parking & Hotels – 12% back (no minimum spend)

I always find shopping for airport parking a complex process, and these kind of sites are a good starting point.

PROs

- Stacks with Quidco/Topcashback which is usually pretty high

- Alternatively you’ll often find decent discounts offered via codes, or links such as from Money Saving Expert, and you would still get this cashback on the discounted total

CONs

- They aren’t always the cheapest (but 12% could make the difference)

- No points earning opportunities

As with the American Express offers, if you have access to these offers, keep a regular check on them and see what is available. It tends to be the same merchants and they will come and go. If you have two eligible cards (you will need to register with two different email addresses) you will very often see different offers across the two, so check both to determine which offers the best deal.

Anything else?

While we’re on the subject, it’s also worth very briefly flagging Halifax Cashback Extras. While unspectacular, it offers occasional travel-related cashback made on any spend with your Halifax debit card, or credit card (if you’re the main cardholder). Cashback is paid into your Halifax bank account at the end of the next month.

At the time of writing, my offers include 10% cashback on spend at Millennium and Apex Hotels, and 10% cashback on Hertz car rental. In the past, there’s been cashback on a variety of other travel options, including Hilton hotels.

Great article Ian, about something I genuinely had no idea existed!

Thanks, Joe. I figured many people might be unaware of this, so thought it worth putting an article together about it.

Now, if you are suitably impressed with Nationwide, and want to open a current account to get these benefits, I’d be happy to you refer and we get £100 each 😉

http://www.nationwide.co.uk/products/current-accounts/our-current-accounts/recommend-a-friend-tab

Cheers – I’ll have a proper look when I’ve got time next week.